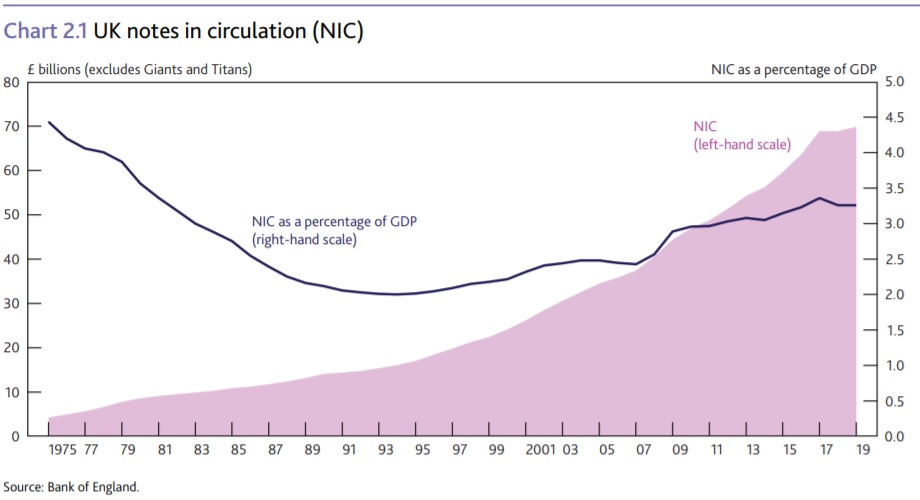

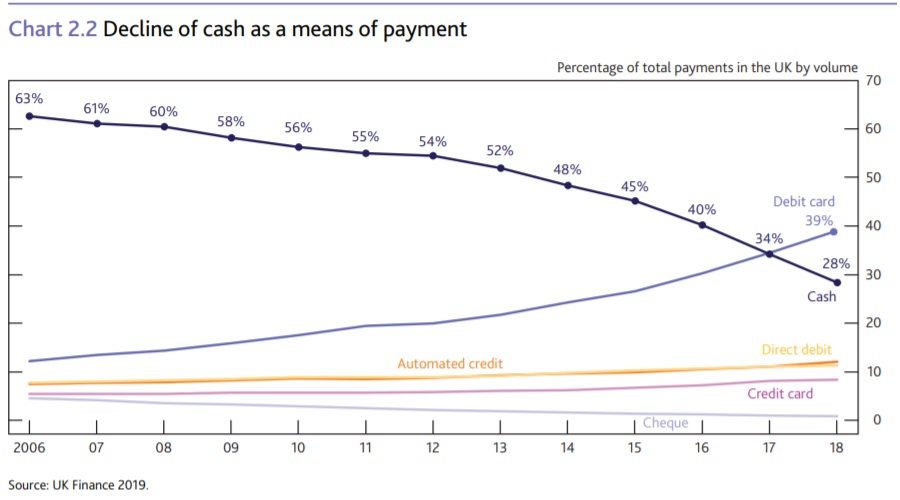

The way we pay is changing, with use of banknotes falling, and the use of privately issued money and alternative payment methods rising. In this context, the Bank of England is exploring the concept of Central Bank Digital Currency (CBDC), as are central banks across the world. (1)

A Central Bank Digital Currency would be an innovation in both the form of money provided to the public and the payments infrastructure on which payments can be made. At the moment, the public can only hold money issued by the Bank in the form of banknotes. Only commercial banks and certain financial institutions (2) can hold electronic central bank money, in the form of ‘reserves’ held in the Bank’s Real‑Time Gross Settlement (RTGS) service.

Unlike banknotes, CBDC would be electronic, and unlike reserves, CBDC would be available to households and businesses. CBDC would therefore allow households and businesses to directly make payments and store value using an electronic form of central bank money. For this reason, CBDC is sometimes thought of as equivalent to a digital banknote, although in practice it may have other features depending on its final design.

If a CBDC were to be introduced in the UK, it would be denominated in pounds sterling, so £10 of CBDC would always be worth the same as a £10 banknote. Any CBDC would be introduced alongside — rather than replacing — cash and commercial bank deposits.

Mark Carney, Bank of England – Governor: „It is now time to look further ahead, and consider what kind of money and payments will be needed to meet the needs of an increasingly digital economy. We are in the middle of a revolution in payments. Banknotes — the Bank’s most accessible form of money — are being used less frequently to make payments. At the same time, fintech firms have begun to alter the market by offering new forms of money and new ways to pay with it.”

„These developments create major new opportunities, present some new risks, and raise a number of profound questions for the Bank. (…) as the issuer of the safest and most trusted form of money in the economy, should we innovate to provide the public with electronic money — or Central Bank Digital Currency (CBDC) — as a complement to physical banknotes?

The Bank has not yet made a decision on whether to introduce CBDC, and intends to engage widely on the benefits, risks and practicalities of doing so.

This discussion paper is part of that process: Central Bank Digital Currency Opportunities, challenges and design

Choices around technology

According to the authors of the discussion paper, „Although CBDC is often associated with Distributed Ledger Technology (DLT), we do not presume any CBDC must be built using DLT, and there is no inherent reason it could not be built using more conventional centralised technology. However, DLT does include some potentially useful innovations, which may be helpful when considering the design of CBDC. For example, elements of decentralisation might enhance resilience and availability, and the use of smart contract technology may enable the development of programmable money. However, adoption of these features would also come with challenges and trade‑offs that must be carefully considered.”

###

(1) Central Bank group to assess potential cases for central bank digital currencies, Bank of England Press release, January 2020.

(2) Reserves can be held at the Bank of England by banks, building societies, PRA‑supervised broker‑dealers, and central counterparties (CCPs). In addition, some non‑bank Payment Service Providers and other Financial Market Infrastructures hold settlement accounts at the Bank of England.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: