„It’s not about being a first-mover anymore – the industry has already passed that point. It’s now about being a fast-follower,” according to Tink.

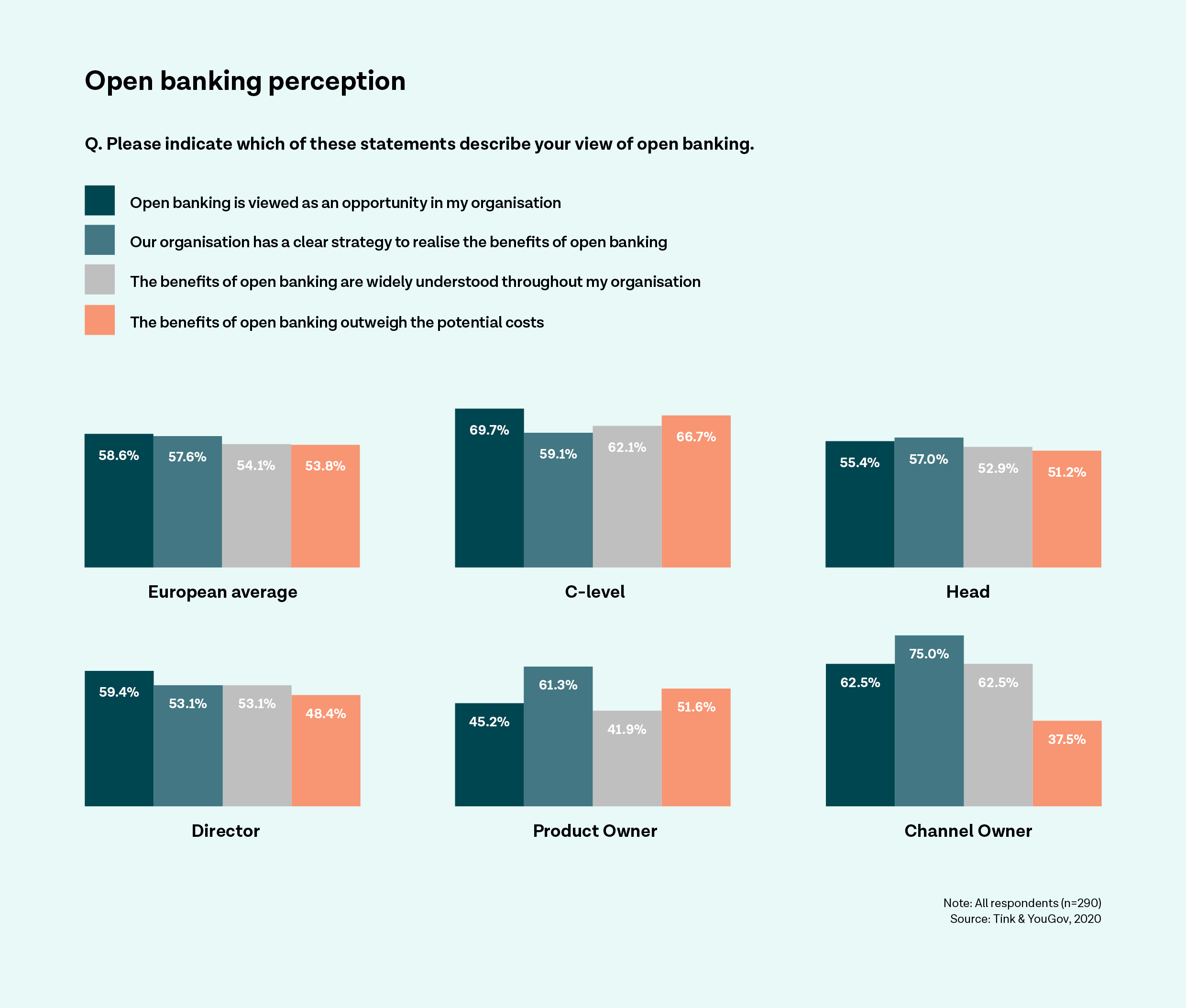

A whopping 70% of C-level financial executives see the opportunities of open banking, while just 45% of product owners feel the same. So why the disconnect? Tink’s latest research report dives into the huge task banks face aligning their organisations to make the most of open banking, and how buy-in differs across the business.

There’s a big difference in how the open banking opportunity is viewed within financial institutions, at least that’s what our most recent research tells us. In our new open banking report, Taking advantage of open banking, we spoke to 290 financial executives across Europe, and found that while there is clearly a lot of positive thinking about open banking, a lack of internal alignment risks holding them back from realising its full potential.

The stats reveal diverging views on everything from open banking capabilities, its value and the skills needed across different parts of the business. This organisational divide reflects the sheer size and scale of the task banks are facing to transform their operations to become open banking ready and meet new customer needs.

More than two-thirds (70%) of the C-suite see the vast opportunities that open banking presents right across their organisation, with 67% also believing the benefits outweigh the potential costs. But the results paint a more varied picture across other parts of the business.

Most channel owners (63%), responsible for the online, mobile or developer interfaces, also recognise the open banking opportunity across their organisation, but in contrast, less than half (45%) of product owners feel the same way.

One explanation for the different levels of buy in could be how departments feel they are resourced. The majority of respondents in financial institutions are positive about having the talent available to execute their open banking objectives (59% on average). IT being the most confident (65%), followed by management (61%) and digital or mobile banking channels (60%). Just 43% of product owners are confident their team has the required resources to capitalise on open banking.

This could also explain a lack of agreement on whether the products and services being offered to customers take full advantage of the company’s open banking capabilities. The overwhelming majority of those in IT (67%) say yes – in stark contrast to under a third (32%) of executives in the digital and mobile banking department who feel the same.

But despite this perceived lack of internal harmony, banks remain in the best position to offer integrated open banking services. As custodians of money and providers of financial services they already have a solid foundation of customers that trust them and are therefore willing to share data with them.

At the same time we shouldn’t underestimate the enormity of the task ahead, for financial institutions to transform their operations to become open banking ready. It is to be expected that there are differing levels of buy-in for open banking across the organisation, and pockets of the business that may lag behind in embracing the opportunity.

As those in the C-suite evolve their open banking strategy, they will need to be alert to any potential open banking knowledge or culture gaps that can result in missed opportunities. Whether it be through strategic fintech partnerships, acquisitions or internal re-alignment, banks can make sure they are in the race to create the best possible customer experience from open banking.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: