Bitcoin hits record above $20K as analysts remain confident of future

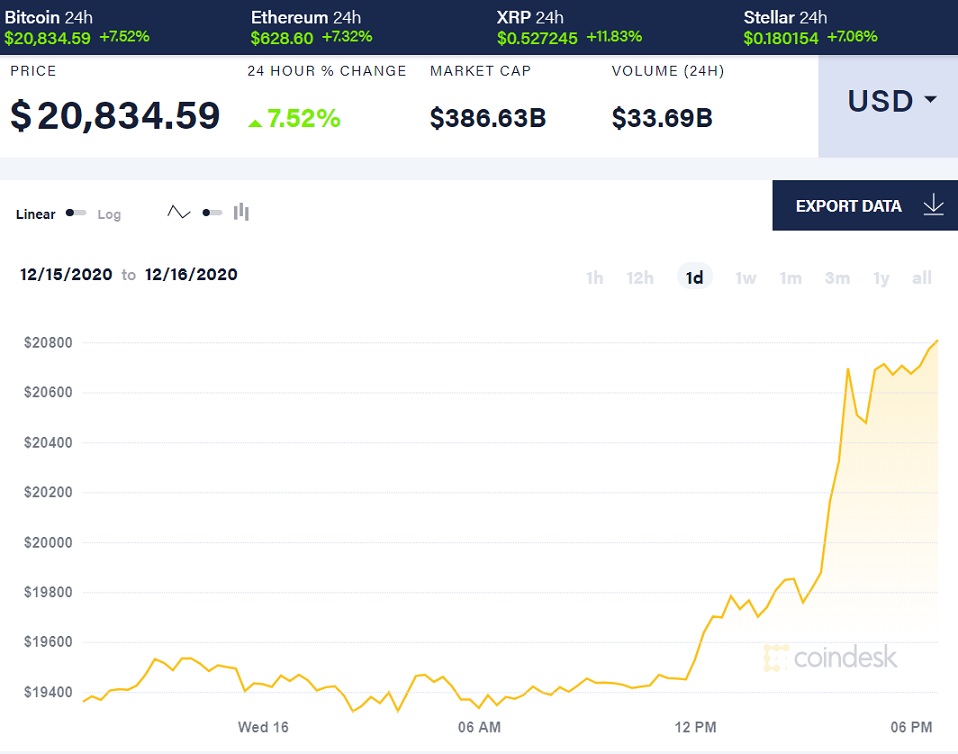

After testing investor patience for three weeks, bitcoin has finally crossed above $20,000 to reach fresh all-time highs, according to coindesk.com.

The number one cryptocurrency by market value jumped over the key psychological threshold during the early U.S. trading hours, surpassing the previous peak price of $19,920 recorded on Dec. 1. At the current price of above $20,800, bitcoin is up 7.5% over 24 hours, according to CoinDesk’s Bitcoin Price Index (BPI).

Bitcoin’s value has doubled in the past three months and the institutional-led rally looks sustainable. Meanwhile, other prominent cryptocurrencies such as ether, litecoin and XRP are still down 58% to 88% from their respective lifetime highs reached three years ago.

“When this [rally to near $20,000] happened in 2017, there was a real lack of products for the new converts to experience, whereas today there are endless uses, protocols, services across farming, lending, standard trading, etc,” Soravis Srinawakoon, CEO and co-founder of cross-chain data oracle Band Protocol told CoinDesk. “Therefore, we’d expect to see the new adopters hang around this time.”

Breaking above $20,000, which represented a significant hurdle in the mindset of most traders, is entirely new ground for bitcoin and opens the doors for a climb to $100,000 over the course of 2021, according to some.

That rise would bode well for other crypto sectors as well, including decentralized finance (DeFi), according to DversiFi’s CEO Ross Middleton.

“Bitcoin profits are partially recycled back into other smaller tokens later in the bull cycle. In 2017 that was other blockchains such as Ripple, Litecoin and EOS,” said Middleton. “However, this time around, funds are likely to flow into the new crop of DeFi blue-chip projects, built on Ethereum.”

And while bitcoin is now up over 180% on a year-to-date basis, gold has added just over 22%. Bitcoin, often touted as digital gold, has decoupled from the yellow metal this quarter with a more than 80% rally. Meanwhile, gold has suffered a 1% drop, with investors pulling money out of exchange-traded funds.

Earlier this week, JPMorgan published a global markets strategy note that points out money has flowed out of gold and into bitcoin since October, and predicts this trend will continue over the medium to longer term.

For more details: Bitcoin’s Relationship With Gold Is More Complicated Than It Looks

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: