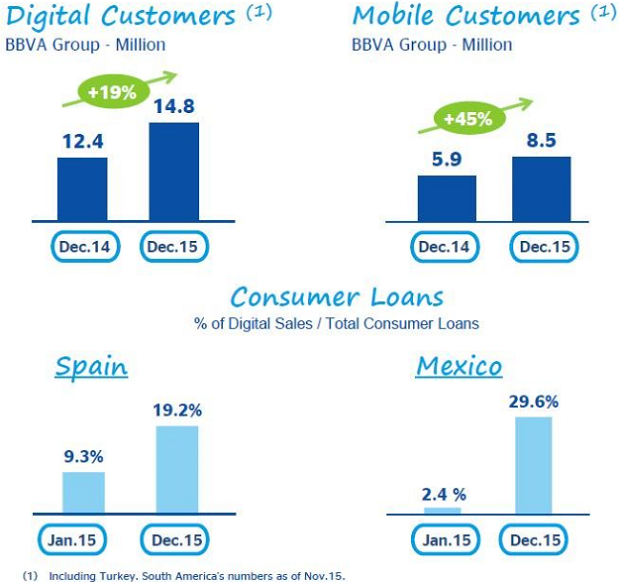

BBVA has 8,5 mil. clients operated through their mobile devices – up 45% y-o-y

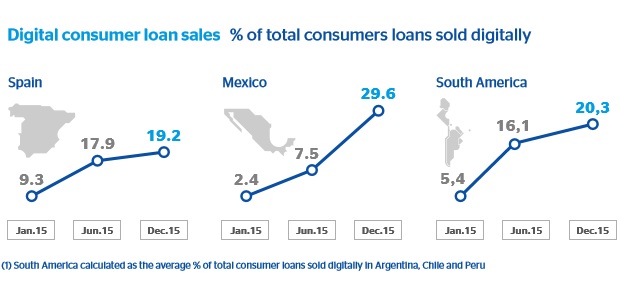

BBVA has highlighted the role played by its digital transformation strategy in pushing the bank’s earnings potential, saying that 19.2% of new consumer credit in Spain last year had been sold through digital channels, double the number sold in the previous year. In Mexico this figure was 29.6%.

BBVA executive chairman Francisco Gonzalez, says: “We have 8.5 million customers who use their mobile but the important factor is not the number but rather the rate of growth. Mobile users are up 45% compared to 2014. Therefore the pace of digital transformation is going very well.”

Digital banking is the lever to accomplish the goal of becoming a leader in customer satisfaction in all geographic regions. The bank is among the leaders in Spain, Mexico, Colombia, Argentina and Venezuela, according to the standards of the Net Promotor Score index.

According to the bank’s press release, the transformation process accelerated in 2015 thanks to the new structuring that was announced in May, accompanied by new strategic priorities. At the same time the BBVA Group continued to launch digital products and incorporate new digital businesses. The latest move was the purchase of a 29.5% stake in Atom, a mobile-only British bank, in November.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: