BlockFi files for bankruptcy as FTX collapse contagion spreads. The trading price of Bitcoin continues to fall and is very close to the production cost.

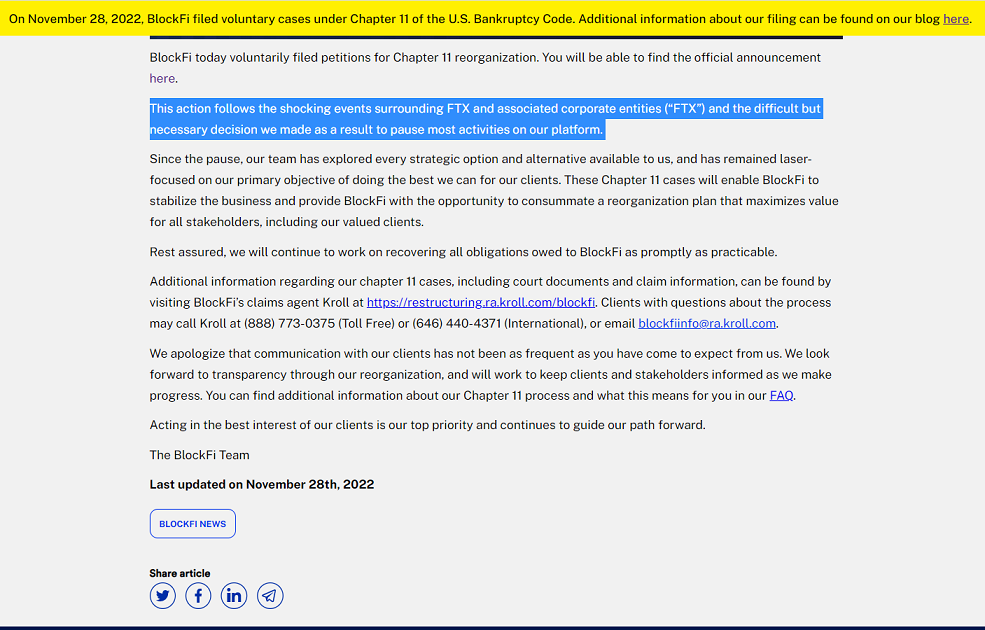

The crypto lender player BlockFi Files voluntary petitions for Chapter 11 protection to preserve client value and pursue recoveries on counterparty obligations. BlockFi received a $400 million line of credit from FTX earlier this year. The firm estimates it has more than 100,000 creditors, and between $1 and $10 billion in both assets and liabilities, according to a company’s petition.

„This action follows the shocking events surrounding FTX and associated corporate entities (“FTX”) and the difficult but necessary decision we made as a result to pause most activities on our platform.” – the company says in a statement.

BlockFi Inc. and eight of its affiliates today commenced voluntary cases under Chapter 11 of the U.S. Bankruptcy Code in the United States Bankruptcy Court for the District of New Jersey (“the Court”) „to stabilize its business and provide the Company with the opportunity to consummate a comprehensive restructuring transaction that maximizes value for all clients and other stakeholders,” according to the press release.

As part of its restructuring efforts, the Company will focus on recovering all obligations owed to BlockFi by its counterparties, including FTX and associated corporate entities (“FTX”). Due to the recent collapse of FTX and its ensuing bankruptcy process, which remains ongoing, the Company expects that recoveries from FTX will be delayed.

“With the collapse of FTX, the BlockFi management team and board of directors immediately took action to protect clients and the Company,” said Mark Renzi of Berkeley Research Group, the Company’s financial advisor.

To ensure a smooth transition into Chapter 11, BlockFi is filing with the Court a series of customary motions to allow the Company to continue to operate its business. These “first day” motions include requests to pay employee wages and continue employee benefits without disruption, for which the Company expects to receive Court approval, as well as to establish a Key Employee Retention Plan to ensure the company retains trained internal resources for business-critical functions during the chapter 11 process. The Company today also initiated an internal plan to considerably reduce expenses, including labor costs.

Platform activity continues to be paused at this time. BlockFi has US$256.9 million in cash on hand, which is expected to provide sufficient liquidity to support certain operations during the restructuring process.

In parallel with these chapter 11 cases, BlockFi International Ltd. a Bermuda incorporated company, filed a petition with the Supreme Court of Bermuda for the appointment of joint provisional liquidators pursuant to section 161(e) of Bermuda’s Companies Act, 1981 in the near term. BlockFi currently anticipates that client claims will be addressed through the Chapter 11 process.

Having raised funds at a $3 billion valuation in 2021, BlockFi has seen its business fall apart in the face of this year’s crypto winter and wider economic downturn. In July, it turned to FTX for the line of credit in a deal that also gave Sam Bankman-Fried’s now-failed business the option to buy BlockFi.

Meanwhile bitcoin clings to $16K, very closed to the production cost – estimated by J.P. Morgan at $13K

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: