New Payments Platform Australia (NPPA) has published details of its ongoing investment in the NPP, to extend and enhance the capability of the platform to meet the needs of participating financial institutions, payment providers and users within the wider payments ecosystem.

The public release of the roadmap comes less than two years since the NPP commenced enabling Australian consumers, businesses and government agencies to make real-time data rich payments between accounts at participating Australian financial institutions.

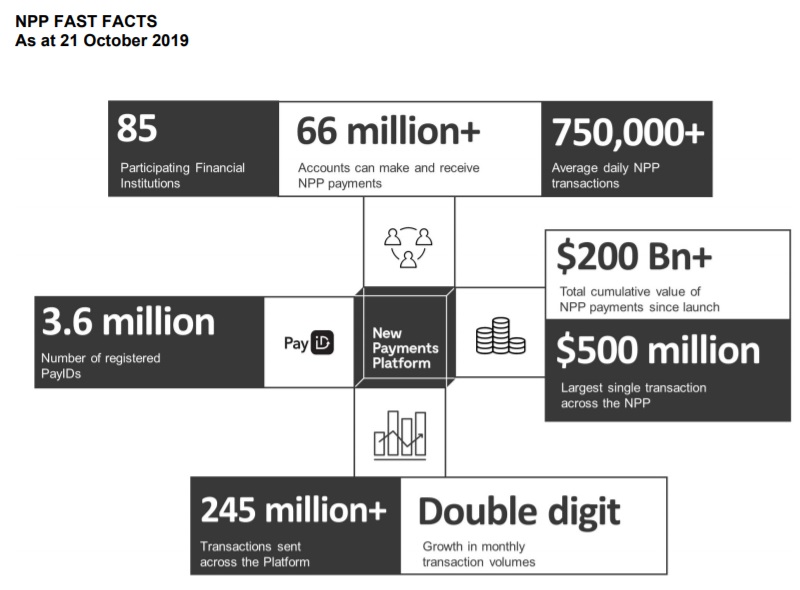

Today approximately 85 banks, credit unions, building societies and fintechs are connected to the NPP (either directly or indirectly) and more than 66 million accountholders can make and receive payments via the NPP. At the same time, more businesses and corporates are realising the benefits of the NPP with approximately one in three transactions involving a payment to or from a business.

As at the middle of October, the NPP is processing an average of approximately 750,000 payments worth $750 million each day. Recently more than $1 billion in transactions was processed in a single day and the largest single transaction settled on the platform so far is $500 million.

Innovative use-cases that tap into the NPP’s core capabilities have also started to emerge. This includes: independent payments solutions providers such as Monoova and Assembly Payments; a service that enables employees to access their income as they earn it in real-time (Earnd); a consumer-to-business payment service that uses the NPP’s speed and PayID to deliver real-time validation and processing for online payments (Azupay); and combining the NPP’s speed with blockchain to create equity management, compliance and share registry services (Block8).

CEO of NPP Australia, Adrian Lovney, says making the Roadmap publicly available ensures NPP momentum will continue.

“We’re focused on developing additional native capability that can support a range of use cases, which can be used by participating financial institutions and third parties to do different things. By developing native platform capability, governed by a common rules framework administered by NPPA, it is akin to providing ‘building blocks’ that others can put together in different ways to deliver payment products and services outside the platform.

“NPPA does this by establishing different ‘business services’ that have different uses. A business service can either be used in its native form by participating financial institutions and third parties, or it can be further built upon and commercialised by an organisation wanting to develop an Overlay Service on top,” Adrian said.

The Roadmap includes the development of foundational capability to enable third party payment initiation on the NPP. Central to this proposition is the account-holder’s authorisation (or consent) for payments to be initiated on their account with the creation of a digital payment arrangement or a ‘mandate’ in advance of the payments being made.

This functionality increases the visibility and control that account holders have over these various payment arrangements, which will resolve some of the most frequent pain points with these kinds of payments today. It could enable a range of use cases in the future, such as recurring or subscription type payments, ecommerce and ‘on behalf of’ services, such as a corporate using a cloud accounting software provider to do their payroll run.

The roadmap also includes structured data capabilities, which will support B2B payments and commercialisation opportunities such as payroll, superannuation, and einvoicing and a business service to support the domestic leg of inbound cross-border payments.

In addition to the capability centrally developed by NPPA and outlined in the Roadmap, individual participating financial institutions are also developing capability to support NPP payments, in a number of areas, such as APIs and conversion of bulk payment files, according to their own business objectives and implementation timing.

Collectively the development and delivery of the capabilities contained in the NPP Roadmap will significantly enhance the platform’s functionality and drive further use of the platform by third parties.

Download a copy of the NPP Roadmap here.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: