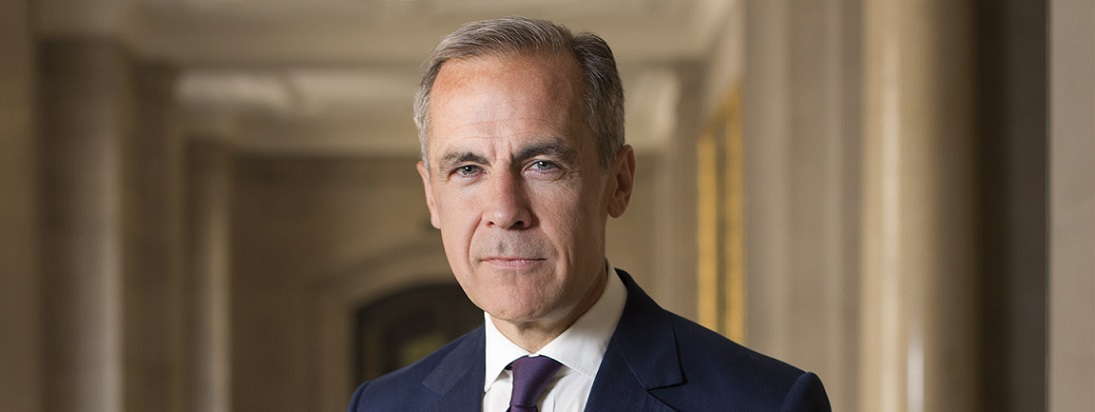

The Bank of England governor, Mark Carney (photo), has challenged the dollar’s position as the world’s reserve currency, arguing that it could be replaced by a global digital alternative to end a savings glut that resulted in 10 years of low inflation and ultra-low interest rates, according to The Guardian.

Likening the move to the end of sterling’s command of international money markets 100 years ago, Carney said the dollar had reached a level of dominance that meant it was a barrier to a sustainable recovery.

He said a new digital currency nbacked by a large group of nations would unlock dollar funds that governments currently hoard as an insurance policy in uncertain times.

Governments stockpile dollars to insure against swings in the US economy, which in recent times have intensified, leading to a significant rise in the cost of borrowing.

A digital currency “could dampen the domineering influence of the US dollar on global trade”, Carney said in a speech at the gathering of central bankers from around the world in Jackson Hole, Wyoming. “If the share of trade invoiced in [a digital currency] were to rise, shocks in the US would have less potent spillovers through exchange rates, and trade would become less synchronised across countries.

“The dollar’s influence on global financial conditions could similarly decline if a financial architecture developed around the new [digital currency] and it displaced the dollar’s dominance in credit markets. By reducing the influence of the US on the global financial cycle, this would help reduce the volatility of capital flows to emerging market economies.”

The Chinese currency, the renminbi, has been cited as an alternative to the dollar along with proposed digital currencies such as Facebook’s Libra. Carney said neither was in a position to take over from the dollar, but new technologies could allow for a global digital currency to challenge the US currency.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: