Bank of America survey: P2P payments become social norm among millennials

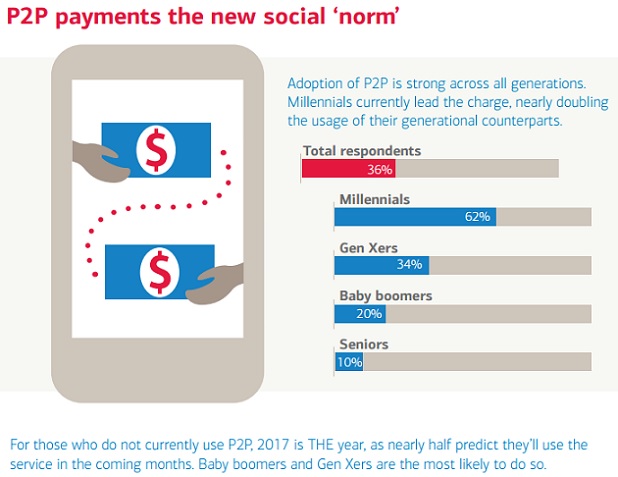

A new survey of 1005 adults with banking relationships and smartphones, released by the Bank of America, finds 36 percent of adults currently use a person-to-person payments service (P2P), with millennials leading the charge at nearly double that rate (62 percent). What’s more, 45 percent of non-users say they plan to start using the service within the next year, foreshadowing exponential growth in the coming months.

Of those that use P2P payment services, 68% cite convenience and time savings as the reason, while 48% mention peer influence. Only 16% say that they use the new digital options because they do not want to use cash and cheques.

The growing ubiquity of services is also a factor, with 30% saying that they have started using P2P payments because of new offerings from banks. BofA recently revamped its app with aspects of Zelle, the platform it owns with other banks which processed 170 million payments last year boasting an aggregate transaction volume of $55 billion, more than double that of PayPal-owned rival Venmo.

Timing is top of mind for P2P payments service users, with 69% of respondents saying they pay others back within the same day, and one-third in under an hour. Similarly, 53% expect others to pay them back within 24 hours, and 22% within the hour.

Respondents see the mobile trend continuing. When asked what they believe to be true about children under the age of 10, 71% agree they won’t know how to write a cheque and 42% that they won’t use physical credit cards. One in seven think the youngest members of Generation Z won’t even know what cash is.

Dowload the report here: Trends in Consumer Mobility Report

Source: Bank of America

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: