Bundesbank warns over ‘highly speculative’ Bitcoin which become more popular every day- 70,000 transactions worldwide a day

The Bundesbank has become the latest big central bank to warn about the risks of Bitcoin, amid rising concerns from regulatory authorities around the world as the virtual currency grows in popularity. There were an estimated daily 70,000 Bitcoin transactions worldwide, that compared with nearly 60m bank transfers and direct debit payments each day in Germany alone, according to one of the member of Bundesbank.

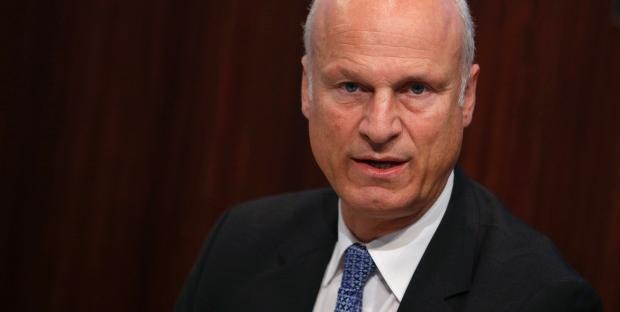

Carl-Ludwig Thiele (photo), a board member of Germany’s central bank, told the newspaper Handelsblatt that Bitcoins were “highly speculative” due to their high volatility and the way they were constructed. “There is no state guarantee for Bitcoins and investors could lose all their money. The Bundesbank is warning emphatically about these risks,” he said.

Mr Thiele added that central bankers and regulators in Europe were increasingly discussing the Bitcoin phenomenon, though their efforts had so far stopped at warning people over the “enormous” speculation risks the currency posed.

A Bundesbank official said that Mr Thiele’s views were shared by the central bank, and that they were in line with recent warnings from the European Central Bank over the risks of Bitcoin.

Bitcoin, a virtual currency that can only be traded online via specialist exchanges and has no central authority in charge of supply, has grown in popularity over the past year and has attracted a number of high-profile investors. But regulators have also sounded fears over the currency’s suitability for money laundering and other illegal activities.

China last month blocked the country’s Bitcoin exchanges from accepting new cash, posing a threat to the virtual currency in what has been its biggest market. The People’s Bank of China, the central bank, also banned banks from handling Bitcoin trades, stating: “It does not have the legal status of a currency, and it cannot and moreover should not be allowed to circulate in the market as a currency.”

Malaysia’s central bank has also warned on the risks of Bitcoin in recent days, while the French central bank cautioned in December that citizens had no guarantee the currency could be exchanged for real money, with growing numbers of retailers accepting Bitcoins as a payment method.

The European Banking Authority warned last month that consumers were not protected by any refund rights under EU law when using virtual currencies for commercial transactions.

Other central bankers have adopted a more positive tone on Bitcoin. The value of the online currency leapt in November after Ben Bernanke, chairman of the Federal Reserve, said that while virtual currencies such as Bitcoin carried risks, “there are also areas where they may hold long-term promise”.

An ECB paper on virtual currencies in 2012 concluded that they did not pose a risk to price stability, provided that money creation remained at a low level, and that they could not jeopardise financial stability.

Underlining this point, Mr Thiele told Handelsblatt that while there were an estimated daily 70,000 Bitcoin transactions worldwide, that compared with nearly 60m bank transfers and direct debit payments each day in Germany alone.

Bitcoin was on Tuesday trading at $1,075 on trading platform Mt Gox. The price of a single Bitcoin has been volatile since hitting a record high of $1,242 in November, falling below $600 just a few days later.

Source: www.ft.com

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: