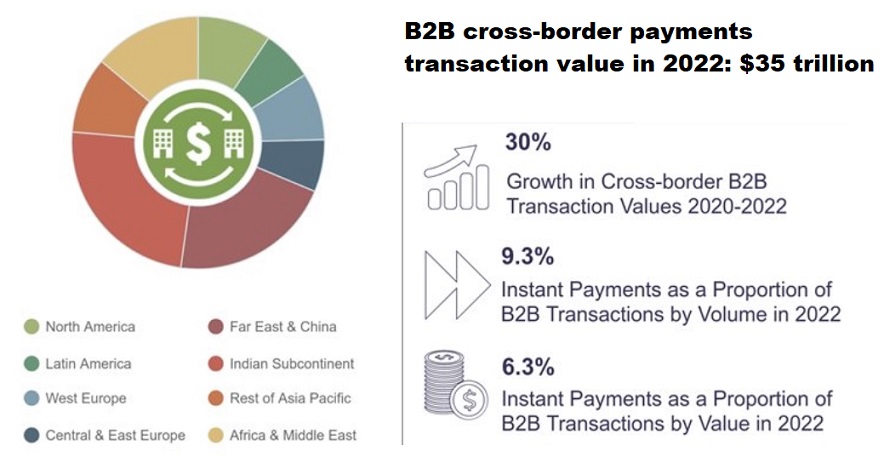

A new study from Juniper Research has found that the total value of B2B cross-border payments will reach $35 trillion in 2022 from a COVID-related low of $27 trillion in 2020; representing 30% growth.

However, „the long-lasting economic impact of the COVID-19 pandemic means that cross-border values will only exceed 2019 values by 2022,” according to the press release.

In the post-pandemic recovery phase, businesses will be more cost conscious; meaning that cross-border payment vendors must offer compelling cost propositions to companies, or they will fail to recover lost traffic, Juniper believes.

For more insights, download the free whitepaper: 3 Key Trends Revolutionising B2B Payments.

The new research, B2B Payments: Domestic, Cross-border & Instant Payments 2020-2025, identified that instant payments, services where funds settle in 10 seconds or less, will account for 9.3% of B2B transactions by volume in 2022, up from 6% in 2020. However, instant payments will only account for 6.3% of B2B transactions by value in the same year; illustrating the predominantly low value of these payments, due to low transaction limits for schemes.

However, the greater value of instant payments’ adoption is in the new capabilities the schemes enable, as research author Nick Maynard explains: “Instant payments schemes are built on ISO 20022, which unlocks additional messaging capabilities. These can be used to inject transparency and build new services such as automation, which will add significant value to complex accounts payable processes”.

The research shows how blockchain networks will increasingly disrupt existing payment types in the cross-border market, driven by requirements for increased efficiency and transparency from traditional money transfer operators. This efficiency, enabled by services including RippleNet and Visa B2B Connect will be critical in enabling these operators to compete with innovative non-bank players. Operators must trial new systems now and refresh their business models, or they will lose market share in a highly commoditised post-pandemic environment.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: