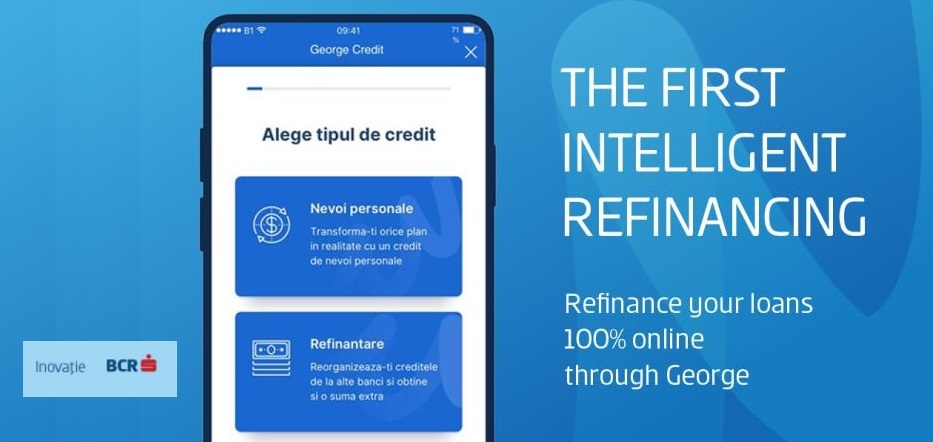

„I am very excited to announce another innovative feature available for the first time in the Romanian digital lending market: the 100% online personal loan refinancing from George! This is yet another milestone from our Digital Labs, aimed at offering customers the fully digital lending solution in one product. George users can get the desired loan amount, opt for the due date of the credit installment and apply for the Intelligent Refinancing, just in a matter of minutes!”, says Anca Petcu, Chief Transformation Officer at BCR, on her linkedin account.

„George is at the heart of this cycle and all these features can be accessed from George Credit, available in the George Store. I am thankful to the BCR teams involved in the development of this unique project! George Intelligent Refinancing is available in George Store starting today and it’s truly a game changer.”, Petcu added.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: