BIS Innovation Hub targets CBDCs, green & open finance in 2021

The Bank for International Settlements’ Innovation Hub (BISIH) set out its work programme, demonstrating its focus on six key areas as it fosters international collaboration among central banks on innovative financial technology.

An investigation into the use of multiple wholesale CBDCs for cross-border payments and a DLT prototype for the distribution of tokenised green bonds to retail investors are among the projects on the agenda this year.

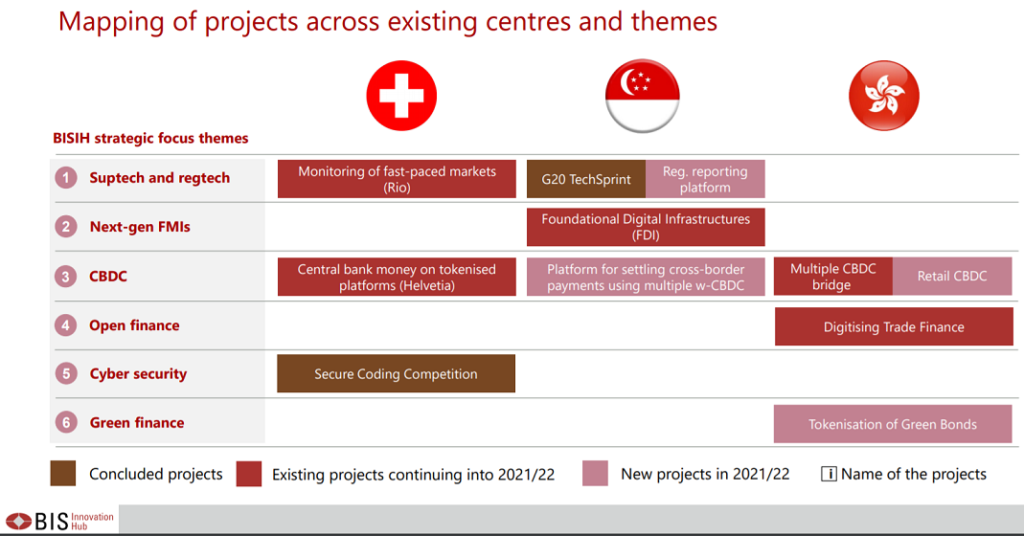

Set up in 2019 the BIS Innovation Hub has centres in Switzerland, Hong Kong and Singapore, with locations in Toronto, London, Frankfurt and Paris, and Stockholm on the horizon.

For the year ahead, the hub has identified six key areas it will work on in an effort to foster collaboration among central banks on financial technology: suptech and regtech; next-generation financial market infrastructures; CBDCs; open finance; cyber security; and green finance, according to the press release.

Among the newly launched projects will be:

. a proof of concept solution for a regulatory reporting platform employing data analytics and data visualisation to provide supervisors with deeper and more timely insights to address risks;

. a proof of concept platform using multiple wholesale CBDCs to explore the feasibility of faster and cheaper cross-border payments;

. a technological research project and associated prototype(s) for tiered retail CBDC distribution architectures; and

. a distributed ledger technology prototype for distribution of tokenised green bonds to retail investors.

The initiatives will be driven by the first three BIS Innovation Hub Centres in Hong Kong, Singapore and Switzerland which have been established in conjunction with their partner central banks: the Hong Kong Monetary Authority, the Monetary Authority of Singapore and the Swiss National Bank.

Other initiatives will be undertaken by the planned new Hub Centres across Europe and North America when they begin operations in the coming months, as well as a Strategic Partnership with the Federal Reserve Bank of New York.

„This work programme shows our commitment to exploring in the most practical ways how best to harness technological change for the benefit of central banks and create public goods to support the global financial system. We look forward to taking on the challenges of the year ahead together with our partner central banks,” said Benoît Cœuré, BISIH Head.

During its first full year of operation, the BISIH advanced work on key projects related to its thematic priorities. These included:

The G20 TechSprint, which enabled central banks and financial regulators to collaborate with fintech firms on technology solutions to resolve operational problems in regulatory compliance and supervision.

The Foundational Digital Infrastructure (FDI) project, which will develop a blueprint for a next-generation cross-border payments network that involves the interconnection of existing rails across jurisdictions.

Project Helvetia, a collaborative experiment showing the feasibility of integrating tokenised assets and central bank money.

The TechChallenge, which showcased the potential for new technologies to resolve problems in trade finance.

Project Rio, a prototype market surveillance platform making use of artificial intelligence and other state-of-the-art technology.

On 19 January 2021, the BISIH also launched the BIS Innovation Network to support BISIH priorities, share knowledge about technology projects and discuss innovative answers to problem statements relevant to central banks. All 63 BIS member central banks were invited to the first meeting, which was introduced by a presentation from innovation expert Alexandre Janssen.

The BIS Innovation Network features six working groups, mirroring the BISIH’s thematic priorities. They are chaired by

Susan Slocum (Reserve Bank of Australia, Suptech & Regtech),

Siritida P Ayudhya (Bank of Thailand, Next Generation FMIs),

Marius Jurgilas (Bank of Lithuania, CBDC),

Aristides Andrade Cavalcante Neto (Central Bank of Brazil, Open Finance),

Tomer Mizrahi (Bank of Israel, Cyber Security) and

Sharon Donnery (Central Bank of Ireland, Green Finance).

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: