Binance Research report on crypto market in H1 2023: „money moved from alternative assets into Bitcoin – notable developments have emerged in DeFi – NFTs experienced higher trading volume – Gaming-related tokens have largely edged higher in price”.

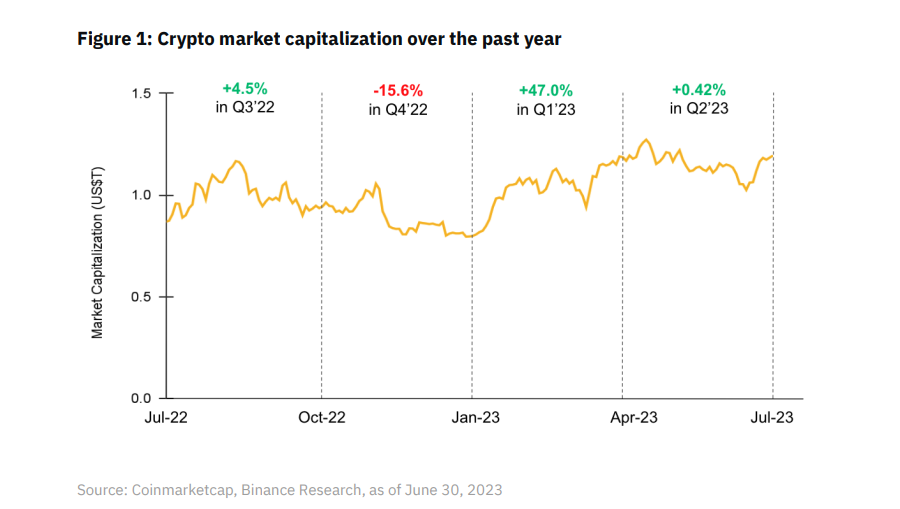

While the first half of 2023 has not been without challenges for the industry, the crypto market has shown resilience, with crypto market capitalization ending the period in positive territory.

Total crypto market capitalization (“market cap”) has risen by 30.3% on a year-on-year basis (“YoY”), closing at US$1.17T on June 30, 2023, compared to US$0.90T a year earlier.

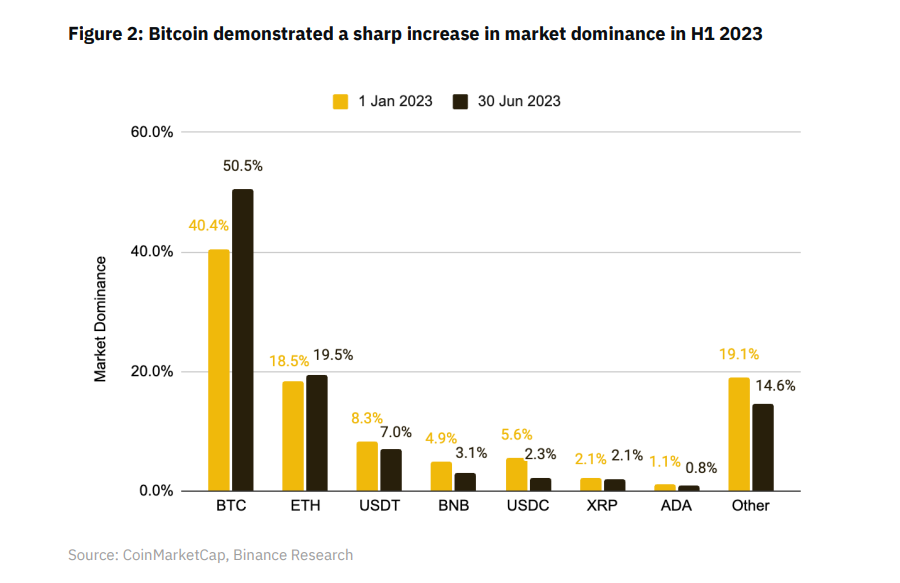

Bitcoin market dominance ended the half-year at its highest level since April 2021, while its year-to-date price performance of over 87% significantly outperformed many common TradFi investments. Bitcoin’s correlation with TradFi is now also at multi-year lows. Ordinals and Inscriptions have reverberated throughout the wider Bitcoin ecosystem with new energy, and we expect to see continued development and innovation in the next few months.

When looking at the top crypto assets, Ethereum and Ripple showed slight increases in market dominance. However, the majority of other top assets declined. Combining this with the fact that the overall crypto market cap grew across H1 2023, it would indicate that money moved from alternative assets into Bitcoin.

L1s had an eventful first half. Ethereum’s liquid staking reached new highs, birthing LSTfi, as BNB Chain focused on scalability. Solana bounced back after a tumultuous 2022 and released a Web3 phone, while Tron’s USDT dominance continued to grow. Avalanche progressed on subnets and corporate partnerships, while Cosmos advanced on shared economic security models.

While optimistic rollups continued to dominate, the ZK world reached new heights with the launch of the first fully functional zkEVMs. Many major players laid out their future visions, largely converging around the idea of networks of blockchains, i.e., L3s, Superchains, Hyperchains, etc.

Despite a 7.0% decline in global stablecoin market value, shifts in adoption trends, regulatory landscapes, and the approaches adopted by certain players have significantly reshaped the sector’s market composition. Among these changes, USDT has experienced a remarkable 25.8% increase in market share year-to-date (“YTD”), resulting in its departure from the major trio of stablecoins.

Notable developments have emerged in DeFi since the beginning of the year, largely attributed to the remarkable ascent of liquid staking, which has become the largest sub-sector, alongside the increasing migration of users towards DEXes. While the sector continues to unlock newer use cases, DeFi’s dominance experienced a 0.5% decline compared to the global crypto market.

NFTs experienced higher trading volume in H1 2023 as compared to H2 2022, largely driven by heightened activity on the Blur marketplace in the earlier part of the year. However, NFTs have underperformed the broad crypto market as the floor prices of many NFT collections have declined YTD.

Gaming-related tokens have largely edged higher in price throughout the first half of 2023, benefiting from the broader market recovery. Currently, more than 67% of games are built on BNB Chain, Ethereum, and Polygon.

The first half of 2023 extended a decline in overall crypto deal activities with a fall in venture capital funding. A clear area of interest has surfaced, with the infrastructure sector attracting the most investments, followed by gaming/entertainment and DeFi.

___________

More details of the report here

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: