Belgian banks and mobile network operators launch itsme®: a single digital identity that replaces all passwords on the web

Launched earlier this year, by seven market leaders from the Belgian banking and telecoms sectors, the app can now be used by ING customers to sign into their accounts and approve transactions.

Could there ever be a single digital identity that replaces the many passwords and card readers on the web? With the itsme® mobile app, it’s no longer a pipe dream. Using this app, all Belgians can prove their identity online beyond the shadow of a doubt: I am who I say I am = it’s me = itsme®. Whether they’re paying at a web shop or signing an official document online.

itsme® is the result of a unique collaboration between Belgium’s four leading banks and three mobile network operators, all of which have pooled their resources to create the ‘Belgian Mobile ID’ consortium. The banks involved are Belfius, BNP Paribas Fortis, KBC/CBC and ING, while the mobile network operators are Orange, Proximus and Telenet The federal government is also involved, making itsme® the first mobile identity app of its kind: extremely secure, easy to use and complies with digital privacy requirements.

These days, every Belgian has a laundry list of passwords, user names, tokens and card readers to be able to operate on the Internet. Not very user-friendly and certainly not suitable for the mobile and digital mobile world we live in. If they had just one mobile identity, users would find it easier to access a whole range of online applications much more easily, such as e-commerce, banking and government services.

The four big banks and three mobile network operators in Belgium have joined forces to form the Belgian Mobile ID consortium to develop just such a digital identity. The result of their combined efforts is the itsme® app, which goes live from 30th May.

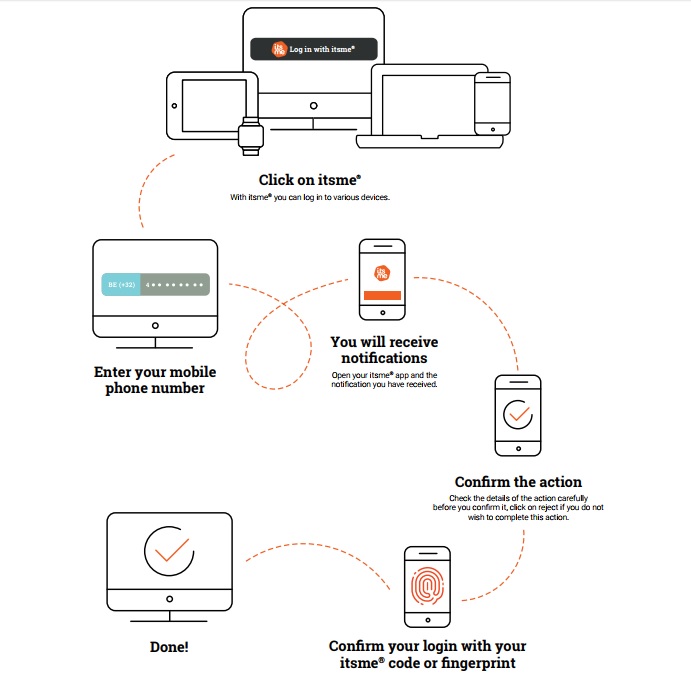

How it works and security

itsme® ensures that every user in the digital world can prove his or her identity beyond all doubt. “The app enables you to log into websites quickly, confirm digital transactions and (coming soon) even sign official documents,” explains Kris De Ryck, CEO of Belgian Mobile ID.

With every action they carry out (logging in, confirming or signing) users are required to enter their secret itsme® code into their mobile phone. A single 5-digit code is all it takes. So no more having to remember a user name and password for each different website you visit. And if your smartphone features a fingerprint scanner,

you can also work using a fingerprint.

Belgians have known for years that the classic payment card with a chip and a PIN code has always been a reliable system. itsme® is following the same path, but on a mobile phone. itsme® combines the proven efficiency of the payment card with the security technology of the SIM card. “It’s like a second layer of protection” explains Kris

De Ryck, CEO of Belgian Mobile ID. “The banks are obliged by law to verify the formal identity of their customers, which provides a watertight identity guarantee: I am who I say I am. The mobile network operators guarantee a highly secure SIM card and mobile network.”

The app itself is secure on three counts: itsme® only works if you use your mobile phone, SIM card and personal itsme® code together. If just one of the three elements is missing, your digital identity is blocked immediately.

Applications

There are so many possible applications for itsme®: for example, you can easily become a new customer at a retailer, order meal vouchers, request documents from your local council, check your pension entitlements on MyPension, sign payment transactions on your home banking, secure your home or turn on the heating remotely (Internet of Things) to be delivered, and so on.

Phase two of itsme® takes the app a step further. From the beginning of 2018, itsme® will offer users the ability to sign official documents via a mobile telephone, with the same binding value as a signature on paper. Once again, there are multiple applications: managing electricity or Internet contracts; viewing a medical file; lodging your tax return via Tax-on-web; signing a temporary employment contract and even a notarial deed.

Government on board

The concept of a mobile identity app fits perfectly with the ‘Digital Agenda’ of Minister Alexander De Croo, the aim of which is to digitise Belgium as quickly as possible. The government has indicated that it wants to provide itsme® as an option for the mobile identification of citizens and companies – federally, regionally and locally. itsme® will not replace the eID card, but your mobile ID (mID) is based entirely on the identity information stored in the eID card. So it is still the government that controls and guarantees identity.

“What’s happening is that the security of the eID card is being transferred to the mobile world,” says Minister

of Security and the Interior Jan Jambon. “You will be able to use your mobile itsme® in all sorts of situations online, but not when it comes to actual physical checks (airports, borders, etc.). You’ll still need your plastic eID card for that.”

One of the biggest benefits of itsme® is that consumers, private citizens, companies and government services can all use the system. “Discussions are currently underway with towns, cities and local authorities and public services, as well as with other public services such as the health sector and notaries,” adds Kris De Ryck from Belgian Mobile ID. “Lots of private service providers, such as insurance companies, temporary employment agencies

and the retail sector have already indicated their interest in the app.”

Itsme app in action

Source: www.itsme.be

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: