The Financial Policy Committee (FPC) from the Bank of England has agreed a set of principles that will guide its assessment of how prudential regulation and supervision should adjust to fast-moving developments in payments activities, which are currently a focal point for innovation in financial services.

These principles are that regulation and supervision should:

. Reflect the financial stability risk, rather than the legal form, of payments activities;

. Ensure end-to-end operational and financial resilience across payment chains that are critical for the smooth functioning of the economy; and

. Ensure that sufficient information is available to monitor payments activities so that emerging risks to financial stability can be identified and addressed appropriately.

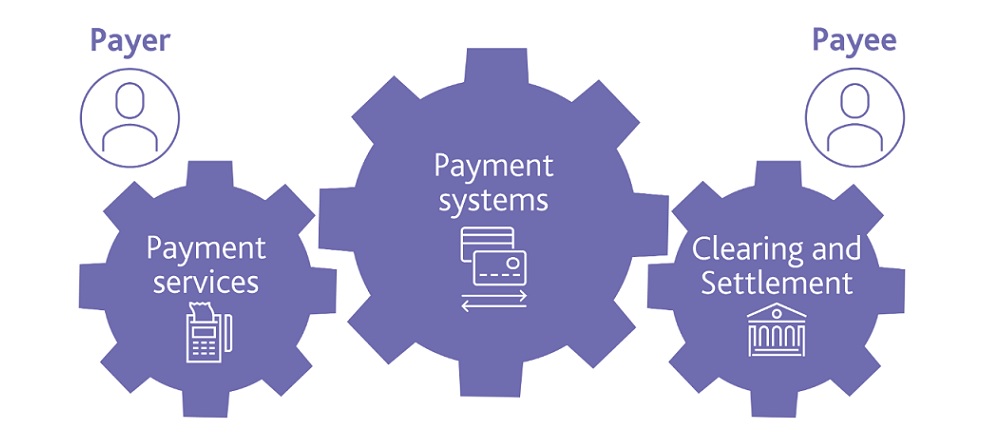

HM Treasury is leading a review of the payments landscape to support choice, competition and resilience and to ensure that regulation and infrastructure keep pace with innovation. These principles could usefully inform any assessment of existing payments regulation in that review.

„Libra has the potential to become a systemically important payment system. The FPC judges that such a system would need to meet the highest standards of resilience and be subject to appropriate supervisory oversight, consistent with the principles set out above. The terms of engagement for innovations such as Libra must be adopted in advance of any launch. UK authorities should use their powers accordingly.”, according to The Financial Policy Committee from the Bank of England.

The FPC encourages exploration of alternative solutions to improve the efficiency of domestic and cross-border payments.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: