Bill Gates’s bet for the next 15 years: „almost everyone will have a mobile money bank account”

By 2030, 2 billion people who don’t have a bank account today will be storing money and making payment with their phones. And by then, mobile money providers will be offering the full range of financial services, from interest-bearing savings accounts to credit to insurance, predicts Bill Gates. In the next 15 years, digital banking will give the poor more control over their assets and help them transform their lives. Bill Gates believes that the key to this will be mobile phones.

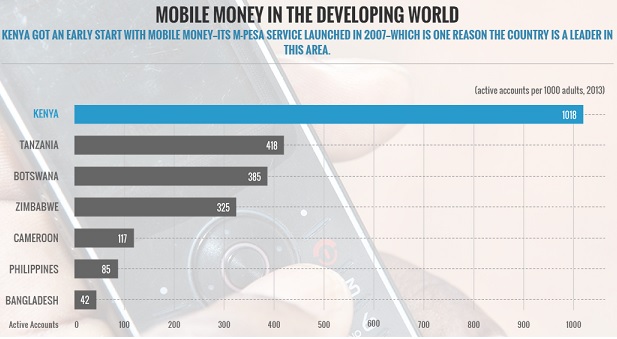

Already, in the developing countries with the right regulatory framework, people are storing money digitally on their phones and using their phones to make purchases, as if they were debit cards.

Traditional banks cannot afford to serve the poor because of their costs. That’s why 2.5 billion adults don’t currently have a bank account.

The companies pioneering mobile banking find it profitable to serve the poor because the marginal cost of processing a digital transaction is near zero. And because so many people in developing countries have mobile phones — more than 70 percent of adults in many countries are subscribers now — the volume of transactions can be very high. By making small commissions on millions and millions of transactions, mobile money providers can make a profit serving poor customers, just as brick-and-mortar banks do serving the wealthy.

In Bangladesh, the fastest-growing financial services company is a mobile money provider called bKash. Less than four years after launching, it processes roughly 2 million transactions per day, with a total value of nearly $1 billion each month.

Source: IMF

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: