Bitcoin to be 6th largest reserve currency by 2030: Research

Bitcoin industry insiders have issued an optimistic prediction for the cryptocurrency over the next few decades, suggesting it could be as widely used as the Swiss franc or the Australian dollar. U.K.-based Magister Advisors, which advises the technology industry on mergers and acquisitions, interviewed thirty of the leading bitcoin companies from across the globe. It found a consensus view that bitcoin will become the sixth largest global reserve currency within 15 years.

The survey also found that an estimated $1 billion will be spent by the top 100 financial institutions on blockchain-related projects over the next 24 months. Jeremy Millar, partner at Magister Advisors who led the research, said that the blockchain was the most significant advancement in enterprise IT in the last decade.

„We have now reached a fork in the road with bitcoin and blockchain. Bitcoin has proven itself as an established currency. Blockchain, more fundamentally, will become the default global standard distributed ledger for financial transactions,” he predicted in an accompanying press release on Tuesday morning.

In September, 13 of the world’s leading banks joined a project to explore the possibilities behind using a type of distributed ledger in the mainstream financial world. Institutions like Bank of America, Citi and Deutsche Bank joined others like Goldman Sachs and J.P. Morgan which had already signed up.

Simon Derrick, chief currency strategist at BNY Mellon, told CNBC via email Tuesday that he suspects the interesting part to the bitcoin story will be the underlying technology and whether it facilitates the introduction of truly digital currencies.

Bitcoin is also renowned for its volatility and has been heavily criticized for facilitating illegal activity, given that it can be used anonymously. The report by Magister Advisors on Tuesday directly tackled this issue of volatility. It said that the primary usage of bitcoin today in developed markets was for speculation. The survey’s respondents estimated that 90 percent of bitcoin by value is being held for speculation, not for commercial transactions.

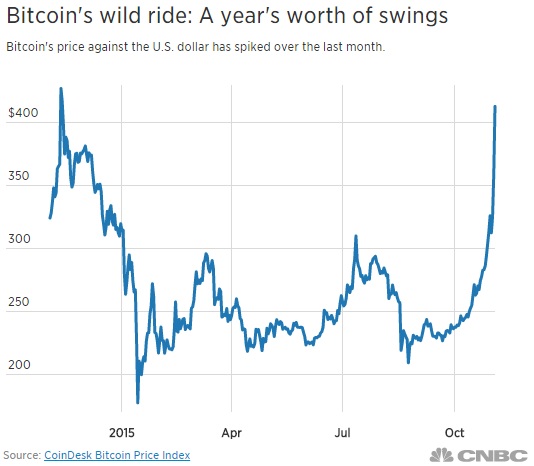

Meanwhile, Bitcoin’s price jumps more than 70% in one month and nobody knows why, according to cnbc.com.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: