Bitcoin could eventually collapse, Swedish central banker warns

The governor of Sweden’s central bank compared buying and selling Bitcoins to trading stamps, questioning the staying power of currencies without government backing, according to Bloomberg.

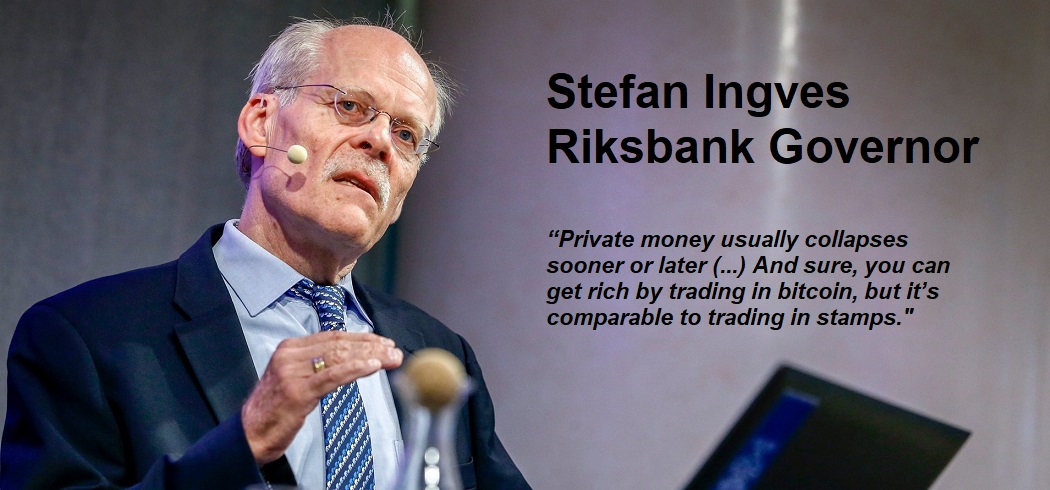

“Private money usually collapses sooner or later,” Riksbank Governor Stefan Ingves said at a banking conference in Stockholm. “And sure, you can get rich by trading in bitcoin, but it’s comparable to trading in stamps.”

Ingves said earlier this year that Bitcoin and other cryptocurrencies are unlikely to escape regulatory oversight as their popularity grows.

What other central bankers have said about bitcoin and crypto

In February, Ireland’s central bank governor Gabriel Makhlouf said bitcoin investors should be ready to lose all their money.

„Personally, I wouldn’t put my money into it, but clearly, some people think it’s a good bet,” Makhlouf said. „Three hundred years ago, people put money into tulips because they thought it was an investment.”

Likewise, in May, Bank of England governor Andrew Bailey said cryptocurrencies have no intrinsic value and may crash to zero.

„I’m sorry, I’m going to say this very bluntly again: buy them only if you’re prepared to lose all your money,” Bailey said as dogecoin was surging to new heights.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: