Blockchain payment methods for e-commerce: Myths and realities for 2022

an article written by Frank Calviño

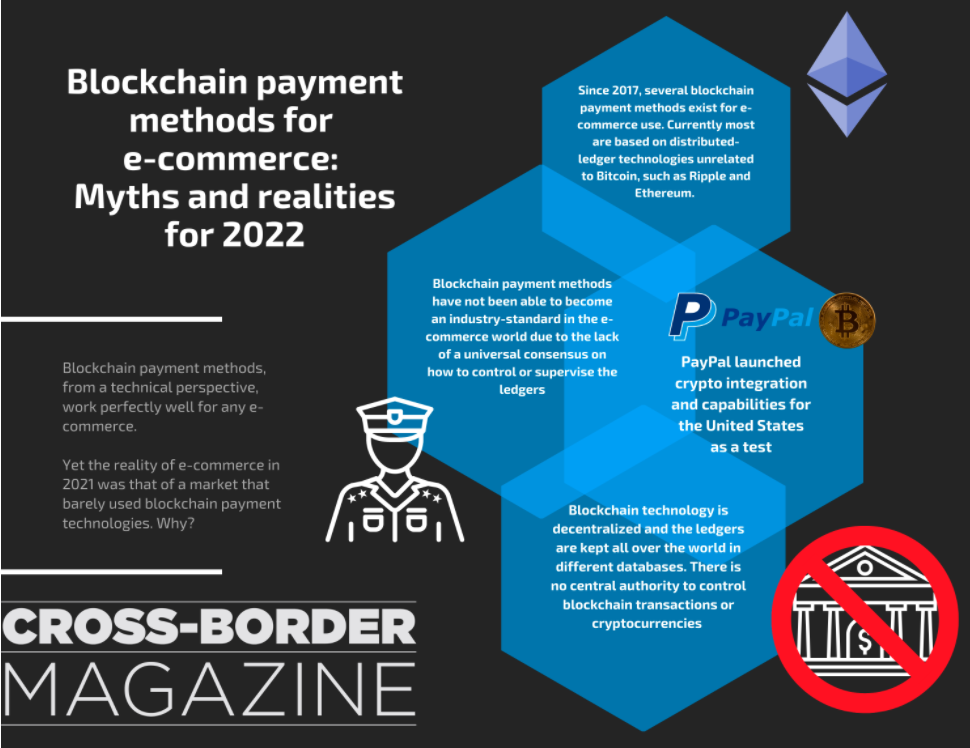

Blockchain payment methods, from a technical perspective, work perfectly well for any e-commerce. Yet the reality of e-commerce in 2021 was that of a market that barely used blockchain payment technologies. Why? Well, it is due to a combination of several issues: some of them human-related, some other practical incompatibilities, and last lot, economic issues that still make blockchain an expensive and somewhat exclusive technology.

Let us review these factors in order to understand if blockchain technologies, will really impact e-commerce globally in the following 2022!

What blockchain payment methods currently exist for e-commerce?

Since 2017, several blockchain payment methods exist for e-commerce use. And most of the new ones are based on distributed-ledger technologies unrelated to Bitcoin, such as Ripple and Ethereum.

But most of the current blockchain payment methods are based and designed to work specifically – and in many cases exclusively – with Bitcoin. Some of these are designed for the relatively small subset of businesses trading directly in Bitcoin and other payment processing solutions address a much larger audience by using the Bitcoin distributed ledger to transfer payments in conventional currencies.

Are Bitcoin-based payments methods done using Bitcoin?

The way payments with Bitcoin are currently working is mostly by using Bitcoin ledgers or Bitcoins itself, as a part of the transaction, but the final payment is done – we could argue that in over 80% of the cases – using traditional currency, either digital or physical, trough the spreading cryptocurrency ATMs in both Europe and The United States.

This combination of traditional currency used via the blockchain ledgers – the Bitcoin ledger primarily – allows them to bypass existing banking infrastructure, with the goal of accelerating payment and reducing cost. The provider converts the payer’s local currency into Bitcoin, then converts the Bitcoin into the receiver’s local currency, often delivering international payments within one to three days.

And this is perhaps one of the first issues: traditional payment methods – credit or debit card based – are faster and far easier to use. At least for the time being and, obviously, due to the fact that the blockchain payment methods have to do all the circumventing systems we mentioned above. If they were used the way that technology was invented, transactions would be instantaneous, regardless of the nation or currency used.

So, what is truly going on then? Why is blockchain technology not being used at its full potential?

What is stopping blockchain payment methods from becoming the e-commerce standard?

Blockchain payment methods have not been able to become an industry-standard in the e-commerce world due to the lack of a universal consensus on how to control or supervise the ledgers – the systems used to control the blockchain transactions – this also poses a fundamental issue that is derived from the core concept behind blockchain and cryptocurrency: there is no need for a central authority to control or supervise the transactions.

Rendering indefective the central banking authorities of the countries. Obviously, this is a major political and social decision. Image having a currency upon which you have no control whatsoever to inflate or devaluate its value.

Lack of control to do this means that the economy can not be force-fed by any political decision and will respond, 100% of the time, to what the market decides… even if the market decides to go bananas and that has happened before because the market is made of humans and sometimes humans stop being rational.

Will blockchain payment methods become a standard for e-commerce in 2022?

Probably not. The main issue, the lack of a universal consensus on how to guarantee the ledgers’ integrity and the political-social implications of a fully blockchain/crypto economy, has not changed and has not given us any reasons for changing in 2022.

Not even the Covid pandemic, which speeded up almost everything related to digitalization and the global economy, was able to increase the support for blockchain technologies.

Currently, the best bet for a universally accepted blockchain payment method capable of being used by e-commerce as a payment method for online shopping is the project led by PayPal, which launched crypto integration and capabilities for the United States market as a test, for a possible future global implementation.

PayPal’s idea is to allow for a seamless transaction between the most common cryptocurrencies and all the rest of the traditional currencies. And currently works with Bitcoin, Bitcoin Cash, Ethereum, and Litecoin.

All in all, it seems that – at least for 2022 – blockchain payment methods will not become a standard for e-commerce and it won’t probably happen in the near future either.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: