Credit Suisse report: bitcoin and blockchain pose little risk to MasterCard or Visa – Swift could be in trouble

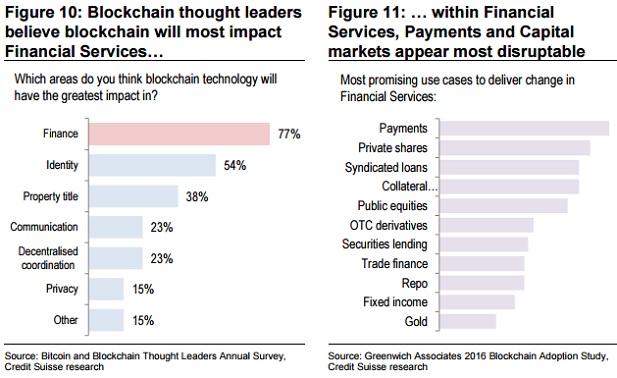

Visa, MasterCard, WorldPay and others in the payments sector can relax: Bitcoin will remain a niche player and blockchain technology poses little risk, according to a new report from Credit Suisse, which has less comforting news for Swift. In response to questions from investors about blockchain and its potential to disrupt traditional industries, Credit Suisse has put together a 135 page report pooling analysis on the impact the technology will have on 14 company stocks from around the world in different sectors: payments, capital markets, financial services and media.

„Bitcoin, a decentralized peer-to-peer payment network, is one application of blockchain and explains why much of our investor interest has focused on payments. However, we believe there are 13 barriers to mainstream bitcoin adoption and we are convinced it will remain a niche payment network. In contrast, the underlying blockchain technology, a distributed database that holds a secure and immutable record of past transactions, is the key differentiator that has the ability to disrupt.”, according to the report.

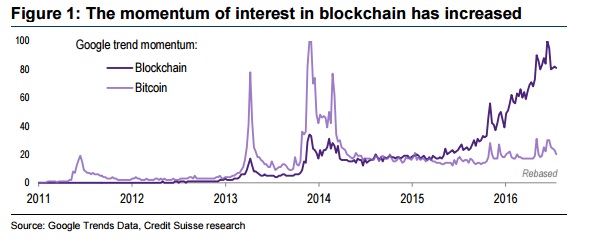

„The buzz surrounding blockchain is comparable to that surrounding the internet in the late 1980s – some go as far as to suggest that blockchain has the potential to reimagine and reinvent key institutions – for example, the corporation.”,the authors says.

Broadly, the authors conclude that Bitcoin faces an uphill struggle to become a major force. In contrast, shared ledgers are seen as a more potent force, with three key properties – disintermediation of trust, immutable record and smart contracts – endowing the technology with real advantages to legacy systems.

Analist view

We judge the obstacles to widespread bitcoin adoption as insurmountable in aggregate. Additionally, although we recognize the benefits of a permissioned public ledger – it is transparent and could remove the need for a central clearing house (currently fulfilled by Visa and Mastercard) – we see limited risk from blockchain as a technology to replace the existing payment rails.

In fact we think recent developments have solidified the roles of Visa and MasterCard (both rated Outperform). Specifically Apple Pay and other „pays” have in effect all elected to use the existing „rails” and make the networks the „guardians” of the tokenization process. In contrast, the „joint ventures” that attempted to change the way consumers transacted (such as Isis/Softcard and MCX/CurrentC) have largely failed. However, in financial service payments, nobody wants to be left out.

We believe bank-to-bank payment systems and trade finance products present the lowest-hanging fruit for disruption. These systems, such as SWIFT, are decades old, have very limited flexibility and face growing security threats (note SWIFT’s recent security breaches (FT, May 24th 2016)). They are also slow and costly – with cross-border wire-payments taking days to clear with fees as high as 10%.

Warns the report: Enter blockchain – a low-cost, instant, virtually unhackable, fully automated, end-to-end transaction system built on a private permission-based network. Such a system would not only enable banks to eliminate costly overheads, but would provide a lower-cost money transfer product attractive to large multi-national organizations with high frequent cross-border funding and trade finance demands.

In capital markets, the report says that blockchain is more of an opportunity than a threat for the London Stock Exchange, which gets an ‘outperform’ rating. In contrast, the market „appears to be overlooking risks” for some bourses, including the Australian Securities Exchange, which is itself bidding to bring the technology to bear in the post-trade arena.

Meanwhile, in financial services, Goldman Sachs is seen as well positioned to reap blockchain benefits thanks to its direct investments in the technology. JPMorgan is also praised for its determination to invest in DLT both internally and through partnerships with startups.

Read the full report

Source: www.finextra.com

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: