BankID expands digital identity protection with OneSpan, extending to millions of customers

OneSpan and BankID plan to unlock cross-border transactions with partnership expansion to all Norwegian Banks

OneSpan, the digital agreements security company, today announced a significant expansion of its OneSpan Cloud Authentication service with BankID. BankID first launched with OneSpan in September 2021 and has already reached a multi-million user milestone that is expected to continue growing as BankID’s technology adoption increases. This expanded partnership further solidifies the crucial role BankID has entrusted to OneSpan to provide high-assurance security and meet compliance standards within the Norwegian critical national infrastructure.

Issued through more than 90 banks and 9,000 merchants, including tax authorities, real estate agents, and education institutions, BankID is by far the most widely-used personal e-ID that provides secure and simple identity authentication and digital signing in Norway. Today, more than four million Norwegians use BankID daily to do their banking, shop online or access vital public digital services.

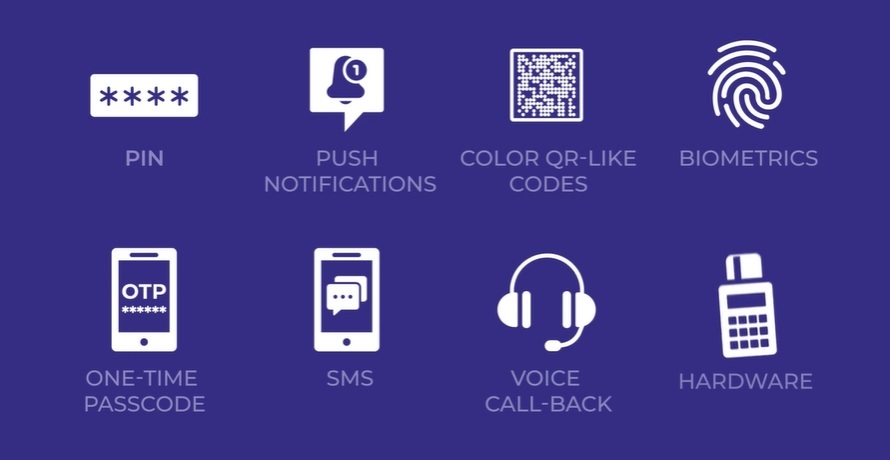

OneSpan’s Cloud Authentication service, combined with its award-winning Mobile Security Suite and App Shielding technologies, are helping secure Norway’s digital identity applications. OneSpan Cloud Authentication is a modern cloud-based solution designed to allow companies around the world to connect to a high-security orchestrated authentication service and quickly achieve complete user base coverage.

The collaboration between BankID and OneSpan enables the most important digital interactions to be delivered with the highest security through mobile identity provisioning, strong user authentication, transaction security, and digital signing. Bringing together an array of next-generation digital identity solutions, this partnership delivers on what consumers are increasingly calling for: simple yet highly secure access to their financial and non-financial applications with a single identity.

“BankID is, and will continue to remain, a central part of our users’ daily lives,” said Jan Bjerved, Head of BankID. “We are strong believers in creating magic for the users in terms of experience, with as little friction as possible and users feeling safe and secure when using our services. Our trust in OneSpan is based on their proven solutions that ensure we provide the highest level of security to our entire population.”

Today, just 14% of key public services across the European Union (EU) states allow cross-border authentication with e-ID. By September 2023, all EU member countries must make a digital identity wallet available to every citizen who wants one. With the advent of Electronic Identification and Trust Services (eIDAS) 2.0, the European Commission intends to make cross-border e-ID transactions a reality. Adopting advanced market-leading security cloud services, such as those offered by OneSpan, is increasingly relevant for e-ID providers to capture an international market position for the 500 million citizens covered by eIDAS 2.0.

“The world needs security-infused workflows native to digital experiences, like BankID’s solution, that preserve and enhance the customer experience and guarantee the integrity of people, data, transactions, and documentation,” said OneSpan President and CEO, Matthew Moynahan. “In a world where the highest levels of assurance are required to establish users’ identities, our partnership with BankID lays the foundation for the future of secure digital identity platforms and unlocks a new world of experiences that can now include cross-border transactions.”

“We are now further improving our services with the launch of our new BankID app, soon also with biometric authentication, that will offer our 4.3 million users an even faster and simpler identification online. The new app will allow better communication with the users and the ambition is to develop the app to become a digital identity wallet that offers a range of value adding services in the future,” said Bjerved.

For more information on OneSpan Cloud Authentication services, visit its solutions page here.

__________

BankID is a personal and simple electronic ID for secure identification and signing online. The first Norwegian customers were issued a BankID in 2004. At that time, the Norwegian banking sector had been working for four years on developing a joint infrastructure. Today 4.3 million Norwegians have a BankID. BankID is used by all the country’s banks, public digital services and an increasing number of enterprises in a wide range of sectors. This summer, BankID and BankAxept are spun out from Vipps and continuing as a separate entity. With this, we are gearing up for growth and an increased pace of innovation. To learn more, visit http://www.bankid.no.

OneSpan helps organizations accelerate digital transformations by enabling secure, compliant, and refreshingly easy customer agreements and transaction experiences. Organizations requiring high assurance security, including the integrity of end-users and the fidelity of transaction records behind every agreement, choose OneSpan to simplify and secure business processes with their partners and customers. OneSpan is trusted by global blue-chip enterprises, including more than 60% of the world’s largest 100 banks, and processes millions of digital agreements and billions of transactions in 100+ countries annually.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: