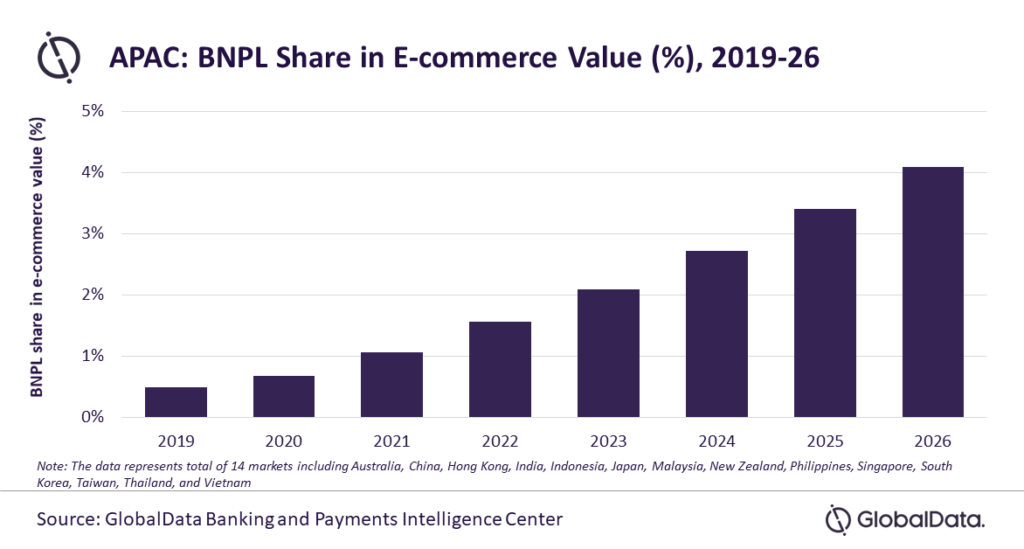

Buy now pay later (BNPL) is gradually becoming a popular payment option among online shoppers in Asia-Pacific (APAC) and is expected to account for 4.1% share of e-commerce payments value in 2026, says GlobalData, a leading data and analytics company.

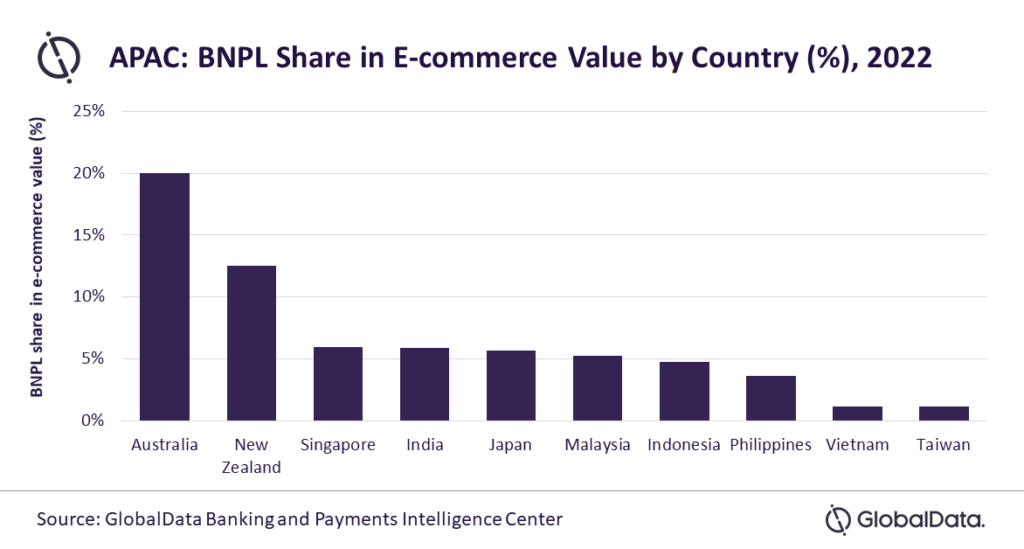

Already popular in countries like Australia and New Zealand, BNPL is gradually gaining traction in other APAC markets as well. GlobalData’s E-Commerce Analytics reveals that BNPL accounted for 1.6% of the e-commerce payments in 2022 in the APAC region.

The COVID-19 pandemic followed by the recent surge in inflation adversely affected consumers’ disposable income and consequently the demand for short-term financing solutions is on the rise. As a result, BNPL has emerged as a viable payment option for consumers, who do not have access to traditional credit options such as a credit card, allowing them to pay for purchases conveniently at later dates in instalments.

Shivani Gupta, Senior Banking and Payments Analyst at GlobalData, comments: “BNPL payment solutions are gradually strengthening their presence in the region’s e-commerce market supported by the proliferation of BNPL service providers, accelerated demand for flexible payments, and consumers’ gradual shift from offline to online channel.”

Australia and New Zealand have well-developed BNPL markets with high adoption level, which are far ahead of their peers in the region. BNPL share of e-commerce payments in Australia is estimated at 20% in 2022, while it is 12.5% in New Zealand. Afterpay, the leading BNPL brand in Australia, serves over 20 million customers. Other Asian markets are also catching up to this with countries like Singapore, India and Japan now seeing high adoption of BNPL services.

BNPL has high growth potential in countries like India, which has low credit card penetration and limited access to formal credit. India has seen the fastest jump in BNPL share in the region, which increased from 0.1% of e-commerce sales in 2019 to 3.2% in 2021 and is expected to account for more than 5% in 2022. To capitalize on the growing demand for BNPL services in India, leading online retailers such as Amazon are offering their own BNPL solutions.

Shivani concludes: “The use of BNPL services is poised for high growth in Asia with consumers shifting to online shopping and growing number of online merchants accepting BNPL brands.”

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: