Bank for International Settlements: „cryptocurrency technology comes with poor efficiency and vast energy use”

The decentralised technology of cryptocurrencies, however sophisticated, „is a poor substitute for the solid institutional backing of money”, says the Bank for International Settlements in its latest Economic Annual Report.

Less than 10 years after their inception, cryptocurrencies1 have emerged from obscurity to attract intense interest on the part of businesses and consumers, as well as central banks and other authorities. They garner attention because they promise to replace trust in long-standing institutions, such as commercial and central banks, with trust in a new, fully decentralised system founded on the blockchain and related distributed ledger technology (DLT).

The cryptocurrencies chapter within BIS Annual Economic Report 2018 evaluates whether cryptocurrencies could play any role as money: looking beyond the hype, what specific economic problems, if any, can current cryptocurrencies solve?

The chapter first reviews the historical context. Many episodes of monetary instability and failed currencies illustrate that the institutional arrangements through which money is supplied matter a great deal. This review shows that the essence of good money has always been trust in the stability of its value.

And for money to live up to its signature property – to act as a coordination device facilitating transactions – it needs to efficiently scale with the economy and be provided elastically to address fluctuating demand. These considerations call for specific institutional arrangements – hence the emergence of today’s independent and accountable central banks.

The chapter then gives an introduction to cryptocurrencies and discusses the economic limitations inherent in the decentralised creation of trust which they entail. For the trust to be maintained, honest network participants need to control the vast majority of computing power, each and every user needs to verify the history of transactions and the supply of the cryptocurrency needs to be predetermined by its protocol.

Trust can evaporate at any time because of the fragility of the decentralised consensus through which transactions are recorded. Not only does this call into question the finality of individual payments, it also means that a cryptocurrency can simply stop functioning, resulting in a complete loss of value.

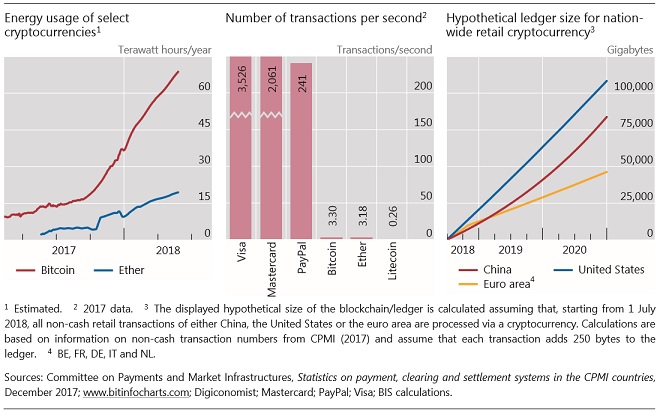

Moreover, even if trust can be maintained, cryptocurrency technology comes with poor efficiency and vast energy use. Cryptocurrencies cannot scale with transaction demand, are prone to congestion and greatly fluctuate in value. Overall, the decentralised technology of cryptocurrencies, however sophisticated, is a poor substitute for the solid institutional backing of money.

Economic Adviser & Head of Research at BIS. Hyun Song Shin, speaks about Chapter V of the Annual Economic Report 2018

That said, the underlying technology could have promise in other applications, such as the simplification of administrative processes in the settlement of financial transactions. Still, this remains to be tested.

As cryptocurrencies raise a host of issues, the chapter concludes with a discussion of policy responses, including regulation of private uses of the technology, the measures needed to prevent abuses of cryptocurrencies and the delicate questions raised by the issuance of digital currency by central banks.

Read the full chapter here: BIS – Annual Economic Report 2018 – Chapter V: Cryptocurrencies, looking beyond the hype

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: