Bitcoin fell below $5,000 – 45 percent loss year-over-year

The price of bitcoin, the world’s largest and most valuable cryptocurrency, fell below $5,000 for the first time since October 2017 and its current price – hovering above $4,500 at time of writing – reflects a roughly 45 percent loss year-over-year. It’s notable that this state of affairs came to fruition during what has historically proven to be a bullish month for bitcoin.

As CoinDesk previously reported, the month of November has concluded with a monthly gain for BTC seven times since pricing data was first collected in 2010, but its current monthly performance of -24 percent is heavily stacking the odds in favor of this November proving to be an exception to the 8-year trend.

BTC’s recent plummet tells only half the story of a much larger cryptocurrency market sell-off, although its plunge below $6,200 on Nov. 14 was likely the spark to the powder keg that was the broader market.

From Nov. 14 to today, the cryptocurrency market has shed $50 billion and a whopping 23 percent from its total capitalization to where it stands now at $162 billion – a far cry from its all-time high north of $820 billion set this past January, according to CoinMarketCap.

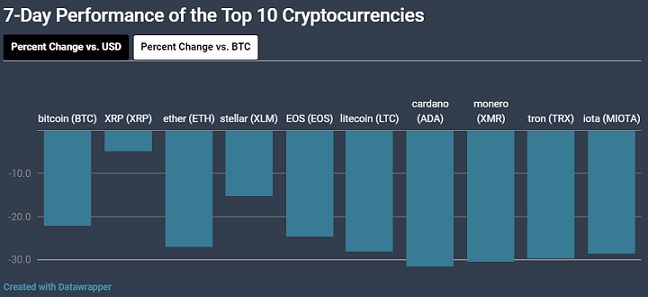

What perhaps best depicts the extent of the market rout is the performance of the world’s 10 largest cryptocurrencies by market capitalization over the past seven days.

Traders and investors alike are now likely waiting for the market to bottom out in what’s known as capitulation, whereby market participants surrender completely and forfeit demand. At such a point in time when a bottom is formed, fear in the market is at its absolute peak, accompanied by falling sell volume that is slowly outpaced by rising buy volume.

Although its now certainly painful for market participants, it remains to be seen if a bottom will be reached any time soon.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: