Banking 4.0 powered by Worldline – First wave of international speakers confirmations covers 13 countries

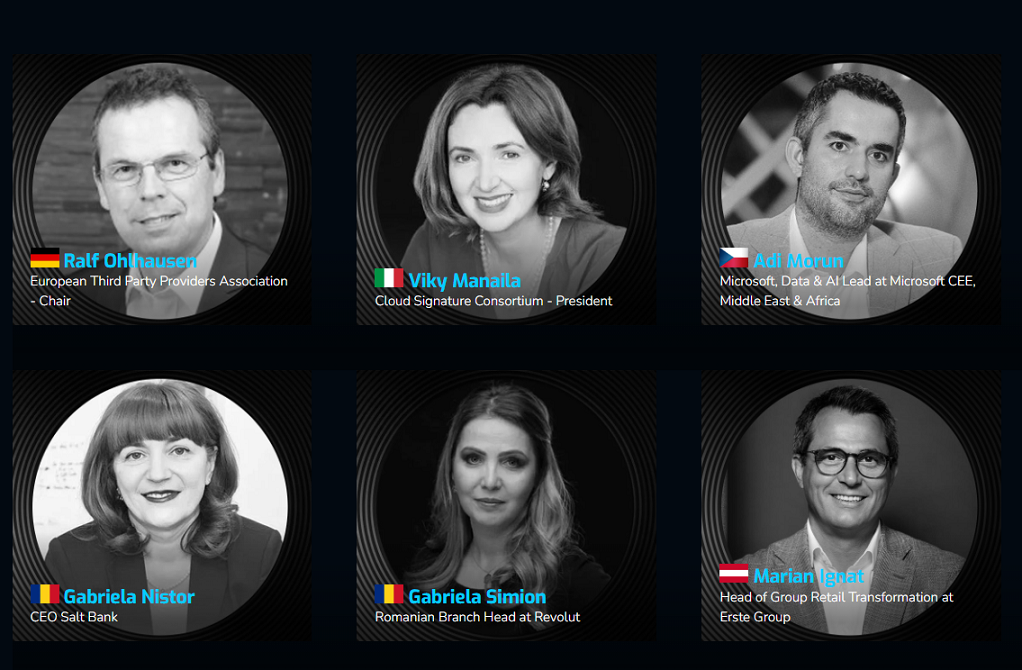

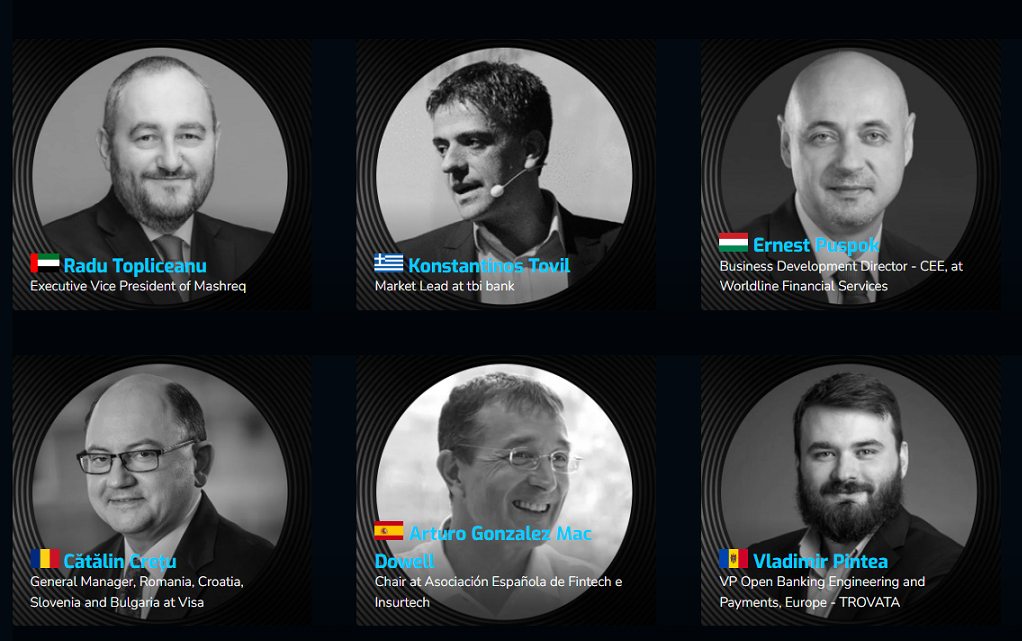

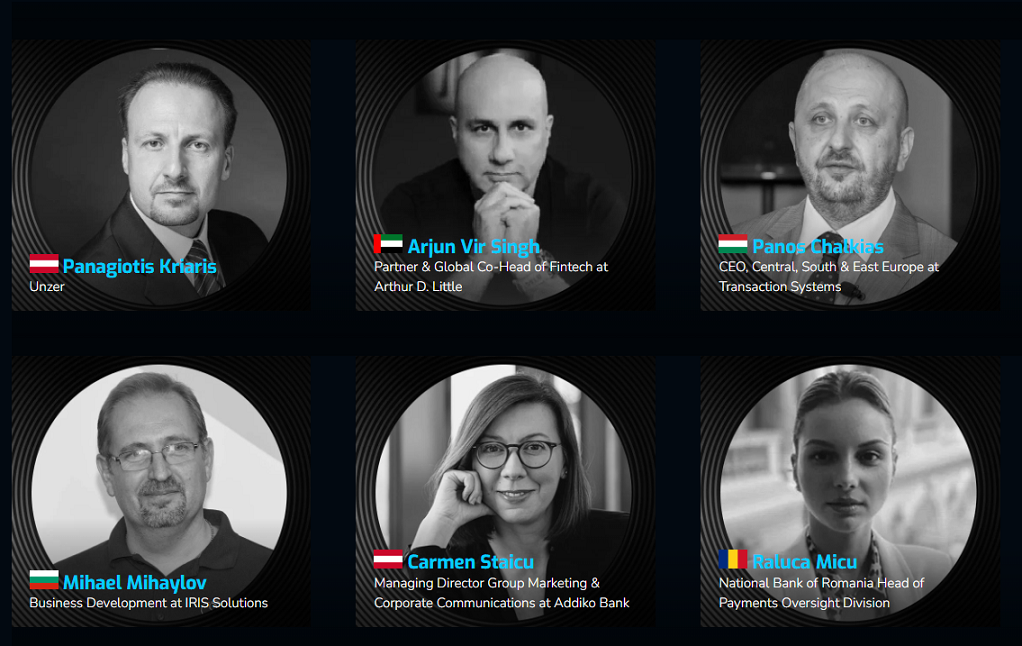

Almost 6 months before the start of the 10th edition of Banking 4.0 – powered by Worldline, a premium event focused on the impact of emerging technologies on banking, recognized by the participants as probably the most relevant fintech conference in Southern and Eastern Europe, the organizers announce the first 15 confirmations from the experts who will take the stage. They are from Austria, Bulgaria, the Czech Republic, Germany, Greece, Israel, Italy, Hungary, Luxembourg, the Republic of Moldova, Romania, Spain and the United Arab Emirates.

„For all three days of vibrant debates, thematically challenging panels, high-tech workshops, and engaging presentations, we expected nearly 100 speakers from more than 30 countries, including France, Switzerland, Poland, the Nordics, the UK, Brazil, and the US. ” – says Sergiu Cone, the event organizer.

This year, the event has an extra day, dedicated to the blockchain technology impact in financial services and payments, with aspects related to stablecoins, (cross-border) payments, central bank digital currencies (CBDCs) and decentralised finance (DeFi).

During this first day, a special attention will be dedicated to the regulatory landscape for crypto assets. Regulation (EU) 2023/1114 on Markets in Crypto-assets (MiCAR) establishes a regime for the regulation and supervision of crypto-asset issuance and crypto-asset service provision in the EU. It came into force on 29 June 2023, and the provisions relating to asset reference tokens (ARTs) will be applicable from 30 June 2024. Also, the European Banking Authority issues ‘travel rule’ guidance to tackle money laundering and terrorist financing in transfers of funds and crypto assets. The amending Guidelines will apply from 30 December 2024.

The other two days will cover topics like AI in conversational banking, fraud prevention and personalized customer offerings, cloud migration, next generation of payments infrastructure, new trends in payments, digital identity – new safe and friendly ways to democratise remote onboarding processes, API-based banking – bank accounts portability, financial inclusion through disintermediation, tokenised financial assets, and much more.

This 10th anniversary edition of Banking 4.0 will take place on 26-28 November, in Sinaia, a superb mountain resort in Bucegi, the former residence of the Romanian kings, a fairytale land located in the immediate vicinity of Bran Castle – Dracula’s Castle. Taking into account the tourist opportunities offered by the specifics of the location, the organizers will prepare some pleasant surprises for mountain lovers.

This year’s theme, „From Tech-Centric to Human-Centric: Conversational Banking in the Digital Era,” aims to explore how we can shift the focus from technology alone to technology that enhances human interactions. As the digital landscape reshapes sectors with advancements in AI, robotics, and quantum computing, the enduring power of human connection remains central to business success.

„The chosen theme aroused unprecedented interest. So far, 20 companies have expressed their intention to become partners of the event and their number continues to grow. Worldline, the largest payment processor in Europe and the third largest in the world, is for the third time in a row the main partner of the event. We are grateful for this long-standing support which is like a statement of high appreciation that honors us. This year’s edition has all the data to be a trully exceptional event.” – Sergiu Cone added.

_______________

NOCASH EVENTS is a powerhouse in the Romanian industry of electronic payments, with almost 25 years of experience in organizing financial & banking events. We started in early 2000, with financial fairs helping retail banking grow on the local market. In 2024, NOCASH EVENTS is an internationally recognised brand.

Since 2017, we have been organizing the Banking 4.0 – international event series – dedicated to the emerging technologies (AI, blockchain, cloud computing, open banking and so on) that have the potential to impact the future of the financial services and business models. We are proud to say that NOCASH EVENTS team has managed to position Banking 4.0 as one the most relevant Fintech-Banking event in Southeastern Europe.

The audience consists mainly of regional C-Level experts responsible for the digital transformation process, in banking or non-banking institutions (card processors, payments infrastructure suppliers, insurance & telecom entities, IT companies and developers, consulting firms, law companies, large online retailers, government authorities, fintech startups, banking & payments associations, regulation bodies).

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: