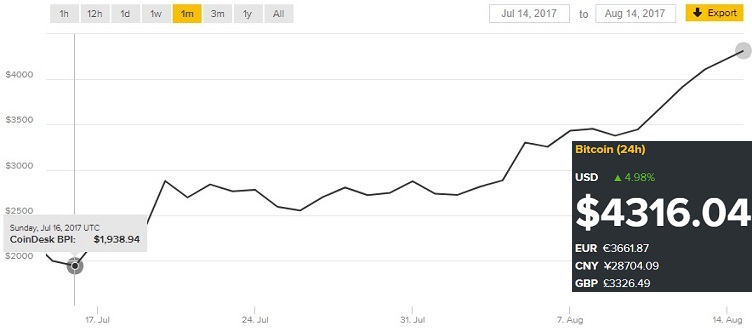

Bitcoin prices pass $4,000 for the first time – the market capitalisation of all cryptocurrencies reached $138 billion, a billion higher than yesterday

Bitcoin has continued to trade at over $4,000 since reaching a record level of $4,225 yesterday, and has now set a new all-time high of over $4,300, for the first time since the cryptocurrency was created in January 2009. According to the CoinDesk Bitcoin Price Index, average prices across exchanges today opened at $4,111 and have seen a 4.97 percent increase so far. At press time, a bitcoin was worth $4,315

Notably, since the price passed the $4,000-mark for the first time yesterday, prices have maintained a level fluctuating at around $4,100, only dipping to below that level once when bitcoin was trading briefly for around $3,900. However, prices soon returned to above the $4,000 point.

The record-breaking price levels would seem to indicate money coming into the market that had been held back pending the uncertain outcome of a split of the bitcoin network that resulted in a new cryptocurrency called bitcoin cash.

Bitcoin cash, which was created on August 1, already stands as the fourth largest cryptocurrency by market capitalization and currently has a value of around $306, according to CoinMarketCap.

The total market cap of all cryptocurrencies has again reached previously unseen levels, and has now reached $138 billion – a billion higher than yesterday’s all-time high.

While bitcoin has seen an over 10 percent increase in market cap in the past 24 hours (on August 13), some other cryptocurrencies have seen increases of over 20 percent, including IOTA and neo, and others have even seen increases of around 30 percent, including decent, nexus and binance coin.

Not all cryptocurrencies have faired so well, though, with ethereum showing -4 percent for the last 24 hours (on August 13), Ripple, -5.5 percent, and bitcoin cash, -8.2.

Source: coindesk.com

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: