Basel Committee investigates fintech implications for banks and identifies 5 scenarious for future development of banking industry

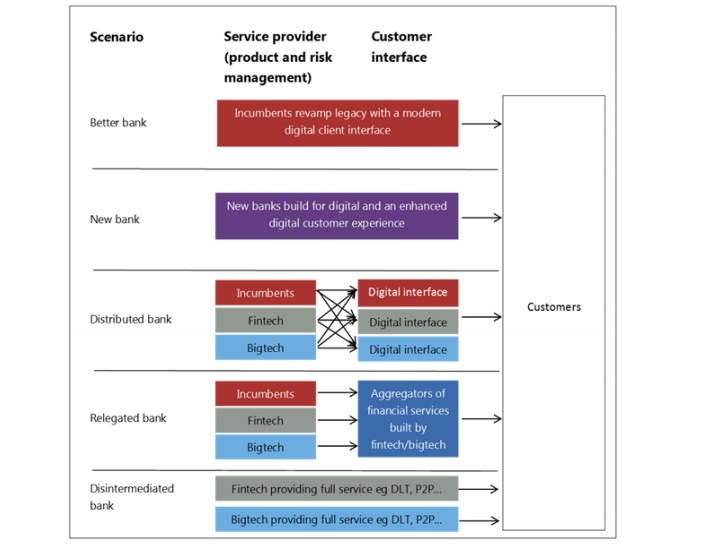

The key questions considered when developing the banking industry scenarios are (i) which actor manages the customer relationship or interface, and (ii) which actor ultimately provides the services and takes the risk. The rise of fintech innovation has resulted in what some have dubbed the battle for the customer relationship and customer data. The outcome of this battle will be crucial in determining the future role of banks.

The Basel Committee on Banking Supervision (BCBS) released a consultative document on the implications of fintech for the financial sector. Sound Practices: Implications of fintech developments for banks and bank supervisors assesses how technology-driven innovation in financial services, or „fintech”, may affect the banking industry and the activities of supervisors in the near to medium term.

„As fintech developments remain fluid, the impact on banks and their business models is uncertain. While some market observers estimate that between 10–40% of revenues and 20–60% of retail banking profits are at risk over the next 10 years, others claim that banks will be able to absorb the new competitors, thereby improving their own efficiency and capabilities.”, according to the Consultation Paper.

The analysis presented in this paper considered several scenarios and assessed their potential future impact on the banking industry. A common theme across the various scenarios is that banks will find it increasingly difficult to maintain their current operating models, given technological change and customer expectations. Industry experts opine that the future of banking will increasingly involve a battle for the customer relationship. To what extent banks or new fintech entrants will own the customer relationship varies across each scenario. However, the current position of incumbent banks will be challenged in almost every scenario.

What is not in doubt is that technological innovation and changing customer expectations mean that banks will find it increasingly difficult to maintain current operating models.

Overview of the five scenarios and the role players

Colour code: maroon indicates incumbent banks; purple new players; grey fintech companies; and blue bigtech companies.

Various future potential scenarios are considered, with their specific risks and opportunities. In addition to the banking industry scenarios, three case studies focus on technology developments (big data, distributed ledger technology, and cloud computing) and three on fintech business models (innovative payment services, lending platforms and neo-banks).

Although fintech is only the latest wave of innovation to affect the banking industry, the rapid adoption of enabling technologies and emergence of new business models pose an increasing challenge to incumbent banks in almost all the scenarios considered.

Banking standards and supervisory expectations should be adaptive to new innovations, while maintaining appropriate prudential standards. Against this background, the Committee has identified 10 key observations and related recommendations on supervisory issues for consideration by banks and bank supervisors.

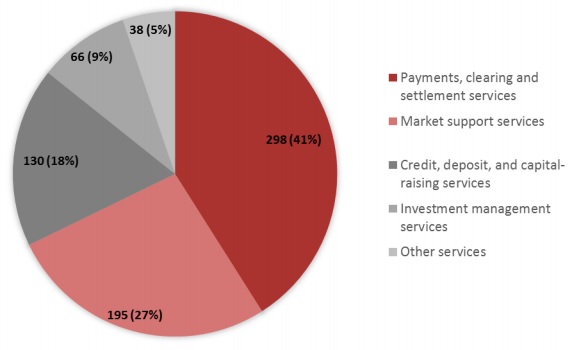

The BCBS conducted an informal survey of its members in mid 2016, asking them to identify the significant fintech products and services within their jurisdictions. The number of fintech companies reported for each sector is shown in Graph below. The survey results do not represent an all-inclusive list of fintech providers. The chart shows a breakdown of prominent providers of more common fintech services within the participating BCBS jurisdictions, based on the views of BCBS members.

Graph – Survey of key providers per fintech activity

Source: The Basel Commitee

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: