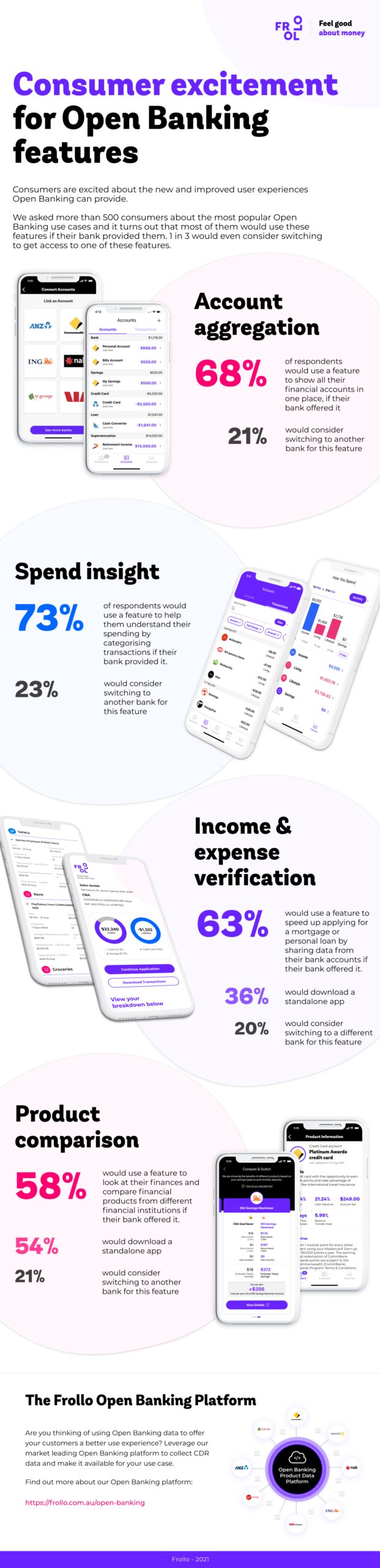

Frollo asked more than 500 consumers about the most popular Open Banking use cases and it turns out that most of them would use these features if their bank provided them. 1 in 3 would even consider switching to get access to these features, according to a company’s blog.

Research previously conducted by Frollo and NextGen.Net, showed that some of the most valuable Open Banking use cases for businesses are Income & Expense verification, Personal Finance Management (PFM) and product comparison.

Frollo’s most recent consumer research shows that the majority of respondents are keen to use these features if their bank offered them and 36% would even consider switching banks for at least one of these features.

Frollo is a purpose-driven FinTech on a quest to help people feel good about money. „We’ve built the simplest way – through our consumer app and SaaS Integration Platform – to help people get their finances on track in just a few simple steps,” the company says.

Frollo is leading the charge in Open Banking in Australia. As the first FinTech in Australia to become an Accredited Data Recipient under Open Banking regulations, Frollo is leading the way towards a more transparent financial sector for all Australians.

Turning data into insights, Frollo’s features include transaction enrichment, money insights, goal setting, bill tracking, budgeting and financial wellbeing tools, as well as product comparisons (through Open Banking).

Frollo (=Front + Follow) is one of the first to launch when Open Banking went live in July 2020. The company is leveraging the benefits of behavioural economics, artificial intelligence and better data to help even more Australians feel good about money.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: