One of the key takeaways of the latest Bank for International Settlements (BIS) Bulletin No 3, Covid-19, cash, and the future of payments, is that although the Covid-19 pandemic has fanned public concerns that the coronavirus could be transmitted by cash, scientific evidence suggests that the probability of transmission via banknotes is low when compared with other frequently-touched objects, such as credit card terminals or PIN pads.

To bolster trust in cash, central banks are actively communicating, urging continued acceptance of cash and, in some instances, sterilising or quarantining banknotes. Some encourage contactless payments.

Looking ahead, developments could speed up the shift toward digital payments. This could open a divide in access to payments instruments, which could negatively impact unbanked and older consumers. The pandemic may amplify calls to defend the role of cash – but also calls for central bank digital currencies.

Viral transmission through banknotes and coins?

The Covid-19 pandemic has led to unprecedented public concerns about viral transmission via cash.

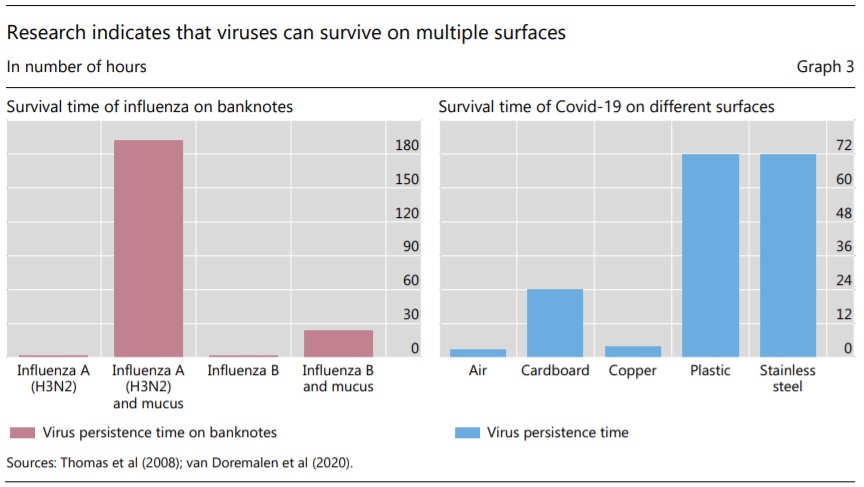

Research in microbiology examines whether pathogenic agents, including viruses, bacteria, fungi and parasites can survive on banknotes and coins (Angelakis et al, 2014). Thomas et al (2008) find that some viruses, including human flu, can persist for hours or days on banknotes, particularly when diluted in mucus (Graph 3, left-hand panel). Lopez et al (2011) find that non-porous surfaces have higher transfer efficiency, meaning that they can transmit viruses and bacteria more readily.

The Covid-19 virus can also survive on surfaces. A study by van Doremalen et al (2020) finds that Covid-19 can persist for three hours in the air, 24 hours on cardboard and even longer on other hard surfaces (Graph 3, right-hand panel). That said, scientists note that the probability of transmission via banknotes is low when compared with other frequently-touched objects. To date, there are no known cases of Covid-19 transmission via banknotes or coins. Moreover, it is unclear if such transmission is material compared with person-to person transmission or transmission through other objects or physical proximity. The fact that the virus survives best on non-porous materials, such as plastic or stainless steel, means that debit or credit card terminals or PIN pads could transmit the virus too.

The head of the German public health institute notes that “(viral) transmission through banknotes has no particular significance”, as airborne droplets from infected individuals are the main infection risk. Moreover, experts note that washing hands after touching cash or other objects may help to reduce the risk of transmission.

Promoting trust in cash and universal acceptance

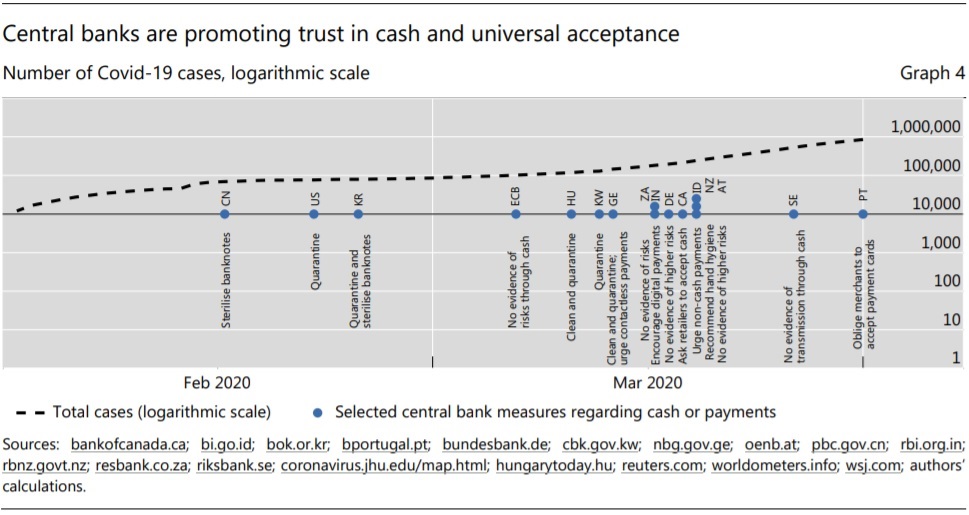

To bolster trust in cash and guarantee universal acceptance, several central banks have actively communicated that risks are low, and taken further actions (Graph 4). The Bank of England has noted that “the risk posed by handling a polymer note is no greater than touching any other common surfaces such as handrails, doorknobs or credit cards”. The Bundesbank has advised the public that the risks of transmission through banknotes are minimal and that a sufficient supply of banknotes is guaranteed. The Bank of Canada has asked retailers to stop refusing cash payments. The South African Reserve Bank has counteracted scams by clarifying that there is no evidence of transmission by cash and it is not withdrawing cash from circulation.

Other central banks have taken further measures. The People’s Bank of China began in February to sterilise banknotes in regions affected by the virus. On 6 March, the Fed confirmed that it was quarantining bills arriving from Asia prior to recirculation. Central banks in South Korea, Hungary, Kuwait and other countries have also moved to sterilise or quarantine banknotes, and thus to ensure that cash leaving central bank currency centres does not carry pathogens. Central banks or governments in India, Indonesia, Georgia and several other countries have encouraged cashless payments.

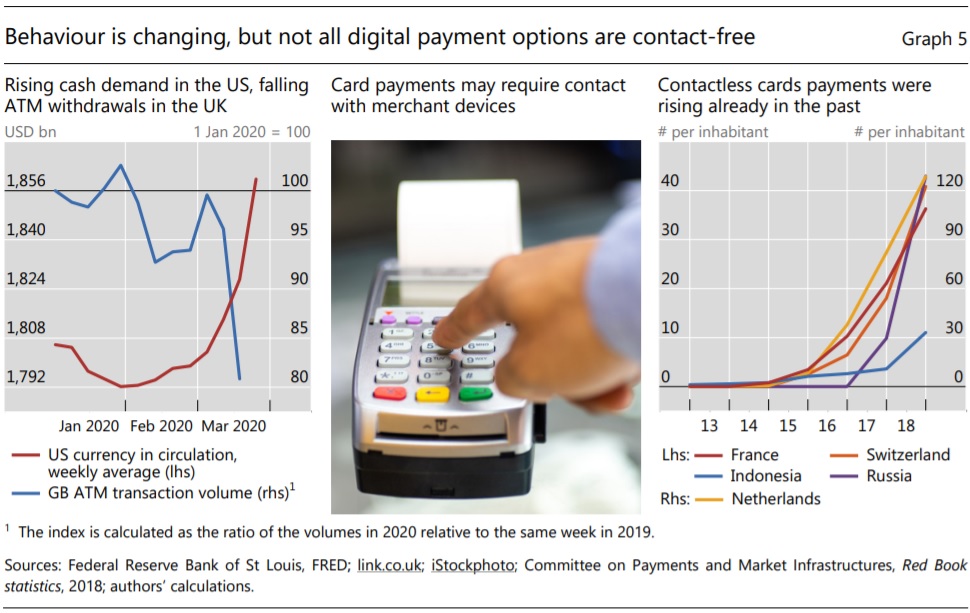

Implications for digital payments and central bank digital currencies Irrespective of whether concerns are justified or not, perceptions that cash could spread pathogens may change payment behaviour by users and firms. In past crises, demand for cash has often increased, as consumers have sought a stable store of value and medium of exchange. At the current juncture, data do not yet paint a uniform picture. In the United States, cash in circulation has recently increased. But in the United Kingdom, automated teller machine (ATM) withdrawals have fallen (Graph 5, left-hand panel). In the medium term, the outbreak could in principle lead to both higher precautionary holdings of cash by consumers and a structural increase in the use of mobile, card and online payments. These developments may differ across societies, and between different consumers.

Current developments bring digital payments to the fore. Yet not all digital payments are immune. For instance, debit and credit card transactions generally require a signature or a PIN entry at a merchantowned device for larger transactions (Graph 5, centre panel). Contactless card payments, which are popular in several countries (Graph 5, right-hand panel) do not require a PIN for small transactions. Recently, authorities, banks and card networks in Austria, Germany, Hungary, Ireland, the Netherlands, the United Kingdom and elsewhere have set higher transaction limits for contactless payments.

Digital wallets or other smartphone-based payment interfaces (eg stored card details or QR codes) where no physical contact of the same object by multiple persons takes place are further potential solutions. Online payments for e-commerce are of course not susceptible to viral transmission.

A realistic assessment of the risks of transmission through cash is particularly important because there could be distributional consequences of any move away from cash. If cash is not generally accepted as a means of payment, this could open a ‘payments divide’ between those with access to digital payments and those without. This in turn could have an especially severe impact on unbanked and older consumers.

In London, one reporter has already noted the difficulties of paying with cash, and the consequences for the 1.3 million unbanked consumers in the United Kingdom. In many of the emerging market and developing economies where authorities have recently called for greater use of digital payments, access to such alternatives is far from universal. This could remain an important debate going forward, potentially asking for a strengthening of the role of cash.

Resilient and accessible central bank operated payment infrastructures could quickly become more prominent, including retail central bank digital currencies (CBDCs). Such infrastructures would need to withstand a large range of shocks, including pandemics and cyber attacks.

In the context of the current crisis, CBDC would in particular have to be designed allowing for access options for the unbanked and (contact-free) technical interfaces suitable for the whole population. The pandemic may hence put calls for CBDCs into sharper focus, highlighting the value of having access to diverse means of payments, and the need for any means of payments to be resilient against a broad range of threats.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: