bunq, the mobile only challenger bank, announced today that the Dutch Central Bank has approved a deal that will see bunq welcome their first external investor, Pollen Street Capital.

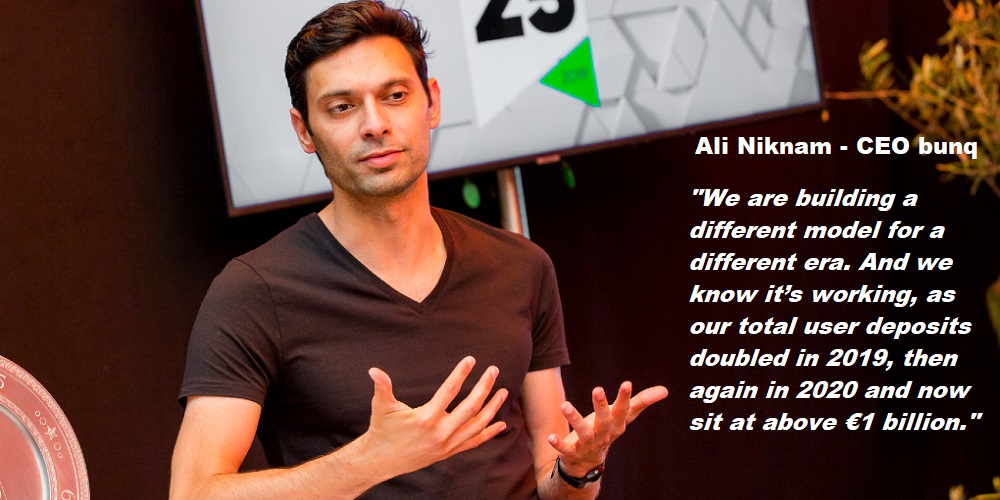

„Our €193 million funding round, valuing bunq at €1.6 billion, sets a new record for European fintech, as we raised the largest series A round ever secured,” says Ali Niknam, CEO and founder of bunq.

bunq is the only completely self-funded challenger bank that branched into 30 European markets without a penny of VC funds.

„This approach has been revolutionary. Many of our competitors have taken a different path during the first wave of fintech expansion in Europe, seeking to run up large vanity numbers often based on dormant accounts or numbers of app downloads, rather than active users.

We are building a different model for a different era, one focused on a committed, engaged and ever-increasing community. And we know it’s working, as our total user deposits doubled in 2019, then again in 2020 and now sit at above €1 billion,” Ali Niknam explains.

The challenger bank announced its first profitable month earlier in 2021 and aim to break even on a monthly basis by the end of this year.

Using the funding announced today bunq has made another step to an ambitious M&A strategy to grow even further.

„As part of today’s deal, we have made our first acquisition, securing Irish lender Capitalflow. Like us they have a laser focus on their users and value sustainability highly. We hope this will be the first acquisition of many, as bunq spearheads a new wave of post-pandemic fintech M&A,” Ali Niknam said.

bunq will also use the injection of funds to fuel its growth across Europe, particularly in Germany and France.

„This follows our introduction this year of German, French and Spanish IBANs and the opening of new offices in Cologne and Paris. Excitingly, we also plan to double the number of bunq staff by the end of 2022.

This unique approach will help us scale our operations sustainably, while keeping our users at the forefront of our work and continuing to remain profitable; a combination no other fintech — in Europe or the US — has yet been able to achieve,” concludes the CEO.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: