Launched in late 2020, the Pix instant payment system in Brazil has proved a runaway success, used by 170 million people, 91% of the country’s adult population.

Brazil’s wildly popular instant payment system Pix is poised for another leap with the launch of a new recurring payments feature this month, central bank officials said, according to Reuters.

Since its launch in late 2020, Pix has rapidly become the leading payment method in Latin America’s largest economy, surpassing cash as well as debit and credit cards. Last year it handled more than 26 trillion reais ($4.61 trillion) in transactions.

Initially slated for launch last October, the new feature went live on June 16, allowing users to authorize recurring charges with a single consent, according to the central bank, which developed and operates Pix.

That will allow for automatic payments of utilities, phone bills, school tuition, gym memberships, and digital or streaming services via the new „Pix Automatico” tool.

The existing automatic debit services via banks are also likely to be disrupted by the new tool.

Companies must sign bank agreements to offer automatic debit, a process central bank regulation director Gilneu Vivan described as burdensome for small businesses. Pix Automatico will simplify the process, allowing small merchants to receive recurring payments with ease.

Vivan also noted that nearly 60 million Brazilians do not own a credit card, a group that will now be able to access subscription-based services previously limited to cardholders.

A study by payments platform EBANX estimates that Pix Automatico could handle at least $30 billion in e-commerce transactions within its first two years of operation.

($1 = 5.64 reais)

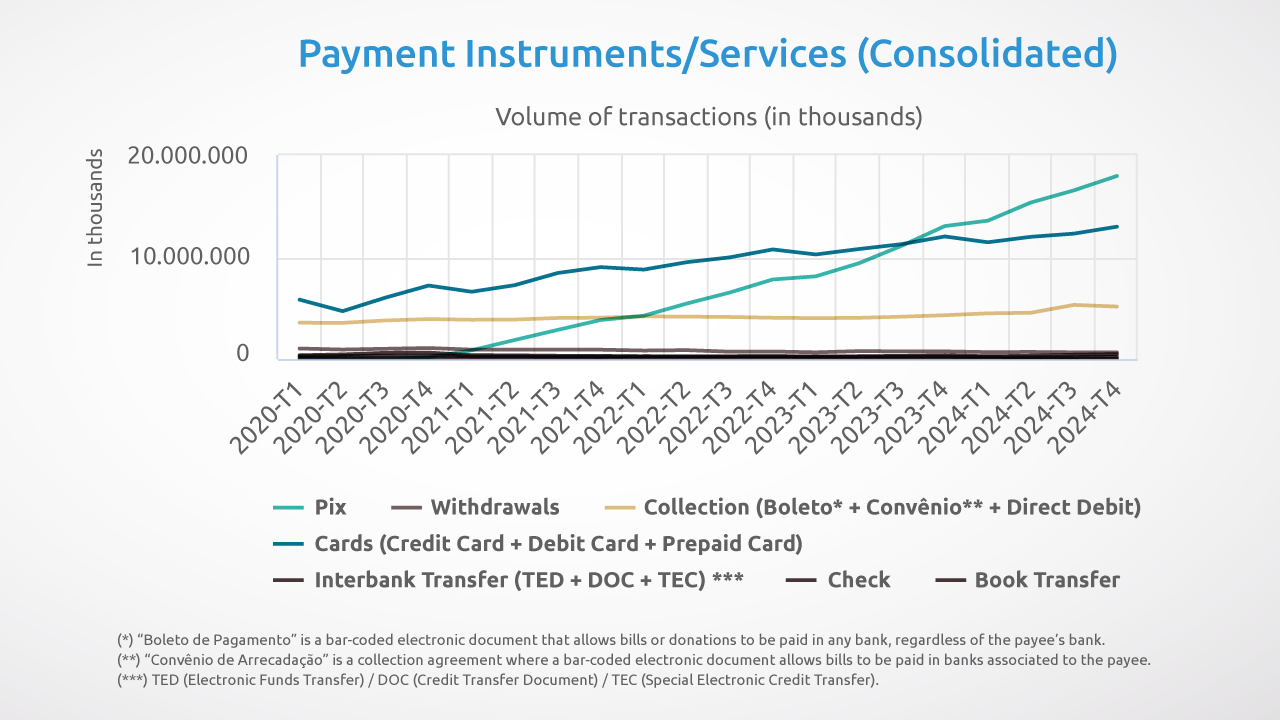

Pix and cards were the most used payment instruments in Brazil in 2024

The Banco Central do Brasil (BCB) recently released the latest edition of the Statistics on Retail Payments and Cards in Brazil. According to the report, Pix was the fastest-growing payment instrument in 2024, with a 52% increase in transaction volume. By the last quarter of the year, it accounted for nearly half (47%) of all non-cash payment transactions in Brazil.

The data also highlight the continued relevance of payment cards in the Brazilian retail payments landscape. In 2024, the volume of transactions grew across all card types: credit (+11%), debit (+2.5%), and prepaid cards (+19.2%), resulting in an average growth of 9.8% in card-based payments.

According to the statistics, there were approximately 235 million active credit cards in 2024, a nearly 14% increase compared to the end of 2023. The number of active prepaid cards rose by about 9%, reaching close to 74 million. In contrast, active debit cards declined by 5%, from around 162 million at the end of 2023 to 154 million in 2024.

Mobile Devices

Mobile phones remained the most used access channel for non-cash payment transactions, with 58.9 billion operations conducted in 2024—an increase of 18.4 billion over 2023. Internet banking ranked second, with 7.3 billion transactions, up 24% year-over-year.

Mobile and internet banking channels processed approximately R$64.2 trillion in 2024, a 5.3% increase over the previous year.

In-Person Channels

Despite the growing use of mobile and internet banking, traditional channels—including bank branches, service posts, banking correspondents, ATMs, credit union service points, and call centers—still accounted for around 45% of the total transaction value in 2024.

Checks

Checks continue to be a part of the retail payments landscape. Despite check transactions falling by 19.7% in 2024 compared to 2023, over 40 million checks are still processed per quarter. Checks are typically used for higher-value transactions, with an average ticket of R$4,517 at the end of 2024.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: