The special chapter of the BIS Annual Economic Report 2024 lays out the implications of new AI applications for central banks. The financial sector is among the most exposed to the benefits and risks of AI. Benefits include improvements for lending and payments; risks include more sophisticated cyber attacks.

AI adoption

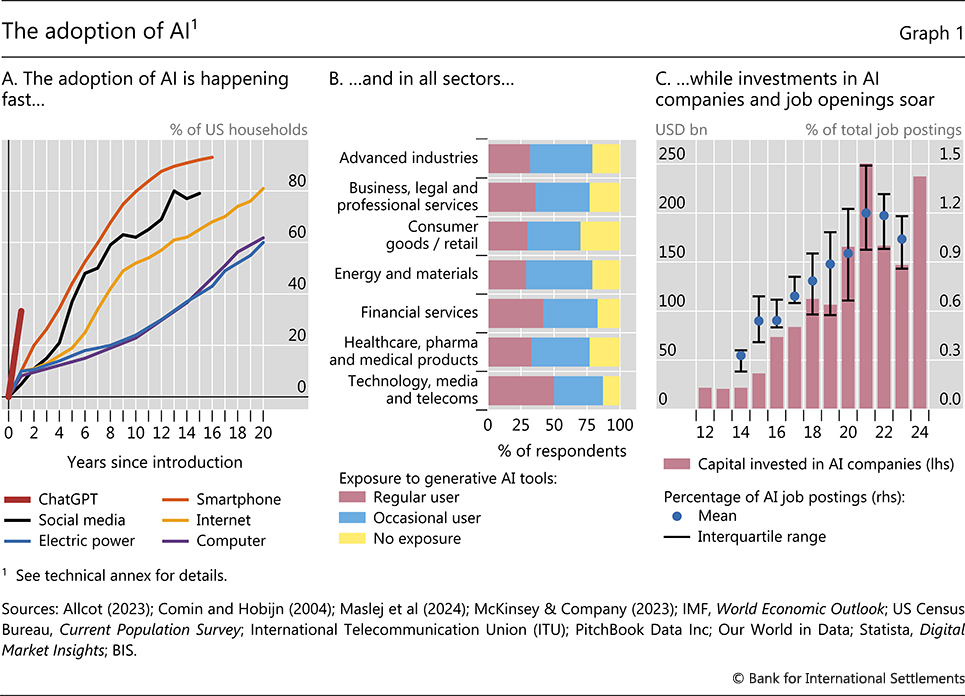

The economic potential of AI has set off a gold rush across the economy. The adoption of LLMs and gen AI tools is proceeding at such breathtaking speed that it easily outpaces previous waves of technology adoption (Graph 1.A). For example, ChatGPT alone reached one million users in less than a week and nearly half of US households have used gen AI tools in the past 12 months. Mirroring rapid adoption by users, firms are already integrating AI in their daily operations: global survey evidence suggests firms in all industries use gen AI tools (Graph 1.B). To do so, they are investing heavily in AI technology to tailor it to their specific needs and have embarked on a hiring spree of workers with AI-related skills (Graph 1.C). Most firms expect these trends to only accelerate.

AI in central banking

The rapid adoption of AI requires central banks to embrace the new technology, the Bank for International Settlements said today, urging policymakers „to anticipate the transformative effects of AI on the economy and to use it to sharpen their own analytical tools in pursuit of financial and price stability” – according to the press release.

AI is poised to impact the financial system, labour markets, productivity and economic growth. With widespread adoption, it could enhance firms’ ability to adjust prices faster in response to macro-economic changes with repercussions for inflation dynamics. The job of central banks as stewards of the economy will also be directly affected as frontline users of AI tools.

Central bank use cases for AI include enhancing nowcasting by using real-time data to better predict inflation and other economic variables and to sift through data for financial system vulnerabilities, allowing authorities to better manage risks. Data have become an even more valuable resource with the advent of AI and will be the cornerstone of central banks’ use of the technology.

„New generation AI models have captured our collective imagination through their uncanny abilities, but they also have a direct bearing on how central banks do their jobs. Vast amounts of data could provide us with faster and richer information to detect patterns and latent risks in the economy and financial system. All this could help central banks predict and steer the economy better.” – said Hyun Song Shin, Head of Research and Economic Adviser at the BIS.

The effects on demand and therefore on inflationary pressures will depend on how quickly displaced workers can find new jobs, and whether households and firms correctly anticipate future gains from AI. In the short-run, supply could outstrip demand, which could lower pressures but those effects could reverse over time as demand also catches up through higher incomes. Central banks will need to stay attuned to these dynamics in their monetary policy.

In the financial sector, AI can improve efficiencies and lower costs for payments, lending, insurance and asset management, the report said. The BIS cautioned that AI also introduces risks, such as new types of cyber attacks, and may amplify existing ones, such as herding, runs and fire sales.

The BIS Innovation Hub is testing AI’s capabilities in several areas together with central bank partners.

„Central banks were early adopters of machine learning and are therefore well positioned to make the most of AI’s ability to impose structure on vast troves of unstructured data. For example, Project Aurora explores how to detect money laundering activities from payments data and Project Raven uses AI to enhance cyber resilience, to mention just two from our portfolio.” – mentioned Cecilia Skingsley, Head of the BIS Innovation Hub.

Key takeaways

Machine learning models excel at harnessing massive computing power to impose structure on unstructured data, giving rise to artificial intelligence (AI) applications that have seen rapid and widespread adoption in many fields.

The rise of AI has implications for the financial system and its stability, as well as for macroeconomic outcomes via changes in aggregate supply (through productivity) and demand (through investment, consumption and wages).

Central banks are directly affected by AI’s impact, both in their role as stewards of monetary and financial stability and as users of AI tools. To address emerging challenges, they need to anticipate AI’s effects across the economy and harness AI in their own operations.

Data availability and data governance are key enabling factors for central banks’ use of AI, and both rely on cooperation along several fronts. Central banks need to come together and foster a „community of practice” to share knowledge, data, best practices and AI tools.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: