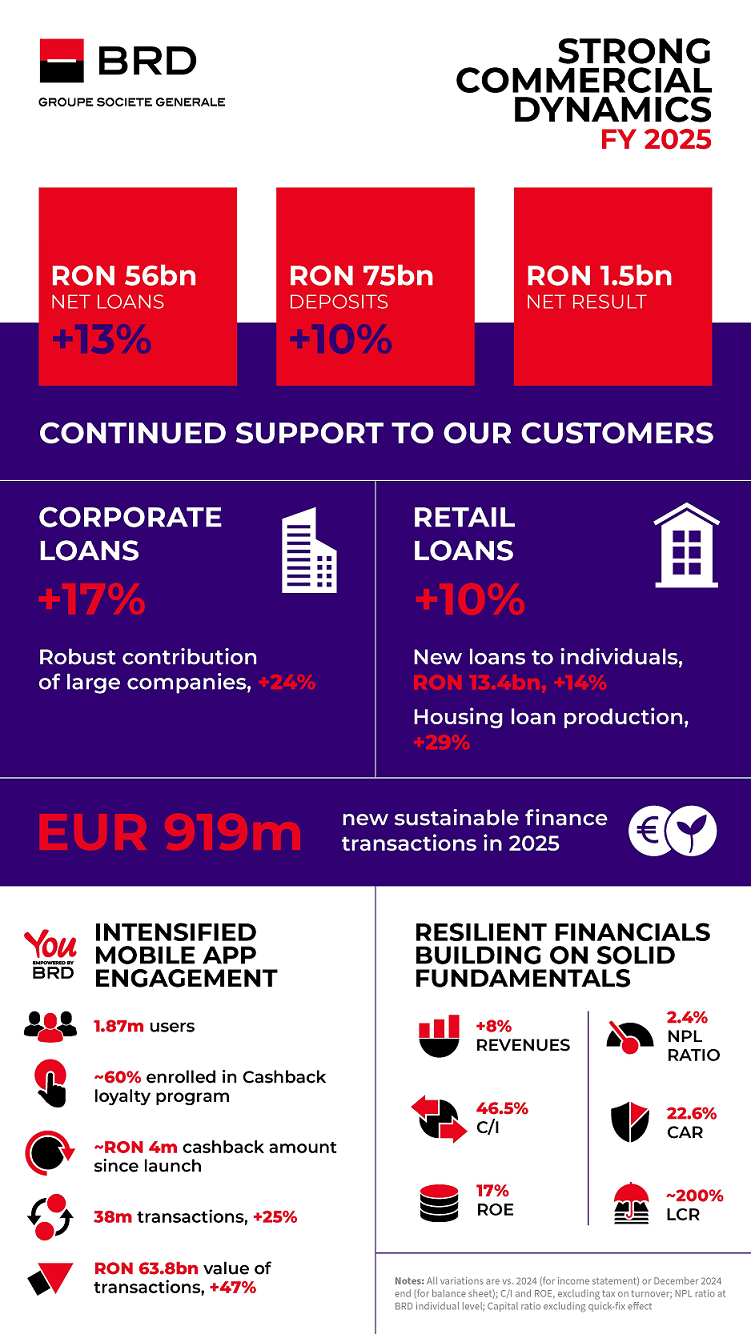

BRD continued to optimize its branch network, which reached 347 branches as at December 31st 2025 (-41 YoY) and offers 24H self service capabilities for cash transactions in 272 branches. At the same time, customer engagement via digital channels continued to rise, as reflected in the growing number of YouBRD users (1.87 million at December 2025 end, +13% YoY) and higher number of transactions via YouBRD (38.2 million, +25% vs 2024), totaling RON 63.8 billion, +47% YoY.

The cashback loyalty continues to gain traction, with 1.06 million enrolled customers in YouBRD at 2025 end, and RON 3.9 million granted in cashback to BRD customers since launch in June 2024.

Commercial performance on corporate and retail

Net loans outstanding, including leasing financing, reached RON 56.1 billion, increasing by +12.9% YoY compared to 2024 end (out of which net outstanding of leasing financing advanced by +6.0% YoY). Loan growth registered positive dynamics on both corporate and retail, albeit continued to moderate its path given challenging economic context.

Corporate lending was the primary driver of growth (+16.7% YoY), underpinned by strong momentum on large corporates (+23.9% YoY). Retail net loans outstanding were up by +10.0% YoY as of December 2025 end, supported by loans to individuals (+11.6% YoY).

Loan production for individuals amounted to RON 13.4 billion, up by +14% YoY vs 2024, driven by higher demand for housing financing, reaching RON 5.7bn in 2025 (+29.1% YoY).

The deposit base rose by +10.5% YoY at year-end, with higher collection from large corporate segment, while retail deposit inflows were constrained by the monthly issuances of Romanian government bonds for individuals, offered at attractive yields.

Non-deposit saving solutions marked an accelerating performance in 2025. Thus, BRD Asset Management, which manages 12 investment funds and provides services to over 179k clients, consolidated its 1st position on UCITS market, with a 25.3% market share and total assets under management reaching RON 9.3 billion up by +51% YoY, as of December 2025 end.

Financial performance

BRD Group’s net banking income totaled RON 4,350 million, up by +8% YoY during 2025, driven by both interest and non-interest revenue streams. Net interest income, representing 71% of net banking income, was up by +6.6% YoY, on resilient interest margins helped by wider lending book and a higher weight of loans in total assets.

Net fees and commissions increased by +10% YoY, supported by intensified activity on cards, custody, transfers, lending and insurance, and also a one-off income item related to cards transaction fees.

Other banking income (+13.9% YoY) evolution mainly reflects previous period base effect, revenues from equity investment disposal and higher net income from associates, related in principle to dividend income.

Operating expenses reached RON 2,223 million, +10% YoY primarily on rising non-staff costs. The latter were influenced on the one hand, by the tax on gross revenues which accounted for 9% of operating expenses and was +58% up YoY (RON 203 million in 2025 vs RON 129 million in 2024), and on the other hand, by the ongoing business optimization efforts, which led to continued prioritization of IT&C expenses, additional costs with external service providers, and a 2024 base effect linked to gains from sale of real estate. Moreover, the cumulated contribution to Deposit Guarantee Fund and Resolution Fund also increased, to RON 49.0 million, from RON 43.5 million in 2024. Staff expenses were up by +2.4% YoY due to employee benefits adjustments and optimisation measures associated with right-sizing efforts.

„All of the above translated into a good level of profitability, with BRD Group net result reaching RON 1,546 million (vs. RON 1,524 million in 2024), up by +6% YoY and high ROE of 17% in 2025, if excluding the tax on turnover.” – the bank said.

Maria Rousseva, CEO of BRD Groupe Société Générale: “Throughout 2025, despite an even more tense and challenging environment, BRD remained committed to supporting its customers and the Romanian economy, achieving dynamic commercial results and resilient financial performance.

Net loans outstanding, including leasing financing, increased by +13% YoY, given high performance on both corporate and retail segments. Building on strong expertise and long-term relationships with customers, lending on corporates preserved a robust growth pace, up by +17% YoY, incorporating expanding sustainable financing, new partnerships with financial institutions and conventions concluded with governmental institutions. Retail lending maintained a double-digit rhythm (+10% YoY), yet on a moderating trajectory, reflecting a more prudent consumer behavior.

Our customers’ digital activity continues to grow, reflected by increasing number of users of YouBRD mobile application and transactions done through the application, giving us confidence that our continuous efforts to enhance customers’ journey and interaction with the bank are truly valued.„

Rousseva added: Building on these solid business fundamentals, BRD delivered a good set of results for the full year, with increased revenues, strict costs oversight, which were marked by a doubling of the tax on turnover starting H2 2025, whereas credit quality indicators remained sound. At the same time, BRD maintained a comfortable capital and liquidity positions, a firmfoundation for sustainable performance.”

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: