BCR reports a net profit of RON 742 million (EUR 149 million) in Q1 2025, +19.8% year-on-year, driven by „significant advance in customer business”

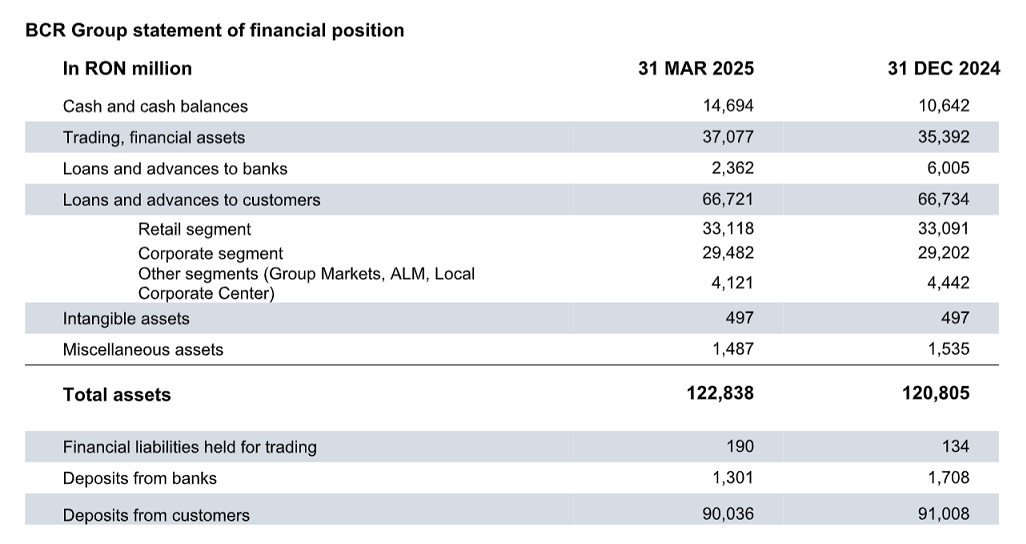

For the Q1 2025, BCR recorded a 9.7% increase in net assets, a 19.8% rise in net profit, 12.7% higher operating revenues, and a 15.7% growth in operating result, all driven by a significantly higher business volume with clients. The stock of net customer loans granted by BCR advanced by 12.5% year-on-year as of 31 March 2025.

BCR’s impact on economy and society

In retail banking business, BCR generated total new loans to individuals and micro businesses of over RON 3.2 billion in Q1 2025. The stock of unsecured consumer loans (including credit cards and overdrafts) increased by 41.4% yoy. At the same time, the stock of standard mortgage loans (Casa Mea) in local currency increased by 14.1% yoy, with Prima Casă loan portfolio impacted by declining demand.

In corporate banking business, BCR approved new corporate loans of RON 3.5 billion in Q1 2025, of which approximately 42% are aimed for investments.

In Q1 2025, BCR Leasing’s financing portfolio reached a value of RON 4.73 billion (EUR 950 million), marking an 11% increase compared to Q1 2024. The volume of new financing also rose by 20% year-on-year. BCR’s leasing subsidiary continued to support the Romanian entrepreneurial ecosystem, registering the strongest growth in the transport, healthcare, and retail sectors.

Financial highlights for BCR Group in Q1 2025

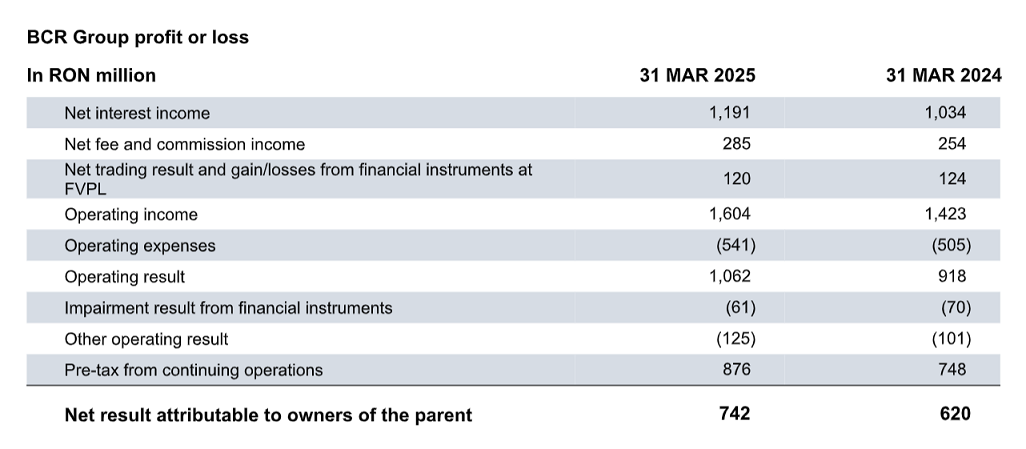

BCR achieved a net profit of RON 742 million (EUR 149 million) in Q1 2025, up by 19.8% against RON 620 million (EUR 125 million) in Q1 2024, „driven by improved operating result underpinned by significant advance in customer business” – according to the press release.

Operating result improved by 15.7% to RON 1,062 million (EUR 214 million) in Q1 2025, from RON 918 million (EUR 185 million) in Q1 2024, on the back of strong increase in operating income and well managed operating expenses.

Net interest income increased by 15.2% to RON 1,191 million (EUR 239 million) in Q1 2025, from RON 1,034 million (EUR 208 million) in Q1 2024, driven by higher business volumes.

Net fee and commission income improved by 12.2% to RON 285 million (EUR 57 million) in Q1 2025, from RON 254 million (EUR 51 million) in Q1 2024, driven by higher transactional business and lending activity.

Net trading & FV result decreased by 3.5% to RON 120 million (EUR 24 million) in Q1 2025, from RON 124 million (EUR 25 million) in Q1 2024.

Operating income increased by 12.7% to RON 1,604 million (EUR 322 million) in Q1 2025, from RON 1,423 million (EUR 286 million) in Q1 2024, driven by improved net interest income and net fee and commission income.

General administrative expenses reached RON 541 million (EUR 109 million) in Q1 2025, up by 7.2% in comparison to RON 505 million (EUR 101 million) in Q1 2024, on the back of higher IT costs to support strategic projects together with slightly higher personnel expenses. As such, cost-income ratio improved to 33.7% in Q1 2025, versus 35.5% in Q1 2024.

Capital position and funding

Solvency ratio for BCR Bank standalone, according to the capital requirements regulations (CRR) stood at 23.2% as of February 2025, well above the regulatory requirements of the National Bank of Romania. Furthermore, the Tier 1+2 capital ratio of 21.8% (BCR Group) as of February 2025 is clearly „reflecting BCR’s strong capital and funding positions”.

Net loans and advances to customers remained stable against 31 December 2024 at RON 66,721 million (EUR 13,406 million) as of 31 March 2025.

Deposits from customers slightly decreased by 1.1% to RON 90,036 million (EUR 18,090 million) as of 31 March 2025 from RON 91,008 million (EUR 18,296 million) as of 31 December 2024.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: