The new iPhone will make mobile payment easier by including a near-field communication chip for the first time. Apple Inc. plans to turn its next iPhone into a mobile wallet through a partnership with major payment networks, banks and retailers, according a person familiar with the situation, mentioned by Bloomberg.

The agreement includes Visa Inc., MasterCard Inc. and American Express Co. and will be unveiled on Sept. 9 along with the next iPhone, said the person, who asked not to be identified because the talks are private.

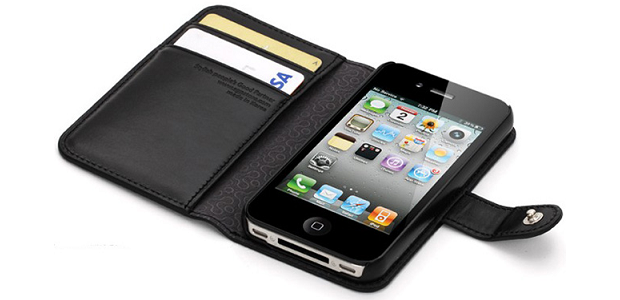

The new iPhone will make mobile payment easier by including a near-field communication chip for the first time, the person said. That advancement along with Touch ID, a fingerprint recognition reader that debuted on the most recent iPhone, will allow consumers to securely pay for items in a store with the touch of a finger.

While companies such as Google Inc. have invested in creating ways for phones to make payments in a physical store, U.S. retailers have been slow to adopt the technology, thus limiting the use by shoppers, according to Ben Bajarin, an analyst for Creative Strategies LLC in San Jose, California. That could change with Apple entering the market because iPhones have the largest market share in the U.S., he said.

For Apple, the push into creating a mobile wallet is to keep users within its ecosystem, thus creating more loyalty to its brand and demand for its products. “It’s about retention, solving and adding features that keep your base engaged and keeping them loyal,” Bajarin said.

Apple’s move is also about generating more revenue from the roughly 800 million global iTunes accounts, which include payment information, that have already been created, said Richard Crone, chief executive officer of Crone Consulting LLC, which advises retailers and banks on mobile-payment solutions.

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: