Addiko Bank, an Austrian financial institution specialising in the consumer and SME sector operating in Central and South-Eastern Europe (CSEE), is preparing to launch operations in Romania with the first solutions offered to consumers in the first quarter of 2025, according to Economedia.ro.

However, the bank does not expect the expansion into Romania to have a notable impact on profitability guidance before 2026.

The bank’s interest in the Romanian market was first reported in 2022 by Profit.ro. At that time, the bank was targeting the Romanian corporate segment, particularly the small firms and the microenterprise. Currently, it envisages entering the consumer lending segment first.

In 2024, Addiko completed the preparatory procedures for entering the Romanian market in 2025, using the cross-border license of its Slovenian subsidiary. The bank now claims it is ready to launch fully digital consumer lending solutions in the first quarter of 2025.

„Addiko will leverage its current digital platform, risk management expertise, and business practices for its digital launch in Romania with an initial personal loan product. The implementation phase has been launched, which is currently focused on IT integration and planning for future tests. The group plans to initiate a pilot phase in the first half of 2025 to stabilize the system and adjust its value proposition,” the bank said.

Addiko Group results in 2024

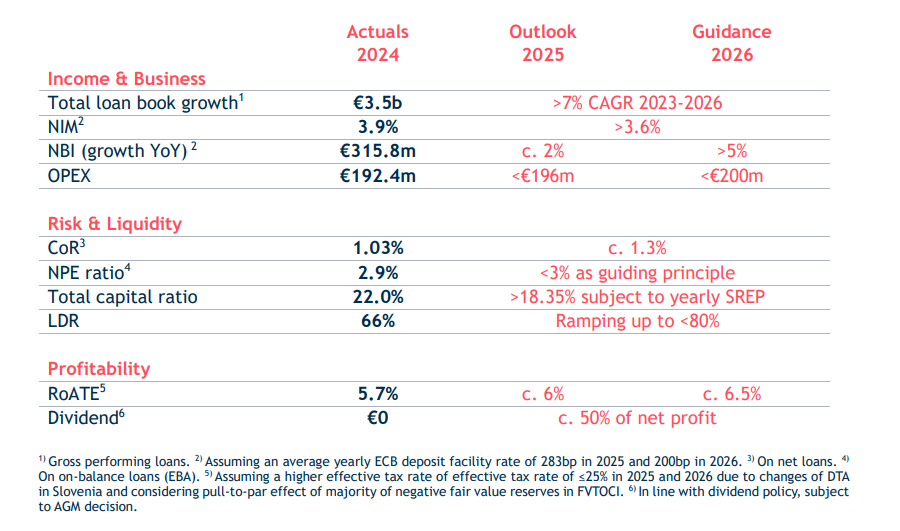

Addiko Group achieved a full-year profit after tax of €45.4m, driven by strong business development in the Consumer segment and focused cost management. The result marks an improvement of 10.4% over the previous year.

“We increased net profit for the third consecutive year and managed to improve our profitability as we gained new customers, delivered on our promises to our existing clients and successfully repriced our offerings in an environment of high interest rates”, said Chief Executive Officer Herbert Juranek.

“The year also brought unexpected developments with two takeover offers in addition to several changes in the shareholder base. The latter has led to the recommendation by the ECB to suspend the dividend payment for the financial year 2024. Despite the complex situation on the shareholder side and the impact of the takeover offers on our bank, we have achieved a solid financial performance, underscoring the strength of our business model and our long-term strategic vision.”

Solid performance in 2024

. Operating result up 8.1% to €112.3m vs. €103.9m last year

. General administrative expenses impacted by extraordinary costs from the takeover bids

as well as inflationary cost increases

. Cost of Risk at 1.03% or €36.0m compared to €11.8m a year earlier

. NPE ratio (on-balance) stable at 2.9% (YE23: 2.8%), NPE coverage at 80.0% (YE23: 80.9%)

. Return on average Tangible Equity at 5.7% (YE23: 5.5%)

. EPS of €2.35 compared to €2.12 a year earlier

The result after tax of €45.4m (YE23: €41.1m) reflected „the solid business development, successful repricing and provisions for legal claims” – the bank said. Expected credit loss expenses stood at €36.0m or 1.03% Cost of Risk (YE23: €11.8m or 0.34%). Following an update of probability of default models, Addiko reduced the overall post-model adjustment to €1.4m (3Q24: €9.3m).

The share of the two focus segments Consumer and SME of the total gross performing loan book increased to 89.5% compared to 86.5% a year earlier and in line with Addiko’s strategy. The overall

customer gross performing loan book amounted to €3.51b compared to €3.49b at the end of 2023

while the non-focus as well as the medium SME loan book continued to decrease. The overall focus

book increased by 4% YoY while the focus portfolio excluding the medium SME loans grew by 6%.

____________

Addiko Group is a specialist banking group focusing on providing banking products and services to Consumer and Small and Medium-sized Enterprises (SME) in Central and South-Eastern Europe (CSEE). The Group consists of Addiko Bank AG, the fully-licensed Austrian parent bank registered in Vienna,

Austria, listed on the Vienna Stock Exchange and supervised by the Austrian Financial Market Authority and the European Central Bank, as well as six subsidiary banks, registered, licensed and operating in five CSEE countries: Croatia, Slovenia, Bosnia & Herzegovina (where it operates via two banks), Serbia and Montenegro.

Through its six subsidiary banks, Addiko Group services as of 31 December 2024 approximately 0.9 million customers in CSEE using a well-dispersed network of 155 branches and modern digital banking channels.

Based on its strategy, Addiko Group has repositioned itself as a specialist Consumer and SME banking group with a focus on growing its Consumer and SME lending activities as well as payment services (its “focus areas”). It offers unsecured personal loan products for Consumers and working capital loans for its SME customers and is largely funded by retail deposits. The accelerated run-down of Addiko Group’s Mortgage, Public and Large Corporate lending portfolios (its “non-focus areas”) was concluded in the year 2024.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: