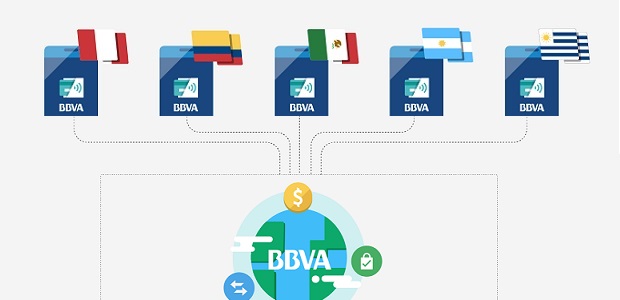

BBVA Group has developed a global platform to facilitate mobile payments across all the countries in its footprint thanks to tokens.

„Instead of relying on local platforms to deliver this functionality to each market, BBVA delivered a single development that provides these services directly across its entire footprint, thus saving time and resources and dramatically improving time to market for all customers. The platform developed by BBVA connects to Visa and Mastercard directly from each country’s application and provides the data required to process digital transactions from a smartphone.”, according to the press release.

BBVA has used token technology to develop a global platform that integrates the activation of mobile payments in its banking apps in any of the countries within its operating footprint. The platform will also offer customers new payment experiences, thanks to tokenization. This approach consists of replacing real payment card numbers with a unique identification code called a “token,” which is generated by Token Service Providers (TSPs) like Visa and Mastercard, and they allow transactions to be performed without exposing the customer’s real data.

This new payment method replaces sensitive debit or credit card data with a unique identification code called a ‘token,’ which is used during a digital transaction. Online transactions are therefore more secure because the customer’s actual card data no longer needs to be provided. BBVA has already committed to helping its customers adopt this new payment approach.

The platform BBVA developed connects to Visa and Mastercard directly from each country’s application and provides the data required to process digital transactions from a smartphone. The platform includes a module that integrates with the banking app and is dedicated to securely storing the data in the device and communicating with the contactless sale terminal in order to process the payment using the mobile devices’ near-field communication (NFC) technology.

Customers in Peru can already use the mobile payment technology thanks to the platform, which will be rolled-out to BBVA’s other markets in the coming months. The platform was developed as an agile, global initiative, in order to ensure that its functionality could be quickly adapted to the distinct customer requirements in each of the respective local markets.

“We want to be the first ones to provide new digital payment features to the customers in our markets, and this is only possible with the designs developed using this platform. A global approach to creating and developing products has become an integral part of our work philosophy at BBVA,” explains Alfredo Sanz, BBVA’s Product Owner for Payment Solutions. “Being the first ones to offer our customers all these options when they are making payments is a key part of the bank’s digital transformation strategy”.

Tokenization is already in use in mobile payment platforms like Apple Pay and Google Play, as well as in the BBVA mobile payment platform. Large digital companies like Netflix and Amazon are gradually adopting tokenization in order to securely store their customers’ credentials.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: