Joint report by The Bank of Canada, European Central Bank, Bank of Japan, Sveriges Riksbank, Swiss National Bank, Bank of England, Board of Governors of the Federal Reserve and Bank for International Settlements.

The report explores the use cases for, and challenges and opportunities arising from, the possible issuance of a general purpose CBDC. It is an exploration and does not imply that the central banks in this group are actively considering issuance.

Central banks have been providing trusted money to the public for hundreds of years as part of their public policy objectives. Yet the world is changing. To evolve and pursue their public policy objectives in a digital world, central banks are actively researching the pros and cons of offering a digital currency to the public (a „general purpose” central bank digital currency (CBDC)).

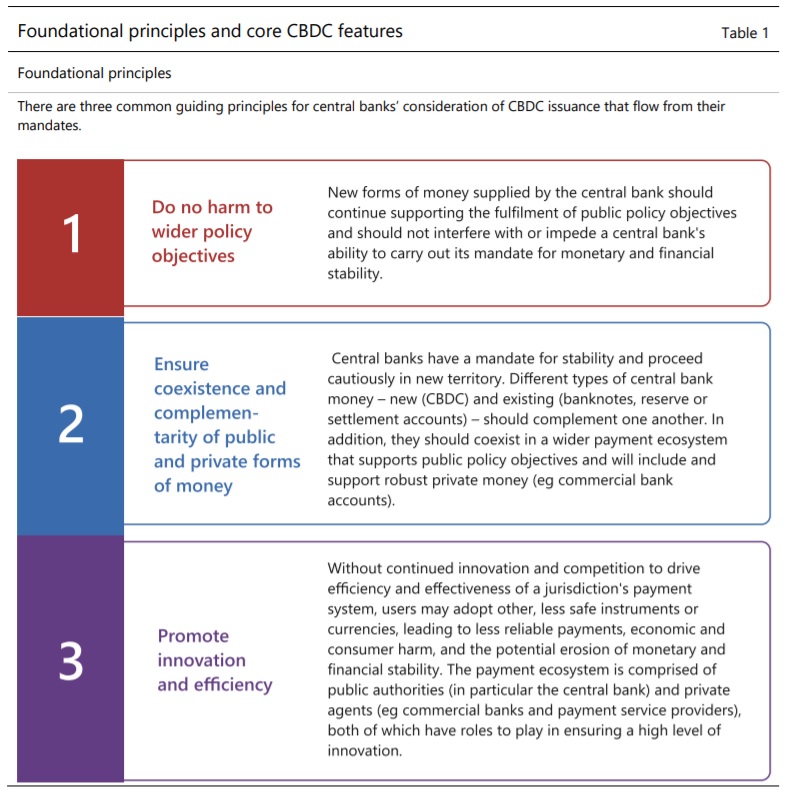

The Bank of Canada, European Central Bank, Bank of Japan, Sveriges Riksbank, Swiss National Bank, Bank of England, Board of Governors of the Federal Reserve and Bank for International Settlements have collaborated on a report setting out common foundational principles and core features of a CBDC. These principles emphasise that, in order for any jurisdiction to consider proceeding with a CBDC, certain criteria would have to be satisfied. Specifically, authorities would first need to be confident that issuance would not compromise monetary or financial stability and that a CBDC could coexist with and complement existing forms of money, promoting innovation and efficiency.

A CBDC robustly meeting these criteria and delivering the features set out by this group could be an important instrument for central banks to deliver their public policy objectives. This group of central banks will continue to collaborate and explore the practical implications outlined in the report.

Benoît Cœuré and Sir Jon Cunliffe, co-chairs of a central bank working group, discuss the report, Central Bank digital currencies: foundational principles and core features.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: