Australia card acquiring market to hit $700 billion in 2025 as growth set to slow amid global uncertainty, says GlobalData, a leading data and analytics company. Also, Australia’s credit and charge card payments is set to maintain an upward trajectory, reaching AUD453.9 billion ($299.7 billion) in 2025 despite evolving global economic challenges.

The Australian card acquiring market

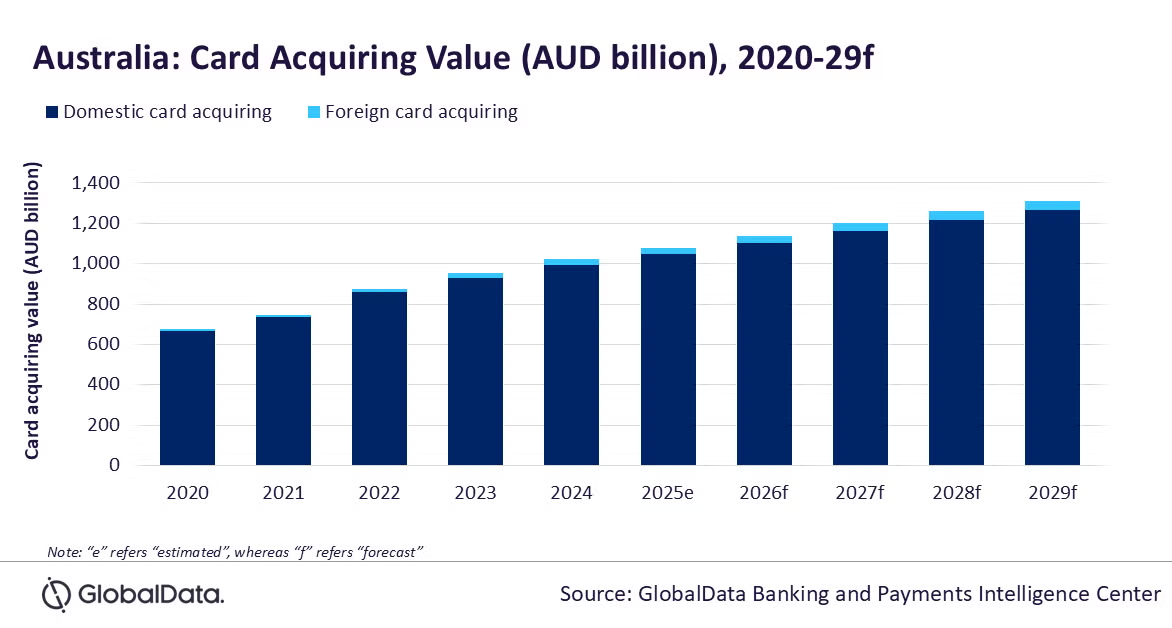

The card acquiring market in Australia is projected to grow by 5.5% to reach AUD1.1 trillion ($713.4 billion) in 2025, says GlobalData. Despite this growth, global economic uncertainty linked to recent US tariffs may weigh on momentum, slowing the pace of expansion compared to previous years of stronger performance driven by cashless trends and consumer spending.

GlobalData’s Merchant Acquiring Analytics reveals that the card acquiring value in Australia registered a growth of 7.5% in 2024, driven by the rise in consumer spending and increasing consumer preference for cashless transactions. However, the current global uncertainty because of latest US tariffs can pose a challenge for the Australia’s overall economic growth, which is expected to impact even payment industry resulting a slower growth in card acquiring value in 2025.

Asha Lalitha, Senior Banking and Payments Analyst at GlobalData, comments: “Domestic transactions with Australian-issued cards dominate the acquiring space in the country, accounting for over 97% of the total value of acquiring transactions. Well-established card acceptance infrastructure, nearly-100% banking population, and the burgeoning e-commerce market are all contributing to this.”

The number of POS terminals per one million inhabitants in Australia rose from 36,012 in 2020 to 40,055 in 2025. In addition to the traditional POS terminals, companies are offering POS solutions designed to target SMEs. For instance, Fiserv launched “Clover” POS solution in March 2025, especially targeting SMEs operating in the hospitality, service, and retail sectors.

Debit cards accounted for 59% of the total domestic card acquiring value in 2024. Credit and charge cards, on the other hand, accounted for 75.3% share in the total foreign card acquiring value, supported by high usage of foreign issued credit and charge cards for purchases of goods and services in Australia both online and in-person.

Traditional banks such as Commonwealth Bank (CommBank), Westpac, and National Australian Bank held significant share in Australia’s card acquiring space, accounting for around 60% of total acquiring value in 2024. CommBank is the leading operator in the Australian merchant acquiring market. The bank offers a wide range of POS terminals, including mobile POS terminals. In May 2023, CommBank rolled out the Smart Mini reader for small businesses, enabling them to accept all types of card payments. The terminals are equipped with features such as surcharging, tipping, and digital receipts.

In addition to banks, non-bank financial institutions such as Tyro, Worldline, and Fiserv also have a presence in the acquiring space in the country.

Asha concludes: “The Australian card acquiring market is projected to grow at a compound annual growth rate (CAGR) of 5%, reaching AUD1.3 trillion ($866.7 billion) by 2029. This growth is supported by strong consumer awareness of digital payments, wider merchant acceptance, and a rising preference for contactless and e-commerce transactions.”

Australia’s credit and charge card payments market

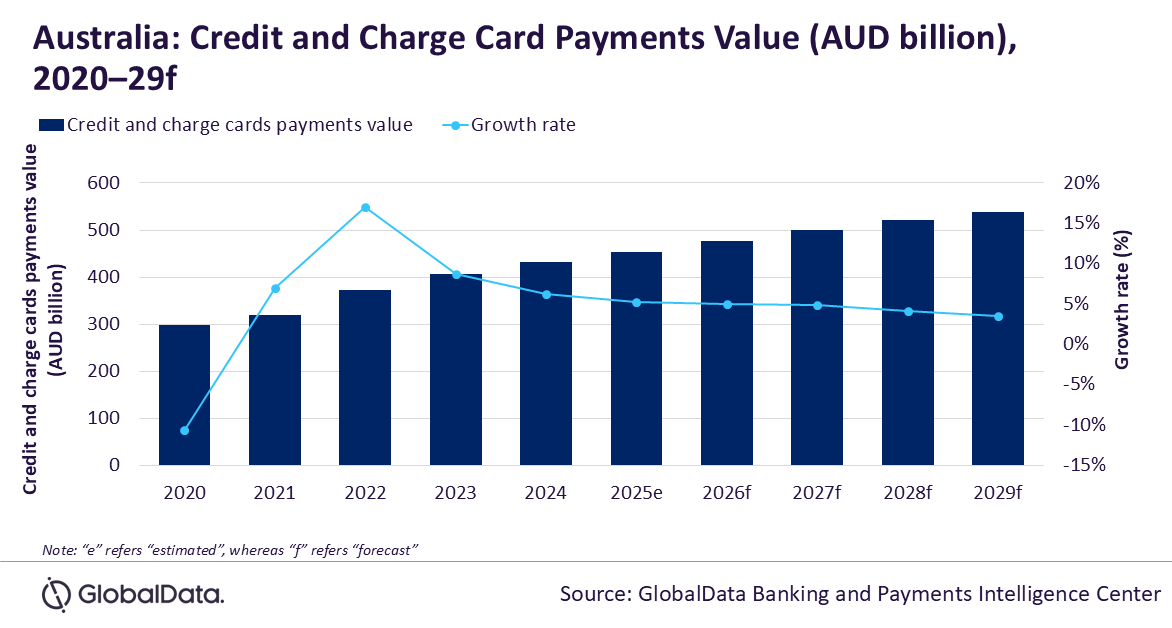

The credit and charge card payments market in Australia continues to demonstrate resilience and growth, underpinned by rising consumer spending, robust payment infrastructure, and an expanding e-commerce landscape. Enhanced by value-added incentives such as cashback offers, flexible repayment options, and installment facilities, the market is set to maintain an upward trajectory, reaching AUD453.9 billion ($299.7 billion) in 2025 despite evolving global economic challenges, reveals GlobalData.

GlobalData’s Payment Cards Analytics reveals that credit and charge card payment value in Australia registered a growth of 6.3% in 2024, driven by the rise in consumer spending.

Kartik Challa, Senior Banking and Payments Analyst at GlobalData, comments: “Public awareness of the advantages associated with credit card usage is widespread in Australia. Consumers frequently utilize these cards to capitalize on benefits, including cashback offers and rewards programs. Bolstered by a robust payment infrastructure and a flourishing e-commerce market, credit and charge cards have gained marked preference among the Australian consumers.”

Australians are increasingly using credit and charge cards for payments, with the frequency of payments per card standing at 225.5 times in 2024 and is anticipated to further rise to 239.5 in 2029. This is driven by banks offering flexible repayment options and value-added benefits such as cashback, reward points, discounts, and installment facilities.

CommBank offers an installment plan “SurePay,” allowing its credit card holders to convert purchases into three, six, or 12 months. Likewise, National Australia Bank’s NAB Now Pay Later option allows customers to split the cost of purchases into four interest-free repayments over six weeks.

Well-developed payment infrastructure has been another key driver for the rise of credit and charge cards in Australia. The number of POS terminals per million inhabitants in Australia stood at 39,031 in 2024, which is higher compared to some of its peers such as China (33,631), Hong Kong (27,184), and India (6,964), though there is significant room for further expansion of POS infrastructure.

Rising e-commerce payments is another factor contributing to the growth in credit and charge card usage. According to GlobalData’s E-Commerce Analytics, credit and charge cards are the preferred payment method for online payments, with 22.5% share in 2024.

Meanwhile, to mitigate the risk of over-indebtedness, banks offer debt reconsolidation programs and credit card balance transfer programs to their customers to enable them to merge multiple loans (including credit card debt) into a single, monthly installment and transfer their credit card balance without interest. For example, ANZ offers balance transfer options that enable customers to consolidate debt by transferring outstanding balances from non-ANZ credit cards to a new or existing ANZ credit card.

Challa concludes: “Australia’s credit and charge card market is poised for sustained growth over the next five years, driven by the economic recovery, growing consumer spending, and growth in e-commerce payments. However, challenges such as the ongoing global trade tariff dispute among major countries, and geopolitical uncertainties remain bottlenecks to the market. Overall, the value of credit and charge card payments is forecast to register a slower compound annual growth rate (CAGR) of 4.4% between 2025 and 2029 to reach AUD539.1 billion ($356 billion) in 2029.”

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: