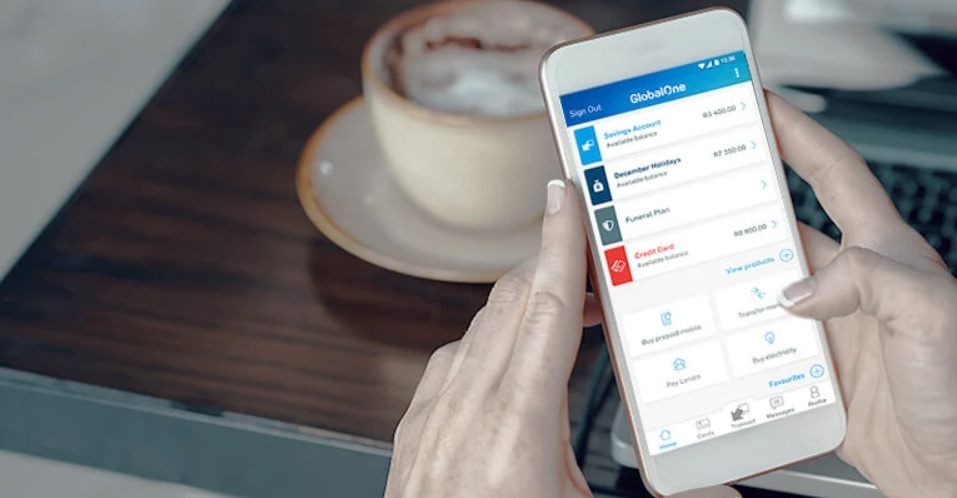

Mastercard has conducted research on people, including older generations, flocking to mobile and online banking amidst the COVID-19 pandemic.

The paper shows that people in the UK are now more likely to have a banking app than a social media app on their mobile phone, according to thepaypers.com. Almost three in five (59%) Brits say they have a mobile banking app, compared to half (50%) who have social media apps.

This trend is most pronounced in the over 65s with 44% saying they have a mobile banking app, compared to the 27% who have a social media app. Mastercard’s findings reveal that with lockdown making it harder to get to the shops, Post Offices, or local bank branches, 30% of people are using banking apps more.

Half (52%) of over 65-year-olds in the UK have used banking apps during the pandemic, with 21% using them more and 23% saying that they are now more confident when using the technology. Six in ten (58%) found it has been easier to use their banking app than they first thought it would be and, interestingly, 100% of users said that they will continue to use their banking apps when life returns to a more normal footing as well.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: