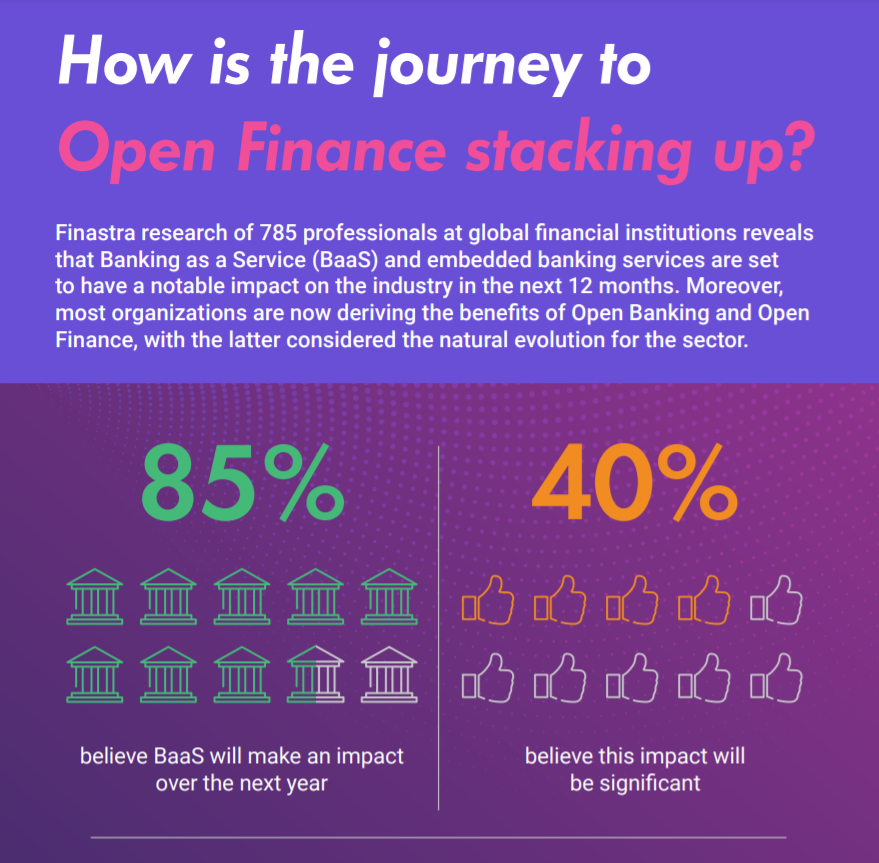

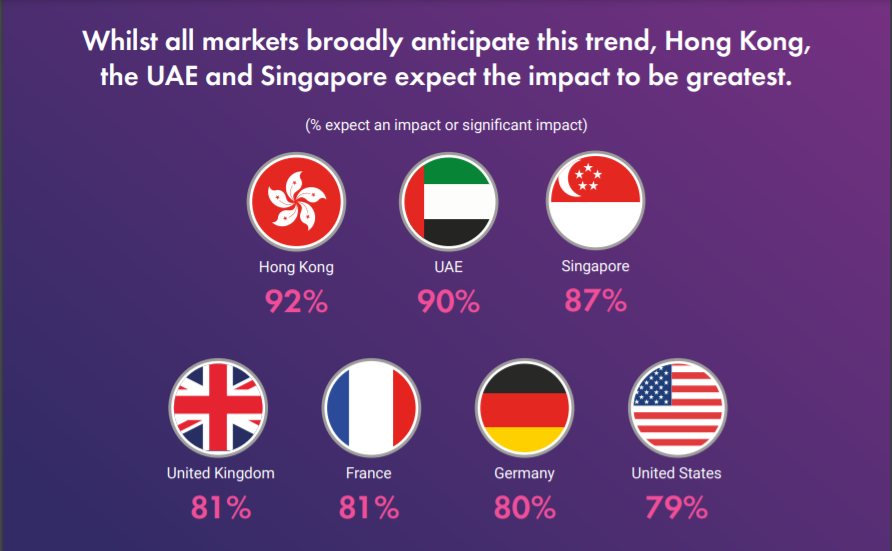

Finastra research reveals that Banking as a Service (BaaS) and embedded banking services are set to have a notable impact on the industry in the next 12 months. Whilst all markets broadly anticipate this trend – 85% of respondents at global financial institutions – Hong Kong (92%), the UAE (90%) and Singapore (87%) expect the impact to be greatest.

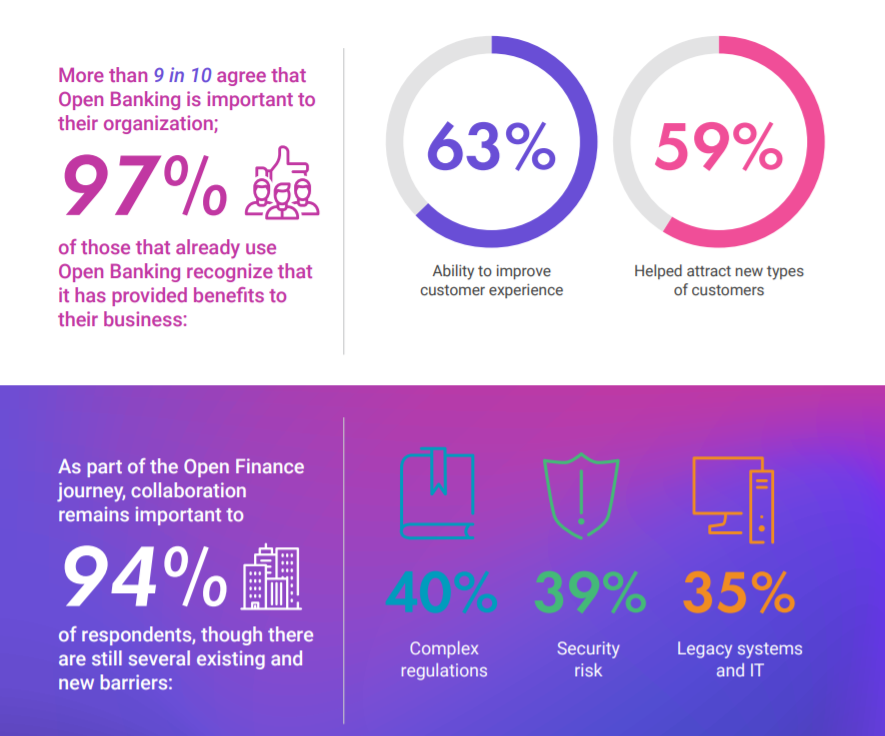

The ‘Financial Services: State of the Nation Survey 2021’, also finds that most organizations are now deriving the benefits of Open Banking and Open Finance, with the latter considered the natural evolution for the sector. Globally, 94% of those surveyed agree that Open Banking is important to their organization, with 63% reporting that it’s enabled them to improve customer experience and 59% stating that it’s helped attract new types of customers.

The research was conducted amongst 785 professionals at financial institutions and banks in March 2021 across the US, UK, Singapore, France, Germany, Hong Kong and the UAE. It explores the Open Banking and Finance landscape, the technology and initiatives set to make an impact in financial services over the next year, and how COVID-19 has impacted the sector.

Other insights include:

Alongside BaaS, mobile banking and artificial intelligence are identified as the other top technologies which will be improved or deployed in the next 12 months. 95% of organizations are forecasting that they will look to improve or develop technology in this period. The UAE (44%) and Hong Kong (42%) lead the way when it comes to interest in mobile banking, compared to an average of 36% across all seven markets

Collaboration remains important to 94% of financial services institutions, though there remain several existing and new barriers surrounding regulation, security, and technology. Complex regulations have been identified as a significant barrier, with 40% of global respondents agreeing. France (47%), Singapore (45%) and Germany (44%) picked this as their number one barrier. An increase in security risk was identified as the top barrier by banks in the US, Hong Kong and the UAE (all 40%), while legacy systems and IT was cited as the top barrier to collaboration in the UK (48%).

COVID-19 has acted as an accelerator for businesses to adapt and invest in new technology and innovation, according to 8 in 10 global organizations. Respondents in Singapore (87%), the UK (82%) and the UAE (82%) are most likely to agree.

Financial services organizations are increasingly looking at their organizational purpose. 86% agree that ‘financial services and banking is about more than just finance, and we have a duty to support the communities we are serving’. At Finastra, we call this redefining finance for good.

“Our findings show how financial institutions are already benefiting from Open Banking and, new this year, a growing role for BaaS. We believe that these initiatives have already started paving the way to true Open Finance, helping financial services institutions to develop and enhance the services they provide to their customers,” said Eli Rosner, Chief Product and Technology Officer at Finastra.

“For BaaS specifically, 81% of global respondents see it as a means to grow business, enhance their distribution channels, shorten time to market and streamline operations.”

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: