BofA launches 401k Pay: comprehensive solution simplifies retirement income management. Banking 4.0 explores the emerging trend of lifestyle banking for customers over 60s.

New digital capabilities modernize retirement planning and payments for plan participants.

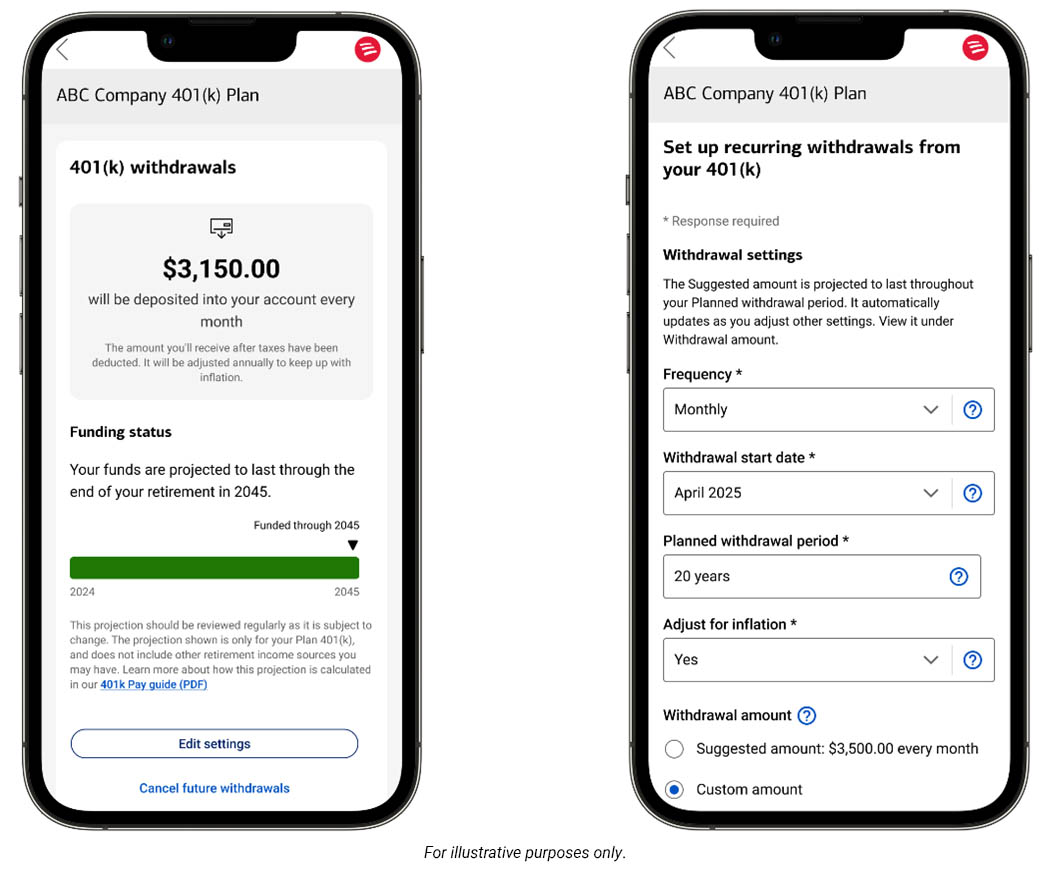

Bank of America is launching 401k Pay, a new solution designed to simplify and conveniently convert 401(k) account assets into a retirement income. „Available November 17 at no incremental charge to the company’s corporate plan sponsor or plan participant clients, the new digital solution provides 401(k) recordkeeping, flexible deposit options and advice in a single centralized hub. This enables plan participants to easily set, deposit and track their income throughout retirement.” – according to the press release.

„401k Pay was developed hand-in-hand with our corporate clients who wanted to offer their employees a retirement income solution,” said Lorna Sabbia, Head of Workplace Benefits at Bank of America. „Including retirement income resources like 401k Pay as part of their workplace benefits offerings provides employers with the opportunity to improve financial outcomes for their employees and can help drive real business results – including helping to improve productivity, employee job satisfaction and retention.”

Available to Bank of America clients enrolled in the company’s employer-sponsored Personal Retirement Strategy program, 401k Pay fully integrates the necessary components of retirement income management, including:

Consistent Income Generation: Helps participants determine the retirement income they generate from their 401(k) account by bringing their full financial life into context – including personalized inputs, cost-of-living adjustments, state and federal taxes, and required minimum distributions.

Flexible Deposit Options: Offers flexibility in the frequency of payments and choice of deposit accounts, including accounts within or outside of Bank of America.

Real-time Recalibration: Provides ongoing income monitoring and tracking, as well as real-time recalibration results for the duration of a participant’s retirement, allowing them to adjust their income as their needs and goals change.

Building upon the success of the company’s Personal Retirement Strategy program, 401k Pay is the next evolution in retirement planning, developed to address the concerns of both employees and employers. The recent 2025 Bank of America Workplace Benefits Report (PDF) shows two key areas where employees say they need financial wellness resources are retirement education and planning (36%) and learning how to generate income in retirement (33%). [1]

„Retirement readiness and the ability to plan for income in retirement are top concerns among plan participants,” said Tom Matarazzo, Managing Director, Institutional Retirement Advisory Programs & Financial Wellness Solutions. “401k Pay is designed to help directly address participant concerns – from planning how much 401(k) income is needed in retirement to drawing on those funds appropriately – with a digital solution that is a leader in the marketplace.”

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: