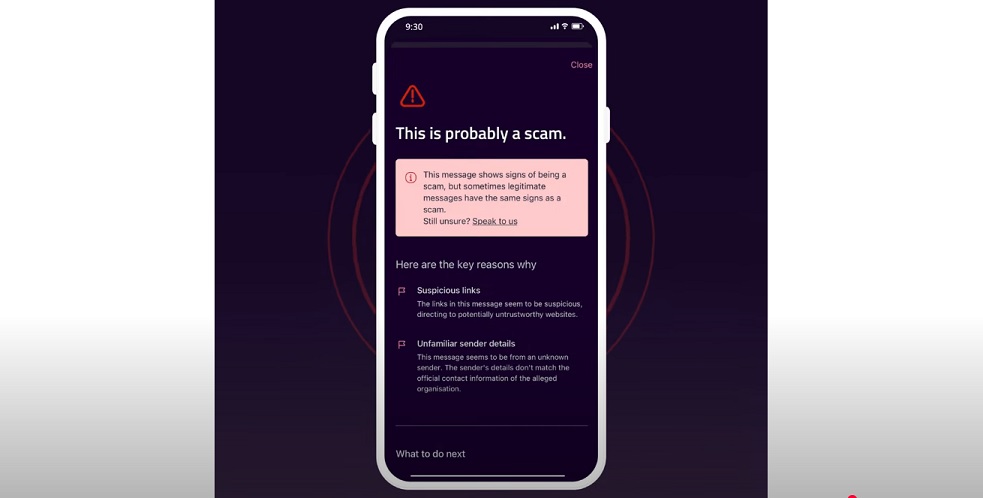

Digital identity protection app, Truyu, has launched a pilot of a free Gen AI-powered tool to help Australians figure out if a text message might be a scam.

„Anyone using the Truyu app – built by CommBank’s venture scaling arm x15ventures – can now take a screenshot of a suspicious looking SMS, upload it into the app, and get instant analysis from the free Scam Checker tool.” – according to the press release.

Scam Checker is the latest feature in the Truyu app, which launched last year to help Australians guard against identity theft.1

„It’s already helped thousands by alerting them in near real-time when their identity is used at major merchants – like banks and telcos – or when their personal information is exposed in a data breach.2 The app then guides them on what to do next.” – the bank explained.

With Scam Checker now added to Truyu, and more features in development, the app is a helpful tool for guiding people on ways they can protect their identity.

Melanie Hayden, Managing Director at Truyu, said: “Scam Checker uses Gen AI and CommBank scams intelligence – it’s a powerful combination. There’s no single solution to stop scammers, but people can help protect themselves when they stop and check. Scam Checker is another great way to check. When you upload a suspicious text to Scam Checker, you’re not just protecting yourself. You’re also helping keep others safe by sharing valuable information that can be used to help protect them too.”

Verify online card transactions in the CommBank app

Customers using the CommBank app will now be asked to verify certain online card transactions via the app – before the transaction is authorised, in real-time. This will reduce the need for one-time passcodes for those transactions.

James Roberts, CommBank’s General Manager of Group Fraud, said: “Scammers often impersonate legitimate businesses by sending fraudulent text messages to trick customers into following instructions in the message. We’re now asking those customers who use the CommBank app to verify some online card transactions directly in the app instead of sending them a code. We are able to give clearer guidance and warnings in the app than in a text message.”

The CommBank app uses advanced device recognition adding another layer of protection against account takeover.

“Earlier this year CommBank introduced in-app authentication to help stop unauthorised access to a customer’s online banking, even if a would-be intruder has obtained the customer’s password. We’re now looking at progressively moving other sensitive notifications and actions into the app – such as transaction alerts and security prompts – to enhance customer protections,” Mr Roberts added.

CommBank’s new in-app verification for certain online card transactions will be offered to customers from this month.

____________

1 According to Australian Bureau of Statistics data for the 2023-24 financial year, 255,000 people fell victim to identity theft.

2 The ID Usage Alert Service does not cover all scenarios.

About Truyu

Launched in May 2024, Truyu is an Australian-first digital identity protection tool that alerts users in near real-time when their name, date of birth, and driver’s licence or passport details are used online at major Australian merchants.

In the event of identity misuse, Truyu provides helpful links, and remediation prompts to help customers secure their information as efficiently as possible and avoid additional harm or loss. In subscribing to ID usage alerts, customers receive three months free, with $4.99 charged monthly thereafter.

In addition to ID alerts, Truyu also notifies users if an email address registered with the app has been exposed in a data breach, giving them proactive guidance to help enhance their online security. Like Scam Checker, this feature is also free for all Australians.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: