Barclaycard marks 50 years of the credit card in the UK

Barclaycard, the global payments company, today celebrates the 50 year anniversary of launching the UK’s first ever credit card. The landmark moment created a societal shift in the way consumers and businesses buy and sell across the country.

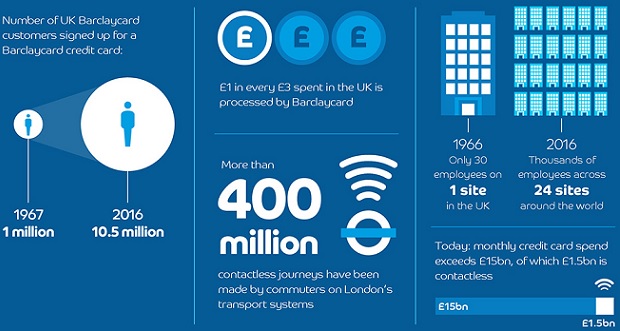

Since the introduction of the credit card on 29 June 1966, its use has grown exponentially and Barclaycard has remained at the forefront with £1 in every £3 spent in the UK now going through the company. Last year the Barclaycard processed 4.6 billion transactions in the UK alone, equating to more than half a million every hour, and £293bn in payments across the globe – a 14 per cent annual increase on the 2014 figure.

Over the past 50 years Barclaycard has transformed buying and selling in the UK and has been an integral part of the fabric of British shopping ever since. Today Barclaycard is the only payments business in the UK to operate as both an issuer of credit cards to consumers and a processor of payments for merchants – meaning it has a unique insight into British spending trends and their impact on the UK economy.

Amer Sajed, Chief Executive Officer of Barclaycard said:

“Back in the sixties, cash was the most popular form of payment and the idea of ‘paying by plastic’ was completely alien to most people. But the introduction of credit cards led to a ‘democratisation of credit’ in the UK and kick-started fifty years of great British shopping, creating a material shift in how we pay for goods and services.

“We’re incredibly proud of the contribution we’ve made to the innovation of payments over the past five decades and we’re equally excited about what the future will hold. Bring on the next 50 years!”

A look back

Fifty years ago today Barclaycard launched the first credit card with a six-page business strategy, an investment of £20,000 and 30 employees who operated from a converted shoe factory in Northampton. Within 12 months, over a million consumers in the UK had signed up for a Barclaycard credit card, which then could be used to make purchases of up to £25.

Barclaycard is the only business in the UK which supports both sides of the transaction in helping consumers to buy and make payments alongside allowing clients to sell and take payments, both in-store and online.

Prior to the launch of the credit card, cash and cheques were the principal methods of payment in the UK. By pioneering a fast and convenient new way to pay, Barclaycard paved the way for a rich history of innovations such as electronic payments, Chip & PIN, contactless and payment wearables, which have continued to transform the way we shop for goods and services ever since.

Barclaycard is now a global operation, employing more than 15,000 employees in 24 locations including the UK, US, Germany and India.

Where it all began, a brief history of Barclaycard

1966: Barclaycard launches the first UK credit card with a team of just 30 people headquartered in an old shoe and boot factory in Northampton. Barclaycard’s acquiring arm, which processes transactions, also gets started.

1977: Barclaycard introduces the UK’s first Company Credit Card to help businesses make payments and keep track of expenses among their staff.

1986: Barclaycard rolls out electronic card payment machines (PDQs) following the first deployment at a Miss Selfridge store in Brent Cross Shopping Centre, London.

1995: Barclaycard is the first UK credit card company to go online with Barclaycard Netlink. At first consumers were only able to pay utility bills, but by 1997 they could also check statements and settle their accounts with a debit card.

2003: Barclaycard rolls out chip and PIN to over half of the adult population and almost 1,000 businesses in Northampton. An industry-wide rollout follows later that year.

2007: Barclaycard pioneers contactless payments in the UK with the OnePulse card, which can also be used on London’s transport network.

2012: Barclaycard is the first UK company to introduce wearable payment devices.

2014: Barclaycard worked with TfL on the first phase of introducing contactless to London London’s tubes, trains buses and ferries by aiding the evolution of the yellow Oyster card readers to enable them to read contactless cards.

2015: Barclaycard creates the nation’s first payments fashion wearables through partnerships with TOPSHOP and Lyle & Scott.

2016: Barclaycard launches ‘Android Contactless Mobile’ and becomes the first financial services brand in the UK to allow customers to make contactless payments on their Android phone, by enabling high value contactless payments for up to £100 to be made without the need to use a card.

Today: Barclaycard has 10.5 million consumer customers and more than 100,000 corporate customers in the UK.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: