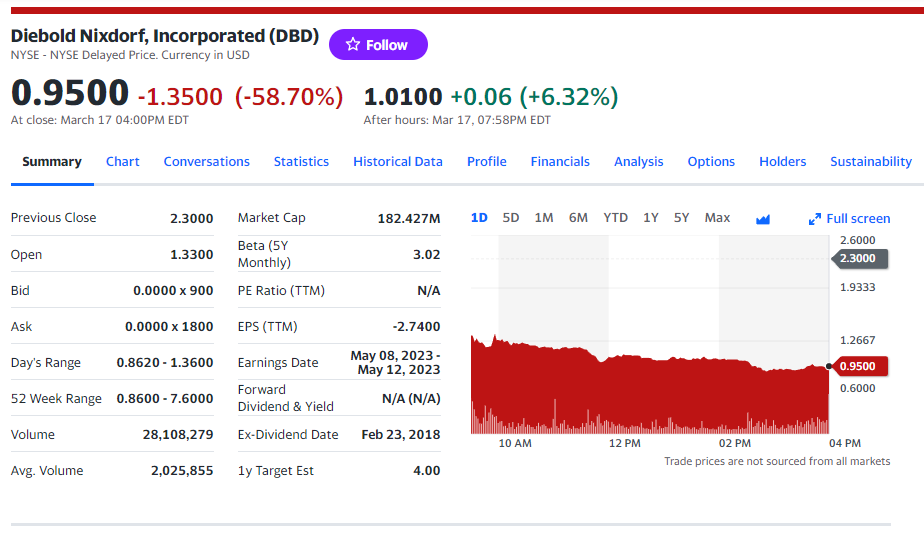

Diebold Nixdorf stock is taking a beating on Friday after the company released its annual shareholder letter for 2022.

The big news investors are latching onto from this letter has to do with the company’s liquidity. Specifically, the company says it’s dealing with “near-term pressure on liquidity.” That unnerved investors today, which explains the stock’s drop.

Breaking that down further, Diebold Nixdorf says it continues to use a steady flow of cash to reach its demand and production forecasts. However, a problem for the company is its efforts to turn inventory into revenue are taking longer than expected.

In addition to all of this, the company says that its ability to continue its business has become a going concern. This has it reaching out to lenders seeking help in the form of near-term financing to continue operations.

Here’s a portion of that letter to investors of DBD stock.

“The Company expects the first-in-last-out facility to provide $55 of additional liquidity and to close by March 20, 2023, however, there can be no assurance that such a facility will be entered into by such date or at all. In addition, the Company is in discussions with its lenders about other strategic initiatives and liquidity solutions for its business.”

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: