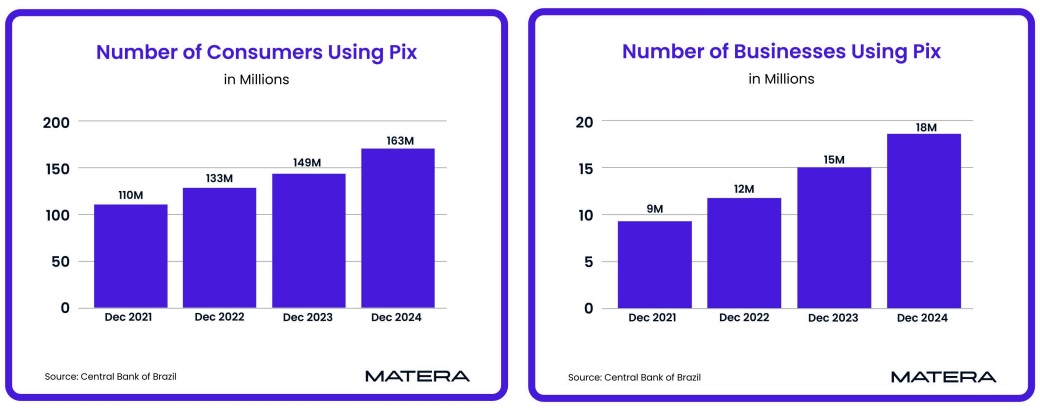

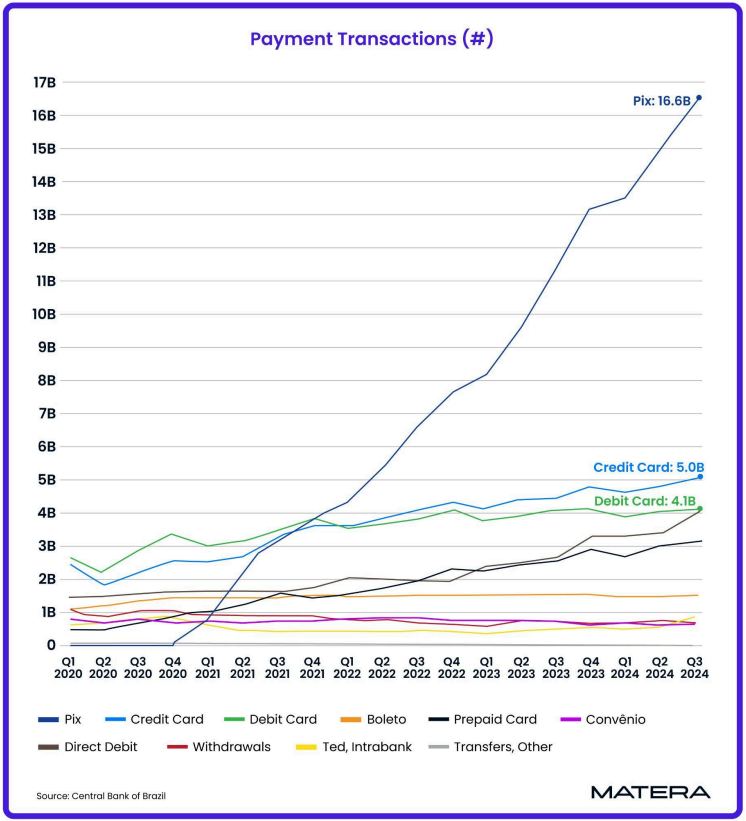

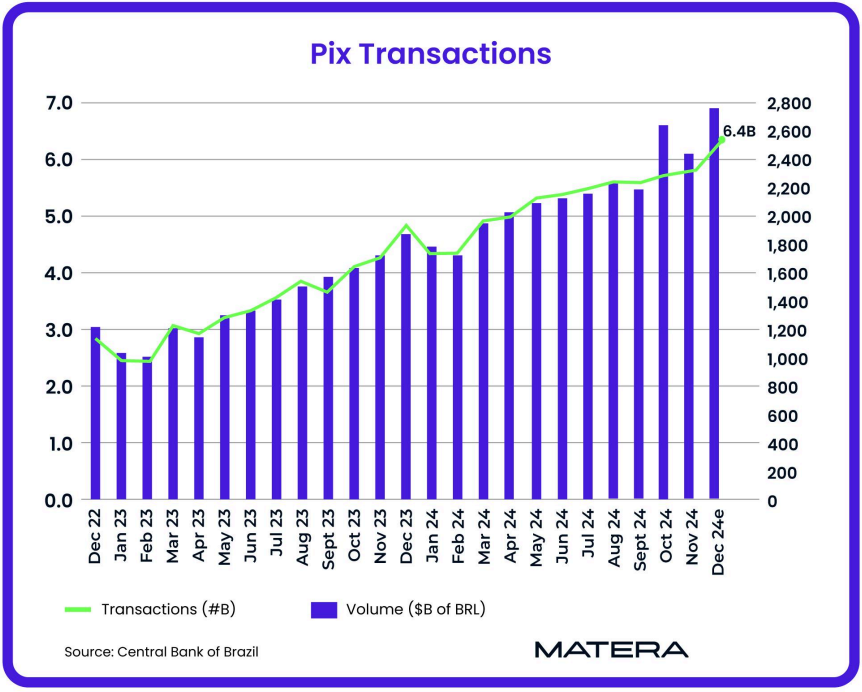

Launched just 4 years ago, Pix has quickly become the most widely used payment system in Brazil. In Q3 2024, the number of Pix transactions was 80% more than credit and debit combined. In December 2024 alone, the number of Pix transactions is estimated to be 6.4 billion, 34% more than in December 2023. Remarkably, on December 20th, Pix hit a one day record of 252.1 million transactions! – according to Pix by the Numbers report released by Matera, a global leader in instant payments, QR code, and digital ledger technology.

Even compared with ACH volume in the U.S., a payment rail that has been around for 50 years in a

country with roughly double the Brazilian population, Pix continues to impress. ACH volume in 2024

is estimated at 34 billion or just over half the 2024 Pix transactions.

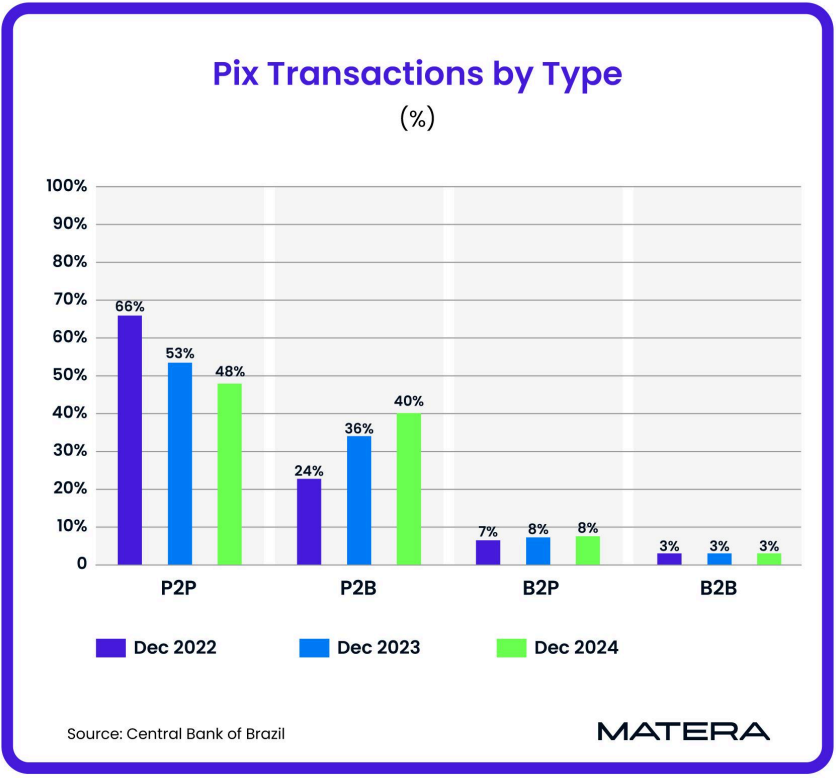

The fastest growing use of Pix remains consumers paying businesses (P2B).

P2B Pix transactions grew 94% in 2024 vs. 2023. However, B2B transactions are coming on strong. In December 2024, B2B transactions grew 56% vs December 2023. For P2B, the increase during this same time period was 53%.

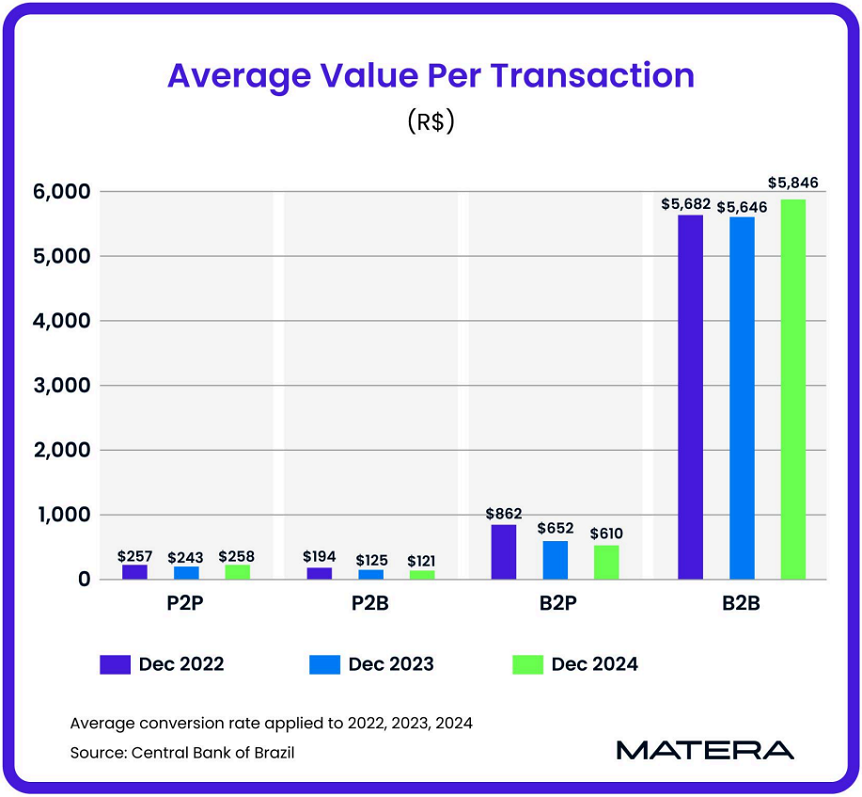

The volume of B2B Pix transactions far outpaces any other use case. In December 2024 alone, the volume of B2B Pix transactions exceeded R$1 trillion (approx. $200B USD). This compares to R$296 for B2P, R$288 for P2B and R$702 for P2P. The average value of a B2B Pix transaction in December 2024 was R$5,846 (approx. $1200 USD). This compares to R$121 for P2B (approx. $24 USD) and R$258 for P2P (approx. $52 USD).

Brazil’s journey with Pix showcases what is possible when innovation and inclusive design come together to address modern payment needs. From its rapid adoption to the groundbreaking developments of NFC-enabled „tap-to-Pix” payments and Pix Automatic for recurring transactions, Pix is a testament to how transformative instant payments can be when technology aligns with user demands.

What’s Next

NFC and Pix automatic are the most exciting developments scheduled for Pix in 2025.

NFC Payments: Scheduled for rollout in 2025, Pix NFC-enabled tap-to-pay will allow users to make instant payments with a simple tap, offering functionality comparable to Apple Pay but without the associated transaction fees.

Paying with Pix will soon be as easy as tapping to pay with Apple Pay using a credit card. Once Apple announced they were opening up their NFC chip to payments, the Central Bank of Brazil accelerated the adoption of Pix with NFC on their roadmap. They gathered input from the industry on how to

implement and are outlining the specifications for 2025.

Most noteworthy is that the NFC accessed on an iPhone to make Pix instant payments does not require access to the NFC for payments that Apple recently unlocked. The implications are huge as Apple plans to charge for access to this newly unlocked part of NFC.

Brazil has found a way to implement Pix via NFC without having to pay Apple for every transaction.

While Apple had restricted the use of NFC for payments to its Apple Pay ecosystem, it has always allowed NDEF (NFC Data Exchange Format) tags to interact with iPhones. This functionality can be leveraged to create NDEF-compliant tags that trigger actions like opening a deep link to Open a URL or prompt an action like opening an app among other actions.

Pix Automatic: Launching on June 16, 2025, Pix Automatic will enable recurring payments for subscriptions, utilities, and even recurring investments, further expanding Pix’s versatility. Consumers will need to opt into recurring payments, and the Central Bank has outlined in the user experience how banks and merchants can gather this consent.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: