Bank Fines Report 2024: banks worldwide were issued a total of $4.5 billion in penalties. The most common violation among the banks was Anti-Money Laundering breaches.

The Bank Fines report reveals the list of banks that faced the biggest fines in a yearly basis. Fines were imposed by regulators for breaches of different protocols like Anti-Money Laundering (AML), violation of Know Your Customer (KYC) and operating guidelines, personal data leaks, among others.

Bank Fines 2024 Report, reveals that between January 1 and December 30, 2024, banks worldwide were issued a total of $4.5 billion in penalties across 57 violations.

The key findings of the report:

. Total aggregated bank fines in 2024 reached a whopping $4.5 billion;

. The most common violation among the banks was Anti-Money Laundering breaches;

. The United States recorded the highest number of bank fines at 19, representing 33% of all bank fines in 2024;

. The United Kingdom recorded the second-highest number of bank fines at 10, representing 17.5% of all bank fines worldwide;

. The largest fine of the year—$3.09 billion—was issued to TD Bank;

. The second-largest, $348.2 million, was levied against JPMorgan Chase & Co;

. In total, 57 bank fines were documented in the report.

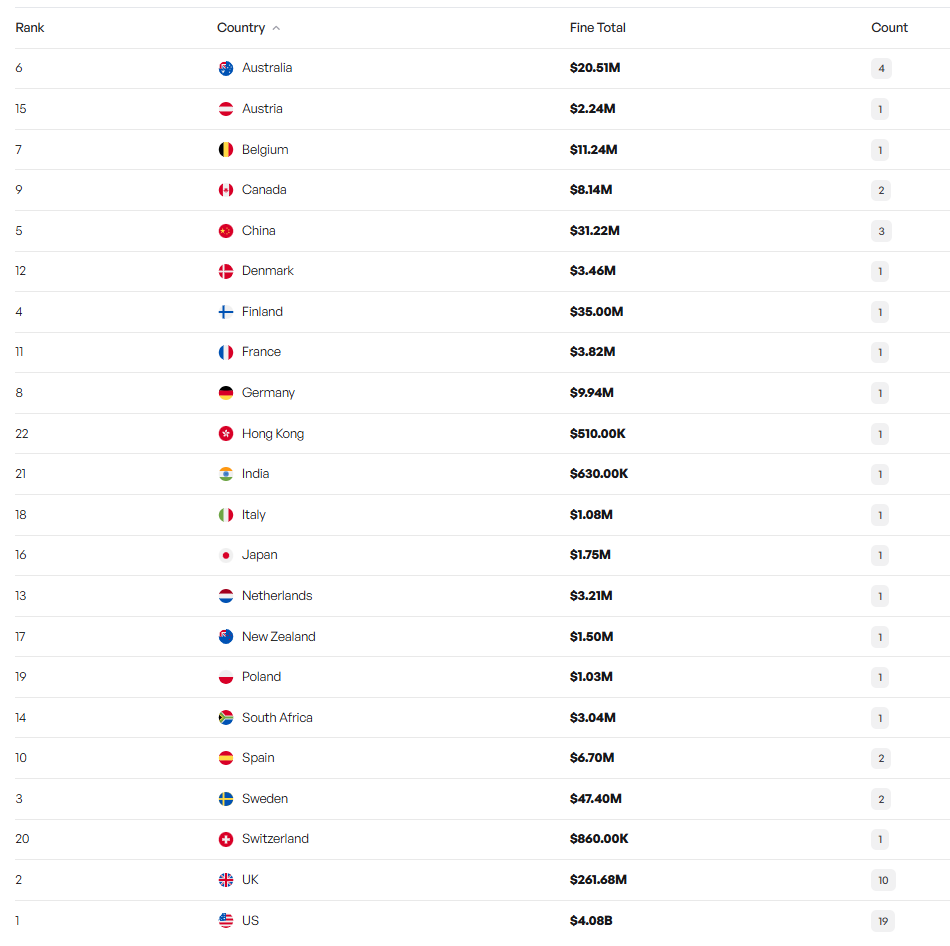

Ranking by country

Methodology

This report compiles and analyzes the largest bank fines imposed globally in 2024, with a focus on substantial penalties over $500,000. The fines included are primarily associated with violations of anti-money laundering (AML) regulations, the Bank Secrecy Act (BSA), consumer protection laws, and various other forms of financial misconduct.

Data Collection:

The data for this compilation were sourced from publicly available enforcement actions, regulatory announcements, and verified financial audit reports. Efforts were made to ensure the comprehensiveness and accuracy of the data collected; however, it is important to acknowledge that the dataset may be incomplete. Enforcement actions related to incidents occurring in the latter part of 2024 may not be fully documented by the time of this report’s release.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: