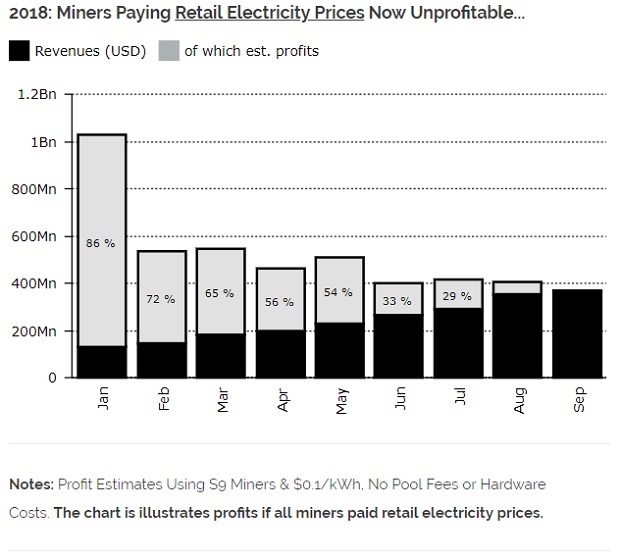

Bitcoin miner revenues in the first 6-months of this year surpassed all earnings of 2017 but activity became unprofitability for the first time

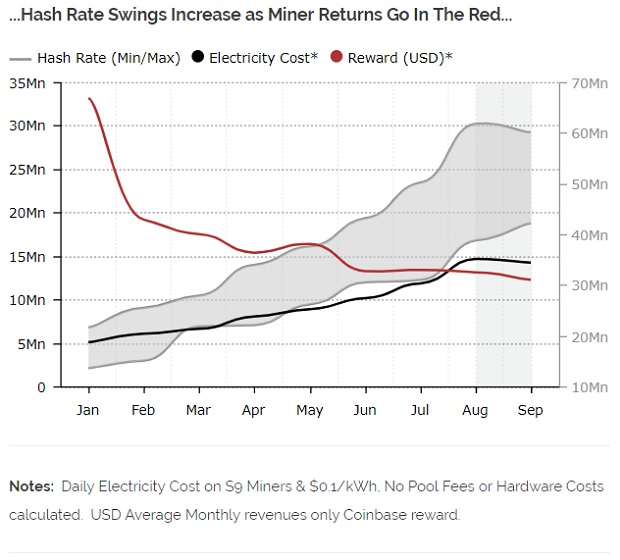

To date, revenues have exceeded last year by a whopping $1.4Bn. But the record hash rate hit at the end of August saw miners paying retail electricity prices move to unprofitability for the first time in September, Diar estimates show.

Bear market aside, Bitcoin’s price remains over 40% higher than a year ago. And the coinbase reward of 54,000 Bitcoins per month remain up for grabs by Bitcoin miners. The reward and fees for the first three quarters of this year represented $4.7Bn in revenues for miners who are keeping the network secure.

The investment proposition for smaller miners held true throughout most of this year, but has since become questionable on the back of an increase of computing power competing for the coinbase reward (see chart).

MINING FOR BIG GUNS ONLY

China, who has an average cost of $0.08 kw/h at retail, and estimated to be half that at wholesale, is currently one of the handful of countries that would make economic sense to mine for Bitcoins with retail prices. Even then, however, equipment, salaries, rents, overheads could push inexperienced mining operations into the red.

Bitmain, who released new information about their operations to support their upcoming Hong Kong listing revealed a business model that could bring new economic realities – and powers – to the fore.

The company, who runs two of the largest mining pools, as well as a key investor in ViaBTC, is actually banking on the sale of mining equipment – and has been for several years. In the first half of this year, 95% of revenues came from the sale of its miners.

Business then, for Bitmain is good when miners are earning. And according to it’s IPO disclosures, the mining equipment mammoth sells just over half (51.8%) of their miners to international clients. And Bitmain estimates that it has cornered 75% of global market for miners.

SWING PRODUCER?

While Bitmain has spread its tentacles across the world with operations and warehouses, it also runs 11 mining facilities in China – home to 200k mining units. Should those units represent S9 miners, and be fully deployed to mining Bitcoin alone, this could represent a near 6% of the networks current hash power, that sits just below its all-time high.

With three more mining farms planned to go online in 1Q19 in the United States (Washington State, Texas, and Tennessee) could see Bitmain acting as a swing producer in an effort to keep the network profitable for all miners – including their own operations in the west where operating expenses are likely to run much higher than in their home base.

WHOLESALE SQUEEZE TIME?

It’s unlikely then that the recent tapering out of the Hash power to last. With big mining operations on low electricity costs running at anywhere between 50-60% gross profit from Bitcoin revenues, the market has a lot of room left to grow and, profits to squeeze. But Bitcoin mining has, at least for now, and most likely in the future, moved into the court of bigger players with deep pockets.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: