BIS working papers: Stablecoins and safe asset prices

This paper examines the impact of dollar-backed stablecoin flows on short-term US Treasury yields using daily data from 2021 to 2025. Inflows into stablecoins reduce three-month US Treasury yields by 2–2.5 basis points within 10 days, while outflows can have a larger impact, raising yields by 6–8 basis points.

Focus

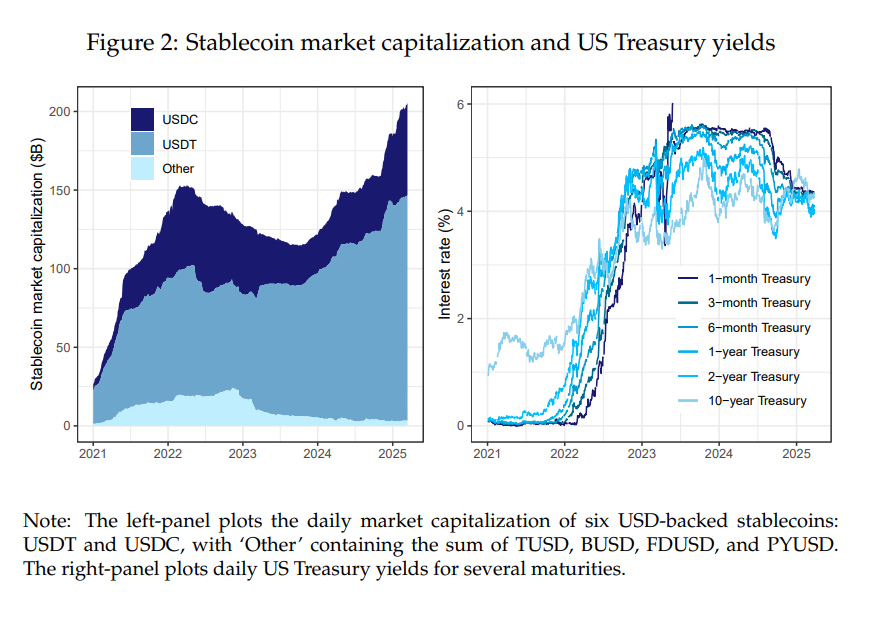

Stablecoins are digital assets designed to maintain a stable value relative to a reference asset, such as fiat currencies. The market is dominated by stablecoins that are pegged to the US dollar, with backing assets composed mostly of dollar-denominated short-term instruments such as US Treasury securities.

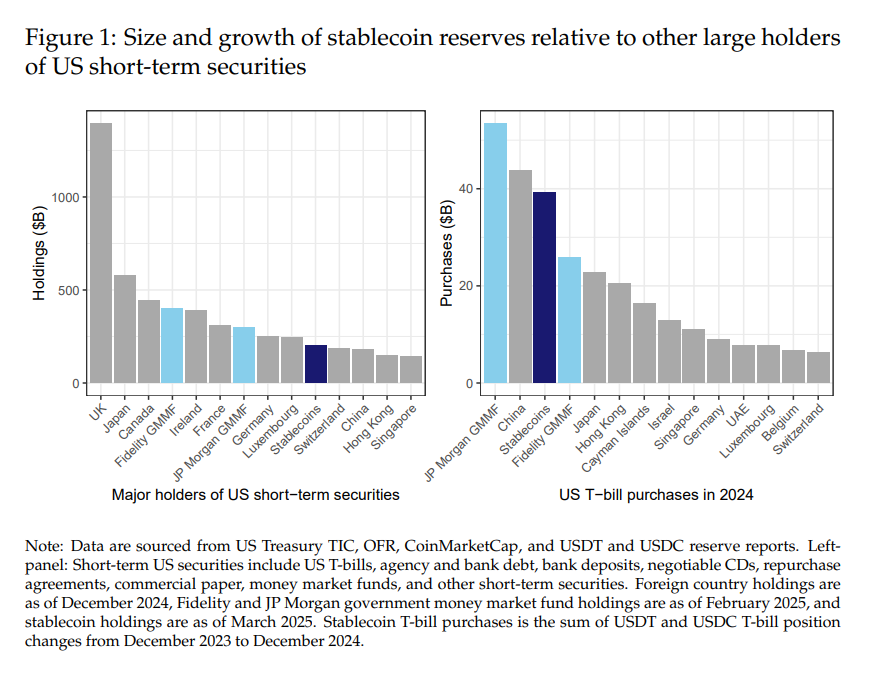

As of March 2025, their combined assets under management exceeded $200 billion, surpassing the short-term US securities holdings of major foreign investors. In 2024, they purchased $40 billion of US Treasury bills, similar to the largest US government money market funds and larger than most foreign purchases. Their rapid growth in recent years raises questions about the impact on the markets they invest in, with potential broader implications for monetary policy and financial stability.

Contribution

The paper highlights the growing interactions between stablecoins and traditional financial markets by analysing stablecoins’ impact on short-term US Treasury yields. Using daily data from 2021 to 2025 and an instrumental variable approach to address identification concerns, it isolates the effect of stablecoin flows on three-month Treasury bill yields. By breaking down the contributions of individual stablecoin issuers, the paper offers insights into stablecoins’ growing role in safe asset markets and their implications for monetary policy transmission and financial stability.

Findings

Inflows into stablecoins reduce three-month US Treasury yields by 2–2.5 basis points within 10 days, while outflows can have a larger impact, raising yields by 6–8 basis points. The effects are concentrated in short-term Treasury securities, with limited to no spillovers to longer-term maturities. Given its relative size, Tether (USDT) contributes the most to estimated effects, followed by Circle (USDC). These results suggest that stablecoins have already established themselves as significant players in Treasury markets. Their growth blurs the lines between cryptocurrency and traditional finance and carries implications for monetary policy, transparency of stablecoin reserves and financial stability – particularly during periods of market stress.

What authors say:

„We find evidence of asymmetric effects: stablecoin outflows raise yields by two to three times as much as inflows lower them. Decomposing the yield impact by issuer shows that USDT (Tether) has the largest contribution followed by USDC (Circle), consistent with their relative size. Our results highlight stablecoins’ growing footprint in safe asset markets, with implications for monetary policy transmission, stablecoin reserve transparency, and financial stability.„

More details here: BIS Working Papers No 1270 – Stablecoins and safe asset prices

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: