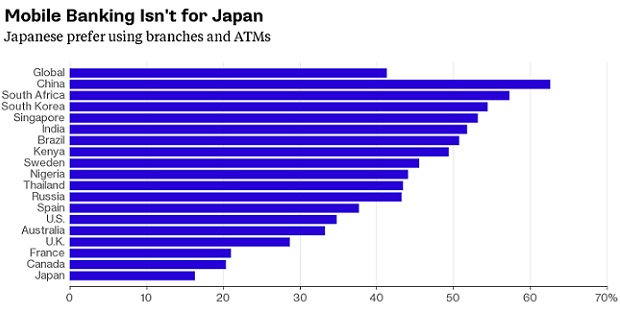

Bloomberg: mobile banking is not for Japanese who prefers using branches

The luxurious branches help to explain why Japan, birthplace of the Walkman and PlayStation, falls behind even India and Nigeria in the use of mobile phones for banking. With its still-heavy reliance on cash for transactions, Japan has the lowest usage of mobile banking among 18 nations, mainly because physical outlets and automated teller machines can do more than phone apps, according to a UBS Group AG study.

“Management commitment to mobile banking isn’t that strong in Japan compared to other countries,” UBS analyst Shinichi Ina, who co-wrote the July report, said in an interview. “There are still a lot of customers who like branches, and I think that’s part of the reason for the lack of urgency.”

That’s potentially a missed opportunity for Japanese banks to not only save the costs of running branches and ATMs but also change with the times. Mobile-banking users worldwide are expected to more than double to 1.8 billion people by 2019, Juniper Research and KPMG data show in a separate report compiled with UBS. Younger clients in particular are more inclined to use phones for banking.

The Japanese preference for branches is in stark contrast with China, where long queues at crammed branches have driven people to portable devices. China ranked No. 1 in the UBS survey, with 63 percent of customers using their phones for banking, compared with only 16 percent in Japan. The U.S. was 13th, with 35 percent.

In Japan, ATMs allow users to transfer money to people and update transaction records by inserting their passbooks, making them more popular than branches, according to an April study by Fujitsu Research Institute. About two-thirds of customers use the machines at least once a month, while 21 percent visit branches, the report shows. Fujitsu found even fewer Japanese using their phones for banking than UBS’s survey: 13 percent.

Source: bloomberg.com

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: